Best Stocks and Shares ISAs for 2026

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Selecting the best stocks and shares ISA is the most consequential decision a UK investor can make to protect their wealth from the rising tide of dividend and capital gains taxes. In 2025, the £20,000 annual allowance remains a cornerstone of British financial planning, yet the sheer volume of competing platforms has made the selection process increasingly complex for those seeking the optimal balance of cost and market access.

The landscape is currently defined by a fierce rivalry between traditional high-street stalwarts and agile fintech disruptors, each offering vastly different fee structures and interest incentives. Navigating these ISA providers requires a keen eye for hidden costs, such as foreign exchange markups and platform custody charges, which can quietly diminish your compounding potential over the long term if left unchecked by an unoptimised account choice.

I have spent months rigorously testing these platforms to identify which truly deliver on their promises of efficiency and reliability. My evaluation prioritised the user experience, fee transparency, and the depth of available investment research.

The following rankings represent the culmination of that research, highlighting the platforms that set the standard for 2026. Here are my top picks for the best stocks and shares ISAs available today.

Best stocks and shares ISAs

Choosing the right investment platform is critical for long-term growth. I personally tested over a dozen ISA providers to identify the most compelling options. My testing focused on real-world trading, ensuring each platform delivers the stability and value required to manage your annual £20,000 allowance effectively.

Our rankings are based on a rigorous analysis of fee structures, investment range, and mobile functionality. I prioritised providers that offer transparent pricing and professional-grade tools, helping you keep more of your returns. This guide focuses exclusively on platforms designed for self-directed investors who want full control over their portfolios, rather than automated robo-advisor services.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: No

Trading 212 is a popular investing platform best known for its commission-free trading, easy-to-use mobile app, and support for low-cost investing in stocks and ETFs. Read full review

- Tax-free investing via an ISA.

- High interest rate on cash balances.

- User-friendly mobile app with practice accounts available.

- Commission-free stock and ETF trading, including fractional shares.

- Doesn't offer a SIPP.

- Limited educational materials when researching investments.

- Only offers stocks and ETFs; does not offer mutual funds or bonds.

- Minimum Deposit: £100

- Share Trading: 0-9 Deals/ Month: N/A

- ISA: Yes

- SIPP: Yes

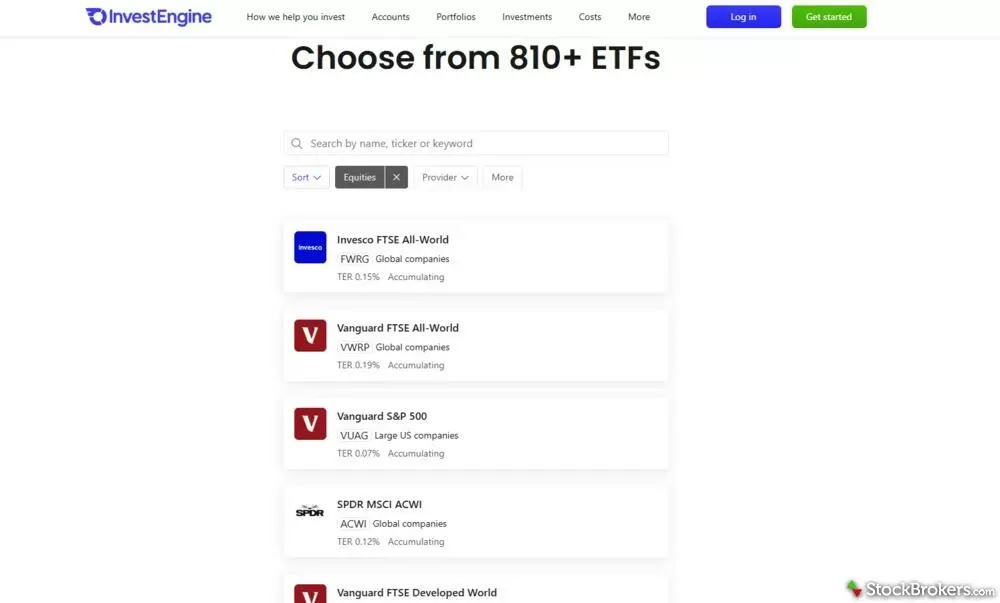

InvestEngine specialises in ETFs, a type of low-cost investment fund allowing you to invest in a wide range of shares, bonds, gold, and more. InvestEngine does not charge any account fees for DIY investors, but there is a small 0.25% charge for its managed funds.

- 800+ global ETFs.

- No platform fees or trading commission for the DIY portfolio.

- Managed portfolios are available for just 0.25% annual fee.

- Supports ISA and SIPP tax wrappers.

- Unique feature of multiple, named investment pots.

- Limited to ETF investing only.

- Doesn’t offer junior ISAs or junior SIPPs.

- Uninvested cash doesn’t earn interest.

- Trades are executed only once a day.

- Transfers out must be in cash.

- Minimum Deposit: £0

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: Yes

IG is an investment platform aimed at experienced investors looking to make frequent trades on the stock market, with thousands of shares, trusts and ETFs to trade. It offers a comprehensive and easy-to-use trading platform that is used by both private and professional investors. Read full review

- Trade 11,000+ shares, trusts, and 2,000 ETFs with £0 commission.

- Pays 4.5% interest on uninvested cash balances.

- Invest via an ISA or SIPP.

- One of the best U.K. stock trading apps for active traders.

