XTB UK Review

Your capital is at risk.

XTB has set itself up as a strong competitor to other low-fee investment platforms, and aims to be an all-in-one investment app. Its low fees, educational content, and ISA offering makes it particularly attractive to newer investors.

XTB also offers a free ISA, so you can invest without worrying about paying tax on potential returns. However, the app can be complicated to navigate, particularly if you're new to investing.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

No

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| 2026 | #7 |

| 2025 | #6 |

| 2024 | #10 |

| 2023 | #12 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Commission-free stock and ETF trading.

- Easy-to-use mobile trading app.

- Invest through a flexible ISA.

- Pays 4.25% interest on uninvested cash (pound sterling).

Cons

- No mutual funds or bonds.

- Expensive if you trade more than €100,000 a month.

- No SIPP offering.

My top takeaways for XTB in 2026:

- XTB offers commission-free share and ETF trading for those trading less than €100,000 a month, so unless you’re a highly active trader, you’re unlikely to pay trading fees.

- You can invest in more than 6,600 stocks from 14 stock exchanges through XTB, including the London Stock Exchange, NYSE, and Deutsche Boerse, but mutual funds and bonds are not available.

- XTB offers an investment ISA with no platform charges.

- The platform can be confusing to navigate if you're a beginner looking to invest in shares and ETFs, as XTB predominately offers CFD trading.

- XTB offers a range of ebooks and courses to users to help improve trading knowledge.

XTB fees

Commission-free trading: XTB offers commission-free share and ETF trading for those trading less than €100,000 a month, so you’re unlikely to pay trading fees unless you are a highly active trader. Transactions above this amount are charged a commission of 0.2%, or a minimum of €10, which can quickly add up. On a £350,000 trade, for example, you’d pay a commission of around £574.

Commission-free trading makes XTB a great value for many investors, in line with other brokers including Trading 212, Freetrade, and eToro. There are no custody or platform charges for maintaining an account with a value of less than €250,000, unlike traditional U.K. platforms that either charge a percentage of your portfolio or a flat fee. This means XTB allows you to buy, sell, and hold stocks and ETFs for free, which is a great value. An FX fee of 0.5% is applied if you are buying stocks or ETFs in another currency. XTB does offer USD and EUR accounts, so if you invest in international shares regularly you can avoid the FX charge by trading in the direct currency.

Stocks and shares ISA: XTB offers a flexible stocks and shares ISA, which I think is a fantastic recent addition, having launched in 2024. It means you can invest without worrying about potential capital gains tax or taxes on dividends. Another bonus is that XTB's ISA is free to hold unlike other platforms such as Interactive InvestorInteractive Investor or CMC Invest, which charge a monthly fee for their ISAs. Bear in mind there is an overall ISA allowance of £20,000 you can pay into ISAs each year. Currently, the ISA is only available to open through the app and not the web platform. There are no plans to launch an XTB self-invested pension (SIPP), which is a shame for those investing for retirement.

Withdrawal and inactivity fees: It’s free to open and close an account with XTB, and no withdrawal fees are applied when the amount is above £50. If you want to withdraw less than this, a £5 charge is applied. There is also an inactivity fee of £10 a month charged if you haven’t made a trade for more than 12 months and if no cash has been put in your account in the previous 90 days. Be mindful of opening an account and then leaving it idle, as the costs could quickly rack up. However, keep in mind the inactivity fee doesn't apply to XTB's ISA, only the general investing account.

It’s free to deposit and withdraw GBP, EUR, and USD into your wallet. A virtual wallet that can hold multiple currencies is currently being rolled out in parts of Europe, but is not currently available to XTB users in the U.K.

| Feature |

XTB XTB

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Platform Fee (Funds): £0 - £250,000 | N/A |

| Annual Platform Fee (Funds): £250K-£500K | N/A |

| Annual Platform Fee (Funds): £500,000 - £1m | N/A |

| Annual Platform Fee (Funds): £1m and over | N/A |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | N/A |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

You can invest in more than 6,600 stocks from 14 stock exchanges through XTB, including the London Stock Exchange, NYSE, and Deutsche Boerse. You can also invest in over 1,800 ETFs, and more appear to be added all the time. Mutual funds or bonds are not available, so investors looking for these would have to go to another platform such as Hargreaves Lansdown, AJ Bell, or Interactive Investor.

