Best Cash ISA Accounts & Rates for 2026

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

A cash ISA allows you to earn interest on your savings without paying U.K. income tax on the returns. For many savers, it’s a simple and low-risk way to protect cash while keeping money accessible and separate from stock market investments.

This guide focuses on easy-access, variable-rate cash ISAs offered by investment platforms and stock brokers rather than traditional fixed-rate accounts from high street banks. These flexible options let you withdraw or move your money when needed, and in many cases manage your savings and investments within the same app.

If you’re saving for a short-term goal, building an emergency fund, or simply looking for a competitive rate without locking your money away, these broker-based cash ISAs could be a strong fit. I’ve compared them based on interest rates, flexibility, minimum deposits, and overall ease of use.

Best Cash ISA Accounts in the UK

Below are my picks for the best easy-access cash ISAs in the U.K. for 2026. This guide focuses on variable-rate cash ISAs offered by investment platforms and stock brokers, not fixed-rate accounts that lock your money away. Most of the accounts featured are flexible, meaning you can withdraw and replace funds within the same tax year without affecting your £20,000 ISA allowance.

All providers listed are authorised in the U.K. and covered by the Financial Services Compensation Scheme (FSCS), protecting eligible deposits up to £85,000 per institution. Rankings are based on interest rate, flexibility, and overall user experience. As rates change regularly, always confirm the latest details directly with the provider.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: Yes

CMC Invest is a mobile-first investment app best known for its commission-free stock trading, support for ISAs and SIPPs, and simple account structure for long-term investors. Read full review

- Commission-free trading.

- Can hold GBP, USD, and EUR in your wallet.

- You can trade through an ISA and SIPP account.

- Offers mutual funds.

- No web platform.

- £50 fee for phone trading is high.

- Flat-fee monthly charges are on the more expensive end.

- Interest on cash balances is 2%, lower than other platforms.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: No

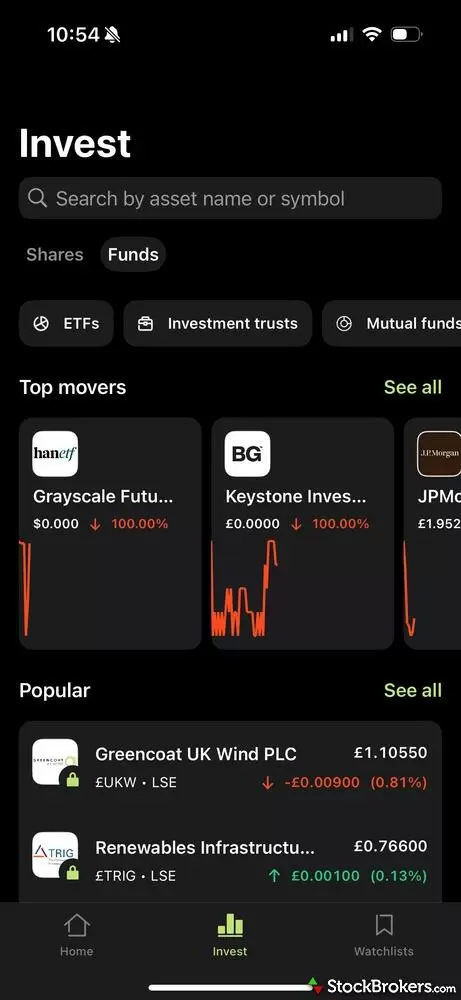

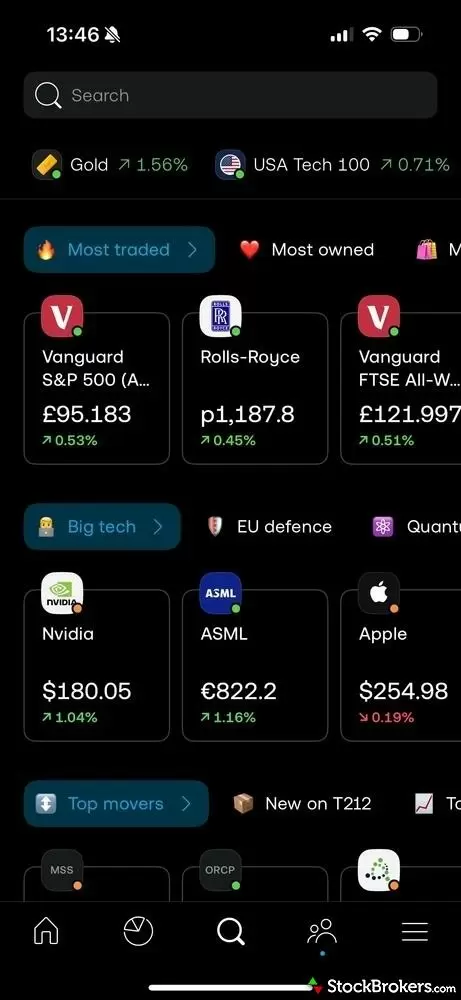

Trading 212 is a popular investing platform best known for its commission-free trading, easy-to-use mobile app, and support for low-cost investing in stocks and ETFs. Read full review