- No mutual funds, bonds, or demo account for share trading.

- Chart tools are limited unless on Pro or £30/month plan.

- £8/month custody fee unless you make three trades/quarter.

- Minimum Deposit: £0

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: No

XTB is a low-cost investing platform best known for its commission-free stock and ETF trading, free ISA, and strong educational content for newer investors. Read full review

- Commission-free stock and ETF trading.

- Easy-to-use mobile trading app.

- Invest through a flexible ISA.

- Pays 4.25% interest on uninvested cash (pound sterling).

- No mutual funds or bonds.

- Expensive if you trade more than €100,000 a month.

- No SIPP offering.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £9.50

- ISA: Yes

- SIPP: Yes

Lloyds Bank is a U.K. investment platform best known for its simple, low-cost investing options, support for ISAs and SIPPs, and appeal to long-term, hands-off investors. Read full review

- Wide range of investments, including bonds and mutual funds.

- Can invest via ISA, SIPP, or taxable account.

- Flat £40 fee is great value for larger portfolios.

- No trading fee for U.S. shares and free regular investing.

- Difficult and time-consuming to open an account.

- £11 per trade for U.K. stocks is expensive.

- Very limited tools and research.

- No interest paid on uninvested cash.

- Minimum Deposit: £0

- Share Trading: 0-9 Deals/ Month: £3

- ISA: Yes

- SIPP: Yes

Interactive Brokers is a sophisticated trading platform aimed at confident and institutional-grade investors. For newer investors, Interactive Brokers is more intimidating, though it's worth exploring the platform to see if you could save money or access more investments compared to other brokers. Read full review

- Trade stocks with low commissions and no minimum deposit.

- Offers shares, ETFs, funds, trusts, bonds, and 14,000 no-fee funds.

- Fractional shares available; ideal for beginners.

- Mobile app and tools suit active traders.

- Complex platform may overwhelm new investors.

- U.S.-focused education, less tailored for U.K. clients.

- Platform charges and fees can be confusing.

Your capital is at risk.

Other stocks and shares ISAs I tested

7. Vanguard – Best for low-cost fund investing

| Company | Overall Rating | Minimum Deposit | ISA | SIPP |

Vanguard UK Investor Vanguard UK Investor

|

|

£500 | Yes | Yes |

Vanguard’s stocks and shares ISA is a great choice for investors who value simplicity and low overhead. I found the platform’s focus on its own LifeStrategy and Target Retirement funds makes it incredibly easy to build a diversified portfolio. While the £500 minimum entry is higher than some peers, the 0.15% platform fee, capped at £375, is tough to beat for those primarily using index trackers and ETFs.

8. AJ Bell – Best for ready-made portfolios

| Company | Overall Rating | Minimum Deposit | ISA | SIPP |

AJ Bell AJ Bell

|

|

£250 | Yes | Yes |

AJ Bell offers a middle ground for those wanting a wide investment choice without the premium price tag of some larger rivals. With access to over 4,000 funds and a robust list of "favourite funds," it’s excellent for those who need a bit of guidance. I particularly like the ease of their ready-made portfolios, which provide a straightforward path for beginners to gain diversified market exposure at a competitive 0.25% platform charge.

9. Hargreaves Lansdown – Best for research and service

| Company | Overall Rating | Minimum Deposit | ISA | SIPP |

Hargreaves Lansdown Hargreaves Lansdown

|

|

£100 | Yes | Yes |

As the largest platform in the UK, Hargreaves Lansdown justifies its higher 0.45% fund fee through a top-tier user experience and extensive research. During my testing, the app felt the most polished, and the inclusion of a Lifetime ISA makes it a versatile hub for different tax-efficient goals. It’s an ideal choice for investors who prioritize reliable customer support and high-quality investment inspiration over the absolute lowest cost.

10. Interactive Investor – Best for large portfolios

| Company | Overall Rating | Minimum Deposit | ISA | SIPP |

Interactive Investor Interactive Investor

|

|

£1 | Yes | Yes |

Interactive Investor breaks the traditional percentage-fee model with a flat monthly subscription, making it the most cost-effective stocks and shares ISA for larger balances. If you have more than £50,000, the fixed fee typically works out significantly cheaper than a percentage-based charge. I found the selection of over 40,000 investments impressive, and the free regular investing service is a great way to build wealth without incurring constant trading fees.

Popular Guides

Popular Retirement Guides

- Best SIPP Providers of 2026

- The Complete Guide to ISAs in the UK

- Best Lifetime ISAs of 2026

- The Complete Guide to SIPPs in the UK

- How to Open a Stocks and Shares ISA

- Best Junior SIPPs for 2026

- Best Cash ISA Accounts & Rates for 2026

Popular Stock Broker Reviews

- eToro UK Review

- Trading 212 Review

- Interactive Investor Review

- Freetrade Review

- XTB UK Review

- Barclays Smart Investor Review

- Saxo Review

- Halifax Share Dealing Review

- Hargreaves Lansdown Review

- Capital.com Review

- Interactive Brokers UK Review

- CMC Invest Review

- Vanguard UK Review

- IG Trading Review 2026

- Fidelity UK Review

- AJ Bell Review

- Lloyds Bank Investing Review

Trading 212

Trading 212

InvestEngine

InvestEngine

IG

IG

XTB

XTB

Lloyds Bank

Lloyds Bank

Interactive Brokers

Interactive Brokers