CMC Invest Review

Your capital is at risk.

CMC Invest is the more consumer-friendly offering from CMC Markets, a trading platform that offers a wide range of services from stocks and ETFs trading to spread betting and CFD trading. CMC Invest provides mobile app-based, commission-free trading on stocks and shares, making it a strong competitor to the likes of Freetrade and Trading 212.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

No

CMC Invest pros & cons

Pros

- Commission-free trading.

- Can hold GBP, USD and EUR in your wallet.

- You can trade through an ISA account.

Cons

- No SIPP account yet.

- No web platform yet.

- £50 fee for phone trading is high.

- Only offers U.K. and U.S. equities.

Overall summary

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Charges and fees

There are two plans for CMC Invest customers, with a third on the way to offer SIPPs.

- Core: £0 a month

- Plus: £10 a month

- Premium (reportedly coming soon)

With the Core option, you can open a general investment account and pay no monthly management charges. You can invest in 3,000 U.S. companies, U.K. companies listed on the FTSE 100, ETFs and investment trusts. There are no transaction costs and you get unlimited free trades.

The Plus plan, at £10 a month, allows you to invest through a stocks and shares ISA. You also get access to a wider range of stocks, including mid-cap stocks and mutual funds. With Plus, you can also hold cash in U.S. dollars and euros to reduce trading fees when buying overseas stocks.

You earn 2% interest on any money sitting in your account that is not invested, across both plans.

The Plus plan can work out at good value if you have a large investment portfolio. But it’s more expensive than Freetrade, which offers a similar pay-monthly plan but for £5.99. However, CMC Invest is offering the chance to upgrade to Plus for three months free of charge. This makes it great value for a short-term account.

Like other platforms offering commission-free trading, CMC Invest makes its money by charging a fee for foreign exchange (FX) conversions when buying international shares. It adds 0.5% to the FX rate. This is low compared to other investment platforms. For example, Freetrade charges 0.99% on its basic plan and eToro charges 1%.

CMC Invest charges £50 for telephone trades, which is high. Its aim is to encourage customers to invest through the app.

A Premium plan that offers SIPPs should launch in the first quarter of 2024, says CMC Invest.

Scenario pricing: When calculating annual share dealing costs, trading frequency and account balance are the two most important factors to consider. Assuming a £30,000 portfolio in a traditional, taxable share dealing account, here are five scenarios of how much CMC Invest would cost based on trade frequency:

- 5 trades per year = £0

- 12 trades per year = £0

- 36 trades per year = £0

- 120 trades per year = £0

- 3 fund trades per year = £0

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Custody Fee: £0 - £250,000 | £0 |

| Annual Custody Fee: £250K-£500K | £0 |

| Annual Custody Fee: £500,000 - £1m | £0 |

| Annual Custody Fee: £1m and over | £0 |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | £0 |

| Telephone Dealing Fee | £0 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Mobile trading apps

