Best Investment Platforms in the UK for 2026

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

The best investment platforms in the U.K. make it simple to start investing. They offer low fees, a wide choice of investments, an easy-to-use app, and the right account types, such as a Stocks and Shares ISA or SIPP, to match your goals.

To find the best options for 2026, I tested 16 U.K. investment platforms in detail. I explored both their websites and mobile apps, compared fees, reviewed the range of shares, funds, and ETFs available, and assessed how beginner-friendly each platform is. I also looked at the quality of research tools, educational content, and overall ease of use.

If you’re new to investing, the right platform can make a big difference. Clear pricing, helpful guidance, and a simple interface can give you confidence as you build your first portfolio. Below are my picks for the best investment platforms in the U.K. for 2026.

Best Investment Platforms in the U.K.

Each platform below earned its place through hands-on evaluation and side-by-side comparison. I assessed how well each provider supports real-world investors, from account setup and funding to placing trades and managing a portfolio over time, focusing on overall value, usability, and who each platform is best suited for.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: No

Trading 212 is a popular investing platform best known for its commission-free trading, easy-to-use mobile app, and support for low-cost investing in stocks and ETFs. Read full review

- Tax-free investing via an ISA.

- High interest rate on cash balances.

- User-friendly mobile app with practice accounts available.

- Commission-free stock and ETF trading, including fractional shares.

- Doesn't offer a SIPP.

- Limited educational materials when researching investments.

- Only offers stocks and ETFs; does not offer mutual funds or bonds.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £3.99

- ISA: Yes

- SIPP: Yes

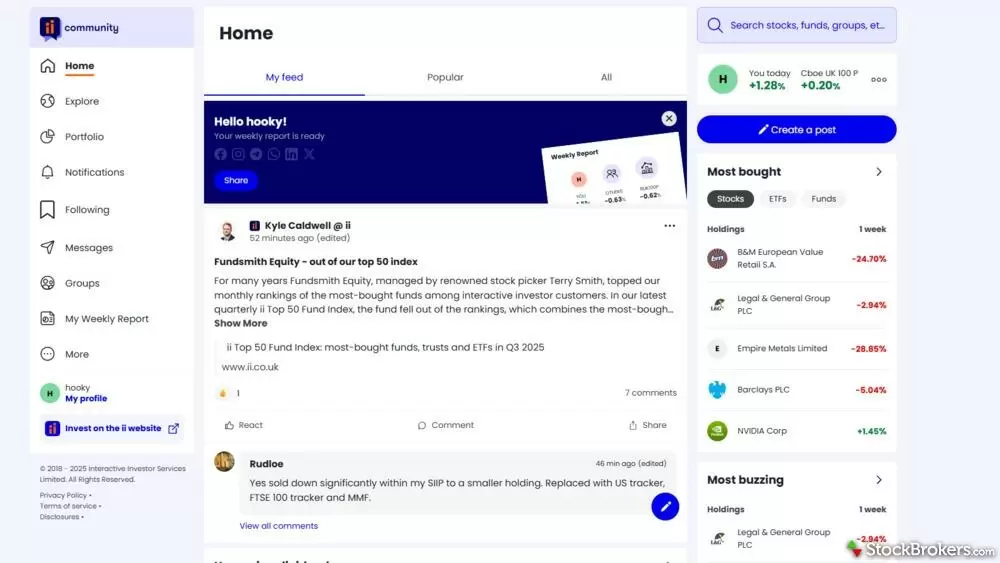

Interactive Investor is a great platform for any investor, offering a wide range of investments for cheap prices on the whole. Read full review

- Flat-fee pricing is cost-effective for larger portfolios.

- Low fees for ISAs, SIPPs, and general accounts.

- New managed ISA offers ready-made, diversified portfolios.

- Research and education materials are excellent.

- Charges £3.99 for mutual fund trades.

- Can be pricey for small portfolios under £15,000.

