Hargreaves Lansdown Review

Your capital is at risk.

As the U.K.’s biggest investment platform for individual investors, Hargreaves Lansdown offers a wide range of investment choices for both beginners and seasoned investors. Hargreaves Lansdown offers thousands of funds, stocks, and bonds to choose from. It also offers ready-made portfolios for those not comfortable with choosing their own, and VCTs for investors looking for higher-risk investments.

The transaction fees for shares and ETFs are higher than other platforms, but if you have a large investment pot, then the price difference is negligible. A trading fee of £11.95 will not seem a huge amount if you are investing £5,000 into an ETF, for example. But you won't always pay this. Hargreaves Lansdown doesn't charge for trades if you sign up for regular dealing, where you invest each month. The platform can also work out to a good value in terms of service charges if you hold mostly ETFs or stocks, as there are no platform fees for these in the general investing account, and they are capped at £45 for the ISA.

-

Minimum Deposit:

£100 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 Junior ISA | Winner |

| #1 Junior SIPP | Winner |

| 2026 | #8 |

| 2025 | #4 |

| 2024 | #5 |

| 2023 | #10 |

| 2022 | #9 |

| 2021 | #10 |

| 2020 | #4 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Offers a wide range of accounts, including stock and shares ISAs and SIPPs.

- Lifetime ISAs, Junior ISAs, and Junior SIPPs are available.

- Low or no annual service fee if you hold shares or ETFs.

Cons

- Stock trading fees are high compared to other brokers, at £11.95 per trade.

- The mobile app is basic and charting is unsophisticated compared to better-ranking brokers.

- Service fees are expensive if you hold a high amount in funds.

My top takeaways for Hargreaves Lansdown in 2026:

- Hargreaves Lansdown offers an extensive range of account types and investments, one of its main benefits.

- Hargreaves Lansdown is the most expensive U.K. broker for one-off share trading, with share dealing charges at £11.95 to buy and sell stocks, although the buying fee is reduced to zero for regular trading through direct debit, and there are no trading fees if investing through a junior ISA.

- Hargreaves Lansdown offers an Active Savings Account, which means you can earn competitive interest rates for cash held in your account through partner banks.

- The mobile app is clean and reliable, but it lacks the advanced charting and tools found on more trader-focused platforms, like Interactive Brokers or Saxo.

Hargreaves Lansdown fees

Share dealing fees: Hargreaves Lansdown is among the pricier U.K. brokers for one-off share trading, based on the 21 investment platforms I tested in 2025. Share dealing charges are £11.95 to buy and sell stocks, although the fee is reduced to as low as £5.95 for frequent trading (more than 20 times per month). If you sign up to regular investing through direct debit fees drop to zero.

If you are completely new to stock trading and are looking to invest low amounts into individual shares, I wouldn’t recommend doing it through Hargreaves Lansdown. Buying £100 worth of shares, for example, would immediately reduce the value of your investment to £88.05, plus you'd also pay 0.5% stamp duty if buying U.K. shares or a 1% FX charge if buying overseas shares. You’d then pay another £11.95 if you subsequently wanted to sell.

If you are looking to invest small amounts, you’d be better off going through a platform such as Freetrade or Trading 212, which don’t charge commission on stock trades. Or you may want to try out paper trading on a broker such as eToro first, which offers demo accounts.

Nevertheless, Hargreaves Lansdown can work out to a very good value for trading larger amounts. Fees for reinvesting dividends are zero at Hargreaves Lansdown, compared to rival AJ Bell, which charges £1.50 for dividend reinvestment. Regular investing — where you invest in the same asset each month through direct debit — is also free, which is another great benefit of Hargreaves Lansdown.

ETF and investment trust fees: Trading fees for ETFs and investment trusts are £11.95, like company stocks. Annual custody fees for ETFs, shares, bonds, and investment trusts are capped at £45 a year through a stocks and shares ISA.

There are no custody charges through a general dealing account, which Hargreaves Lansdown calls a ‘fund and share account’. This means Hargreaves Lansdown can work out very competitive regarding service fees if you don’t hold mutual funds and choose ETFs instead, assuming you don’t trade too frequently and suffer the £11.95 trade fee.