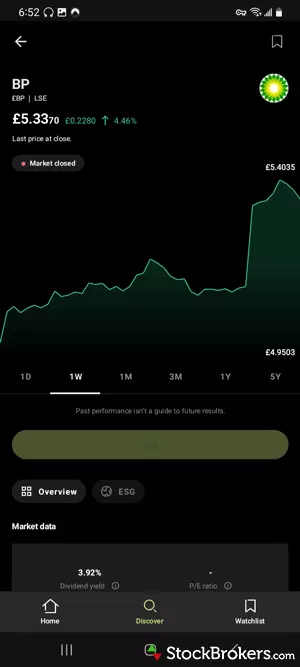

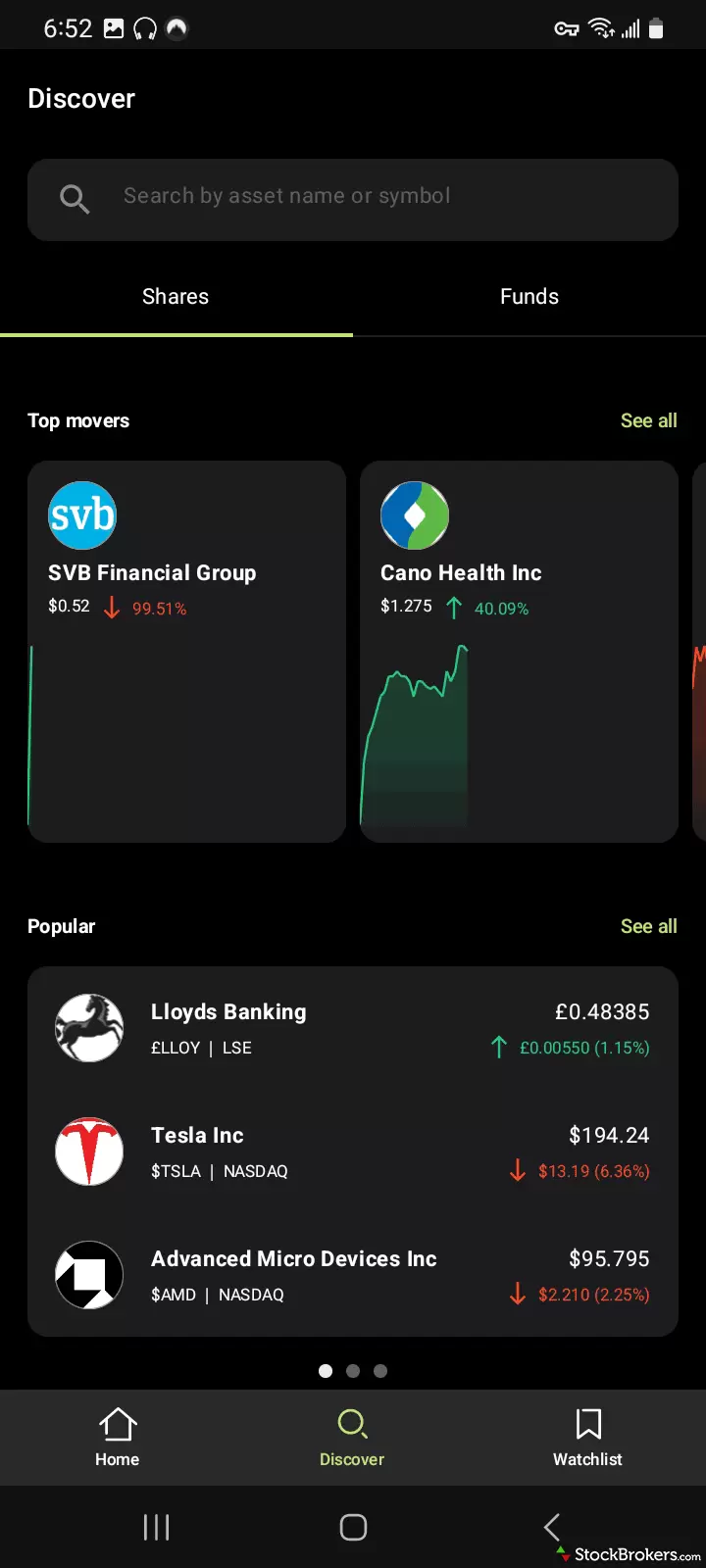

The CMC Invest mobile app is still very basic. There are links to articles and to the CMC Invest community, but these take you outside the app and to the web browser.

I found the guides on how to get started very useful. The app clearly explains in three steps how to discover stocks, use the search function and buy or add an investment to your watch list. There is also a useful guide on how to view your performance and activity, illustrated with screenshots.

The app offers live pricing, which is a great feature not always offered by traditional platforms including Fidelity and Barclays.

You can create a watch list through the app, but it’s not particularly easy. You have to search for a stock to add, and then tap on the top right of the screen to favourite it, rather than pulling stocks through the watch list. It would also be great if the app could make it easier to filter stocks by country, as well as sector.

Tap for a demo of CMC Invest's U.K. trading app.

Website

The CMC Invest website currently exists to explain more about its product, and to give general information about investing, how to open an account and the fees it charges. The app is where all the action happens – you cannot trade through the website. A web platform is in the works, however, according to CMC Invest. In the meantime, investors who prefer to trade through a web app may find Interactive Brokers or IG more suited to their purposes.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Web Platform | No |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 0 |

| Charting - Drawing Tools | 0 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Investment choices

CMC Invest offers more than 3,500 investments in U.K. and U.S. shares, about 1,000 mutual funds, and around 400 ETFs and investment trusts. More markets should be added at a later date as the platform develops.

You can also search for shares with a high ESG score (environmental, social and governance) through the app, which is a great feature as investors are becoming increasingly aware of ethical and environmental considerations. You can set your ESG preferences by saying, for example, that you don’t want to invest in firms that support gambling or palm oil. CMC Invest will alert you if one of your assets doesn’t match your values.