In my testing, I thought international stocks were nicely integrated into the platform. Simply select ‘stocks’ (STC) on the web platform, and you’ll see a dropdown list of countries that you can open to view available stocks for that particular nation's exchanges.

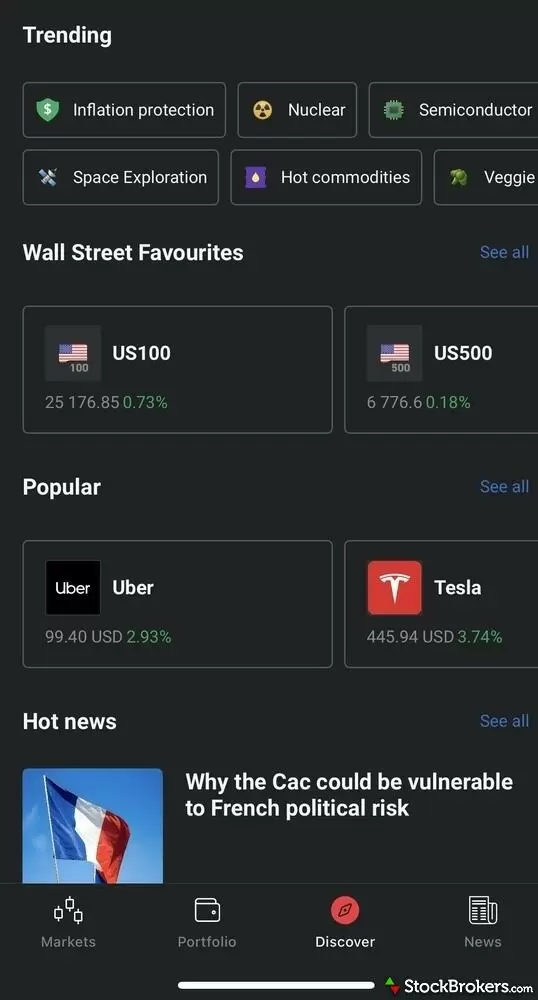

In the app, you can sort stocks by categories like 'popular,' 'tech,' 'British,' 'dividend,' or by themes such as 'AI' or 'gaming.' However, I think it would be better if the app allowed you to sort by market like on the website.

In the app, you can filter stocks by sector, favourites, or most popular currently.

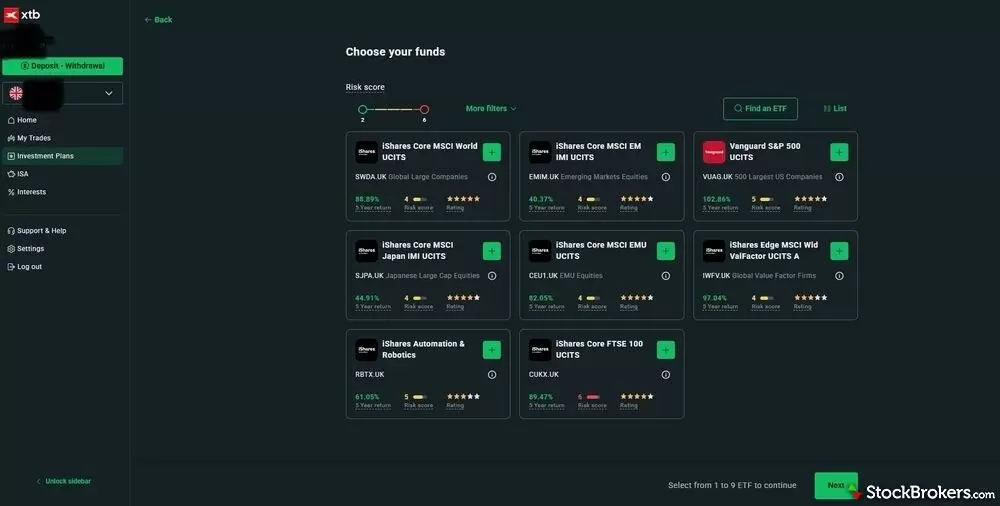

For those that don’t feel confident building their own investment portfolio from scratch, XTB offers ‘Investment Plans.’ Here, you can design a personalised portfolio from 500 ETFs that align with your risk tolerance, industry preferences, or regional coverage. This means that while XTB doesn’t offer mutual funds, there is still an option for investors to access a diversified, ready-made portfolio at exceptionally low cost. It’s free to set up your investment plan, and it's free to run. You can run up to 10 plans at the same time.