- Tax-free investing via an ISA.

- High interest rate on cash balances.

- User-friendly mobile app with practice accounts available.

- Commission-free stock and ETF trading, including fractional shares.

- Doesn't offer a SIPP.

- Limited educational materials when researching investments.

- Only offers stocks and ETFs; does not offer mutual funds or bonds.

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: £0

- ISA: Yes

- SIPP: Yes

Moneybox is an app aimed at beginner investors known for its ‘rounding up’ feature. You link your bank account to the app and can round up your everyday purchases to the nearest pound, with the remainder invested. You can invest in funds, ETFs, and a small number of U.S. stocks through Moneybox.

- Makes investing easy

- You can invest small amounts

- Very user-friendly app

- No trading fees for U.S. stocks (but there is an FX charge of 0.45%)

- Limited number of investments

- Limited research tools and educational material

- Charges can work out expensive on small pots: £1 per month, plus 0.45% a year on the value of your investments in addition to fund fees

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: N/A

- ISA: Yes

- SIPP: No

Zopa is an online bank offering personal loans, savings accounts, car finance, and credit cards. Zopa does not offer investment services so you cannot invest in the stock market through a stocks and shares ISA or SIPP. But it does offer competitive rates of interest on its cash savings accounts if you are looking for a short-term place to save money.

- Wide range of savings accounts paying generous interest

- Offers access to both easy-access and fixed-rate deals through one account

- Flexible cash ISA

- Does not offer investment services

- You have to transfer a minimum of £500 if transferring a cash ISA to Zopa

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: N/A

- ISA: Yes

- SIPP: Yes

Plum is a money management app that helps users save, invest, and manage their spending. You can link your Plum account to other bank accounts to track your spending across multiple accounts as well as create savings goals and savings pots. You can invest in a limited range of funds and US stocks.

- Helps you get a better understanding of your finances and manage your money better

- ‘Round up’ feature makes it easy to save and invest

- Generous interest rate offered on cash savings

- Limited investment range for experienced investors

- Monthly £2.99 subscription fee for the Plum investment ISA

- Fund management fees are charged in addition to this

- ISA is not flexible

- Minimum Deposit: £1

- Share Trading: 0-9 Deals/ Month: N/A

- ISA: Yes

- SIPP: No

Chip is an investment and savings app that appeals to younger savers and investors. It offers easy-access savings accounts and cash ISAs as well as investment accounts. Chip offers competitive interest rates on its cash saving accounts. Its investment fees are low, although the investment range is limited to funds. The platform fee is 0.25% a year on top of a monthly £1 fee.

- Limited range of diversified funds, making it easy for beginners to start investing

- High interest rate on cash savings

- The limited investment options may not appeal to experienced investors

- Chip's stocks and shares ISA through ChipX costs £5.99 a month (£65 a year), although there are no platform fees

Your capital is at risk.

Popular Guides

Popular Retirement Guides

- How to Open a Stocks and Shares ISA

- Best Stocks and Shares ISAs for 2026

- The Complete Guide to ISAs in the UK

- The Complete Guide to SIPPs in the UK

- Best SIPP Providers of 2026

- Best Lifetime ISAs of 2026

- Best Junior SIPPs for 2026

Popular Stock Broker Reviews

- Fidelity UK Review

- Vanguard UK Review

- Lloyds Bank Investing Review

- IG Trading Review 2026

- Interactive Brokers UK Review

- CMC Invest Review

- Barclays Smart Investor Review

- Trading 212 Review

- eToro UK Review

- Capital.com Review

- Interactive Investor Review

- Saxo Review

- Hargreaves Lansdown Review

- Halifax Share Dealing Review

- AJ Bell Review

- Freetrade Review

- XTB UK Review

CMC Invest

CMC Invest

Trading 212

Trading 212

Moneybox

Moneybox