- Minimum Deposit: £0

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: Yes

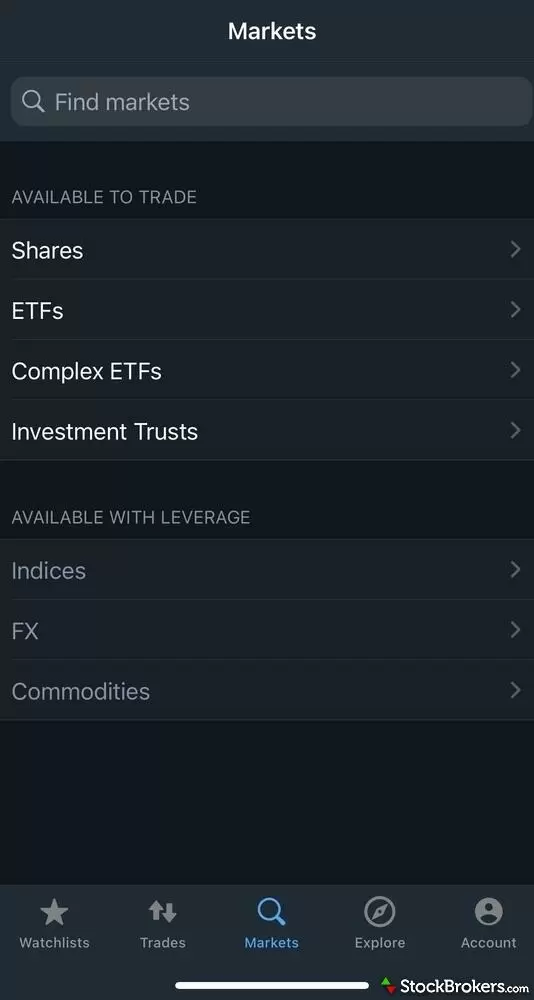

IG is an investment platform aimed at experienced investors looking to make frequent trades on the stock market, with thousands of shares, trusts and ETFs to trade. It offers a comprehensive and easy-to-use trading platform that is used by both private and professional investors. Read full review

- Trade 11,000+ shares, trusts, and 2,000 ETFs with £0 commission.

- Pays 4.5% interest on uninvested cash balances.

- Invest via an ISA or SIPP.

- One of the best U.K. stock trading apps for active traders.

- No mutual funds, bonds, or demo account for share trading.

- Chart tools are limited unless on Pro or £30/month plan.

- £8/month custody fee unless you make three trades/quarter.

- Minimum Deposit: £100

- Share Trading: 0-9 Deals/ Month: N/A

- ISA: Yes

- SIPP: Yes

InvestEngine specialises in ETFs, a type of low-cost investment fund allowing you to invest in a wide range of shares, bonds, gold, and more. InvestEngine does not charge any account fees for DIY investors, but there is a small 0.25% charge for its managed funds.

- 800+ global ETFs.

- No platform fees or trading commission for the DIY portfolio.

- Managed portfolios are available for just 0.25% annual fee.

- Supports ISA and SIPP tax wrappers.

- Unique feature of multiple, named investment pots.

- Limited to ETF investing only.

- Doesn’t offer junior ISAs or junior SIPPs.

- Uninvested cash doesn’t earn interest.

- Trades are executed only once a day.

- Transfers out must be in cash.

- Minimum Deposit: £0

- Share Trading: 0-9 Deals/ Month: £3

- ISA: Yes

- SIPP: Yes

Interactive Brokers is a sophisticated trading platform aimed at confident and institutional-grade investors. For newer investors, Interactive Brokers is more intimidating, though it's worth exploring the platform to see if you could save money or access more investments compared to other brokers. Read full review

- Trade stocks with low commissions and no minimum deposit.

- Offers shares, ETFs, funds, trusts, bonds, and 14,000 no-fee funds.

- Fractional shares available; ideal for beginners.

- Mobile app and tools suit active traders.

- Complex platform may overwhelm new investors.

- U.S.-focused education, less tailored for U.K. clients.

- Platform charges and fees can be confusing.

Your capital is at risk.

Popular Guides

Popular Retirement Guides

- Best Cash ISA Accounts & Rates for 2026

- The Complete Guide to SIPPs in the UK

- How to Open a Stocks and Shares ISA

- Best SIPP Providers of 2026

- Best Lifetime ISAs of 2026

- The Complete Guide to ISAs in the UK

- Best Stocks and Shares ISAs for 2026

- Best Junior SIPPs for 2026

Popular Stock Broker Reviews

- Hargreaves Lansdown Review

- AJ Bell Review

- Fidelity UK Review

- Interactive Investor Review

- Trading 212 Review

- Halifax Share Dealing Review

- CMC Invest Review

- Saxo Review

- Barclays Smart Investor Review

- Lloyds Bank Investing Review

- Interactive Brokers UK Review

- Freetrade Review

- Capital.com Review

- eToro UK Review

- Vanguard UK Review

- IG Trading Review 2026

- XTB UK Review

Trading 212

Trading 212

Interactive Investor

Interactive Investor

IG

IG

InvestEngine

InvestEngine

Interactive Brokers

Interactive Brokers