You can create your own investment plans through XTB, where you can invest in several ETFs that align with your risk tolerance.

XTB also offers generous interest on uninvested cash balances for certain currencies. Investors earn 4.25% interest on GBP, 3.95% a year on USD, and 2.30% on their EUR uninvested holdings — rates that are competitive with bank savings accounts (check XTB's site for the most up-to-date rates).

| Feature |

XTB XTB

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Mutual Funds | No |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | No |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

XTB ISA review

XTB’s stocks and shares ISA is a great option for savers looking to invest through a tax-free account. You have the choice of thousands of stocks or ETFs, and there are no trading fees or platform fees. However, if you’re trading more than £100,000 a month, a 0.2% trading fee is charged.

The only fees you’ll pay are those incurred by individual ETF providers, FX fees of 0.5% if buying international shares, and 0.5% stamp duty if buying most U.K. shares. Any uninvested cash earns 4.25% interest, calculated daily and paid monthly.

One downside of XTB’s ISA is that I find it quite overwhelming, as it allows you to view CFD investments alongside actual stocks and ETFs. It’s not particularly easy to filter or sort stocks or ETFs. Because of this, a beginner might find the app or web trading platform confusing.

Another drawback is that I found it difficult to open an ISA with XTB as it’s not obvious on the website or in the app. However, when I asked the in-app messaging service, I got a quick response. To open an ISA, go to ‘Portfolio’ at the bottom of the app screen and select ISA.

Mobile trading apps

XTB's stock trading app is simply laid out, featuring favourites and hot stocks on the homepage which shows the stocks or instruments that are currently most popular with traders. All prices are in real-time. The top tabs also feature news, market sentiment, and your watch list — although I found it took a while for my watch list to synchronise from the web platform when first testing the platform.

Elizabeth's take

"During my testing, it was easy to put money into my XTB account using a debit card and I could invest the money straight away. It’s easy to make a trade. Simply select a company (if buying stocks) and choose the amount you’d like to invest. If you're looking to invest in shares and ETFs, make sure you select the stock option rather than the CFD version. You'll pay different fees with CFDs and won't actually own the underlying shares."

The charting tools are not as extensive as those offered on the website — for example, you can’t compare different companies or overlay an index on the same chart. However, you can add indicators and drawings, including text.

The chart tools available in the XTB app are not as extensive as on the website, although you can add indicators and annotate charts.

Are you new to investing?

We thoroughly tested 17 top U.K. brokerages to find the best choices for beginner investors. Read more in our guide.

Trading platforms

XTB’s xStation 5 web platform has many trading tools for investors. There is a calendar of key economic news along with upcoming dividend announcements. You can view many assets, including indices, stocks, commodities, and currencies.

I did find the platform not user friendly, and I’m not sure the website would be appropriate for new investors. You may be better sticking with the app initially, or choosing a platform such as Trading 212 or AJ Bell’s Dodl, which are more straightforward and easy to use. However, you can open a demo account with XTB to help you get to grips with the platform, or investing in general, without risking any of your own money. You are given £100,000 in virtual money to practice trading through the XTB demo account.

XTB is still primarily a CFD broker, and I think this comes across on its web platform (and in the app). New investors may find it difficult to differentiate between real stocks and CFDs. To access stocks, click on ‘STC’; from there, you can search for stocks by country or by typing the company name or ticker into the search bar at the top. Simply click on the star button to add to your watch list or select the chart icon to bring up a detailed chart of a stock’s recent trading performance.

The charting tools and indicators on XTB are not as extensive as other platforms, including Trading 212, IG, and Interactive Brokers. You cannot overlay different stocks or indices on the same chart to make it easier to draw comparisons.