When you pay money into your account, the funds are credited to your account instantly. I found this great to get going quickly. There were no issues opening or funding my account.

Note: CMC Invest recently launched a flat-fee Self-invested Personal Pension (SIPP) as part of its Premium Plan.

Forex trading

If your interests lie with trading forex rather than equities, see the detailed CMC Markets review on our sister site, ForexBrokers.com.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| Funds | Yes |

| Research - ETFs | No |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Education

I found the educational material on the CMC Invest website to be on the basic side – unsurprisingly, as the platform is still in development. There is a ‘learn’ hub on the website that includes articles on the different investment types and a video on how a stocks and shares ISA works. For more in-depth stock market coverage, I suggest having a look at other platforms such as Fidelity, Hargreaves Lansdown and AJ Bell, which offer much more research material and articles.

You can also get access to the CMC Invest community by opening a separate account to access its forum. Here, users post about their investing experience and you can ask questions and access customer support. It was a bit of a hassle to create a separate account and it can take 24 hours for your account to be verified. Ideally, community feeds would be integrated into the app, such as on eToro, so you are not redirected to the website.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

CMC Invest is certainly one to watch. The platform is still in development, and I’m eager to see the SIPP charges to see if it can compete with the likes of Interactive Investor and Freetrade, which also offer SIPPs for low fixed monthly fees.

The fact CMC Invest offers commission-free investing is great, and puts it alongside other low-cost platforms eToro, Freetrade and Trading212. The recent addition of mutual funds is also a plus.

I also liked the fact that ESG considerations are easily embedded into the app, making it easy for investors to consider.

About CMC Invest

CMC Invest was launched in 2022 as an online broker that aims to offer high value for money and transparent charges. It is part of CMC Markets, which was founded in 1989 and is listed on the London Stock Exchange. CMC Markets operates in 12 countries and is headquartered in the U.K.

What is CMC Invest?

CMC Invest is a new app that offers commission-free stock and ETF trading. It offers flexible subscription plans. It is free to hold a general investment account, but if you want to trade through an ISA — or access a wider range of stocks — the charge is £10 a month.

What is the difference between CMC Markets and CMC Invest?

CMC Invest is aimed at everyday investors, whereas CMC Markets is aimed at more experienced investors looking to take higher levels of risk with their money through spread betting and CFD trading.

Is CMC Invest trustworthy?

Yes, as CMC Invest is run by CMC Markets, a well-respected broker. CMC Markets has consistently won prestigious awards from numerous reviewers, including our sister site ForexBrokers.com, where it has earned a high Trust Score.

Is CMC Invest a good app?

CMC Invest offers a good app currently and is only likely to get better, as the platform only recently launched in the U.K. Costs are low and the app is easy to use.

Popular Stock Broker Reviews

- Interactive Investor Review

- eToro Review

- IG Review

- Hargreaves Lansdown Review

- Vanguard UK Investor Review

- Saxo Review

- Interactive Brokers UK Review

- Halifax Review

- Trading 212 Review

- Barclays Smart Investor Review

- XTB UK Review

- Freetrade Review

- Capital.com Review

- Lloyds Bank Review

- Fidelity International Review

- AJ Bell Review

Popular Guides

Methodology

For the UK.StockBrokers.com Annual Review, we assessed, rated, and ranked 17 U.K. share dealing platforms over a 10-week time period. Each broker’s platforms and features were exhaustively tested by hand and graded on 53 different variables. In total, over 25,000 words of research were produced.

We thoroughly tested and compared features of prime interest to everyday investors, including but not limited to:

- Investment choices, such as whether the broker offers trading of shares, ETFs, funds, bonds, and CFDs; and offers SIPP and ISA accounts.

- The broker’s charges and fees for investing.

- Functionality and design of mobile apps and website platform, and a fluid experience moving between app and web.

- Usability of tools such as charting and watch lists.

- Market research, such as screening, news and analysis.

- Educational resources including tutorials, online courses, videos, webinars and articles.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors with quality data they can trust. Our lead researcher and writer, Elizabeth Anderson, has more than a decade’s experience as a financial journalist and market researcher. Elizabeth’s expertise is backed by a team of veteran fellow traders, data auditors, editors and project managers who work to ensure that UK.StockBrokers.com reviews and guides are the most unbiased and complete in the industry. Read more about our team.

Compare CMC Invest Competitors

Select one or more of these brokers to compare against CMC Invest.

Show all