However, up to 16 charts can be created at one time so you can track various assets simultaneously across different charts. This is a great feature not offered by many other platforms. Dividend announcement dates can also be added to a chart, and you can add text to annotate a chart.

| Feature |

XTB XTB

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | No |

| Charting - Indicators / Studies | 13 |

| Charting - Drawing Tools | 4 |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | Yes |

Education

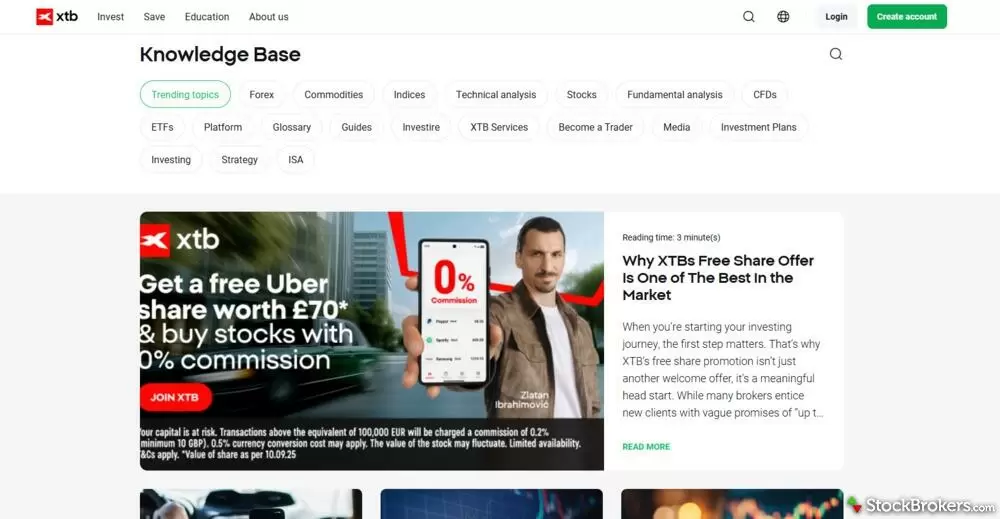

XTB has put together a variety of educational content in various formats to help different levels of investors, whether you’re a beginner or an advanced trader. XTB produces its own educational content in-house, with articles explaining things like what meme stocks are and outlining five FTSE stocks to watch.

XTB offers a variety of ebooks, reports, and courses through its website, covering guides such as share trading for beginners and how to incorporate technical analysis in your investing strategy. These courses are easily accessible on both the mobile app and website, although not all are available if you don't have a trading account with XTB. Some are only available to view if you have a demo account.

When you open an account with XTB, you are contacted by WhatsApp and email by a dedicated account manager ready to answer any questions you have. I found this very helpful. It’s a great feature for those who open an account and need guidance on what to do next.

The XTB knowledge base, available through the website, has educational articles about investing, and in-depth trading courses for clients.

| Feature |

XTB XTB

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

XTB is a well-established brand that is making further inroads in the U.K. by offering a wider range of assets for retail investors. It appeals to both beginner and experienced investors, with charges that are extremely low unless you are trading a large volume of assets (more than £100,000 monthly).

The lack of a SIPP account is a drawback for those looking for long-term retirement investments, but XTB’s ISA and general dealing accounts are strong rivals to other newer and traditional platforms on both fees and investment choices. However, I find the XTB platform less user-friendly than the likes of Trading 212 and Freetrade, which both offer free ISAs. Beginners may find these other platforms easier to use.

XTB is rapidly increasing its U.K. offerings, and we are excited to see what else it will launch in the coming year.

XTB Star Ratings

| Feature |

XTB XTB

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Best Stocks and Shares ISAs for 2026

- Best Lifetime ISAs of 2026

- Best SIPP Providers of 2026

- Best Crypto Brokers & Apps for March 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Junior SIPPs for 2026

- Best Cash ISA Accounts & Rates for 2026

Popular investment platform reviews

- Lloyds Bank Investing Review

- Vanguard UK Review

- CMC Invest Review

- Saxo Review

- Halifax Share Dealing Review

- Trading 212 Review

- AJ Bell Review

- Fidelity UK Review

- Barclays Smart Investor Review

- Capital.com Review

- Hargreaves Lansdown Review

- IG Trading Review 2026

- Interactive Investor Review

- Interactive Brokers UK Review

- Freetrade Review

- eToro UK Review

Popular guides

About XTB

XTB was founded in Poland in 2002 under the name X-Trade Brokers, renaming to XTB in 2004, and now has 13 offices worldwide. It is listed on the Warsaw Stock Exchange (WSE: XTB.PL) and employs around 1,000 people. XTB began offering share trading in the U.K. in July 2023, having previously only offered forex and CFDs. XTB says it has 1.2 million active clients, and has added 800,000 of those in 2024, with the majority attracted by its 0% commission on stocks and ETF trading.