Mutual fund fees: Funds are free to buy and sell on the Hargreaves Lansdown platform, which is good for those looking to invest in mutual funds (also called open-ended funds) for diversification. There is an annual management charge of 0.45% on mutual fund holdings of up to £250,000, and this charge can work out to be fairly expensive as your investments increase.

ISA, SIPP, and savings account fees: Another pro of Hargreaves Lansdown is that it does not charge anything for Junior ISAs. There are no service fees or trading charges. This is unique among its rival brokers and I think is a real selling point for Hargreaves Lansdown when it comes to saving for your child. For Junior SIPPs, share trading charges are a flat £5.95.

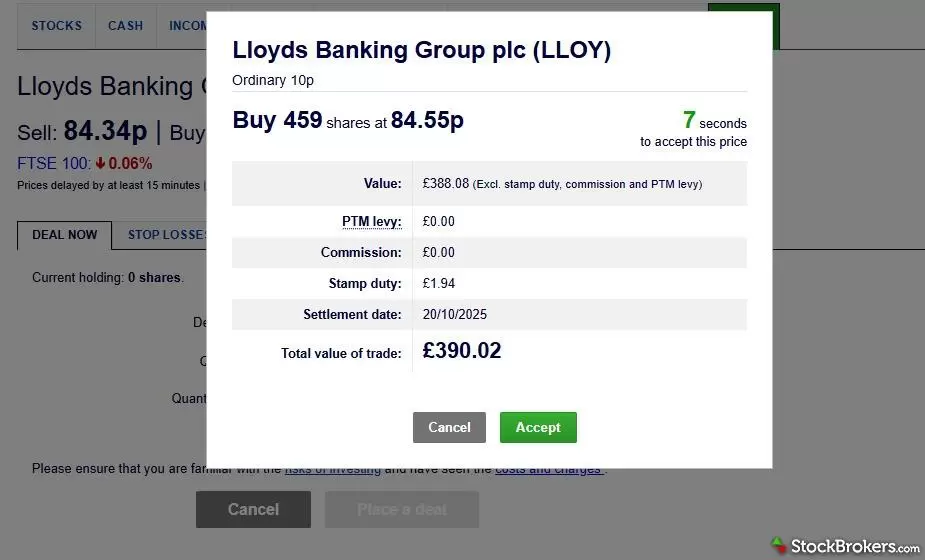

It’s easy to place a trade on Hargreaves Lansdown. Charges are low if investing through a junior ISA as you don’t pay transaction fees – just 0.5% stamp duty if buying U.K. shares such as Lloyds.

| Feature |

Hargreaves Lansdown Hargreaves Lansdown

|

|---|---|

| Minimum Deposit | £100 |

| Share Trading: 0-9 Deals/ Month | £11.95 |

| Share Trading: 10-19 Deals/ Month | £8.95 |

| Share Trading: 20+ Deals/ Month | £5.95 |

| Annual Platform Fee (Funds): £0 - £250,000 | Up to £1,125 |

| Annual Platform Fee (Funds): £250K-£500K | £1125 - £1750 |

| Annual Platform Fee (Funds): £500,000 - £1m | £1750 - £3000 |

| Annual Platform Fee (Funds): £1m and over | £3,000 - £4,000 |

| Bonds - Corporate - Fee | £20 - £50 |

| Bonds - Government (Gilts) - Fee | £20 - £50 |

| ETFs - Fee | £11.95 |

| Investment Trusts - Fee | £11.95 |

| Telephone Dealing Fee | £20 - £50 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Hargreaves Lansdown offers a very wide range of investments, from company stocks, ETFs, self-employed pensions, investment trusts, and bonds. You can buy company shares through international stock exchanges based in Europe and North America.

It’s easy to feel the platform is overwhelming at times, particularly for beginners, as there are thousands of investments to choose from. Those just starting out may find it helpful to explore Hargreaves Lansdown’s Wealth Shortlist, which highlights funds that Hargreaves Lansdown recommends for the best long-term performance potential.

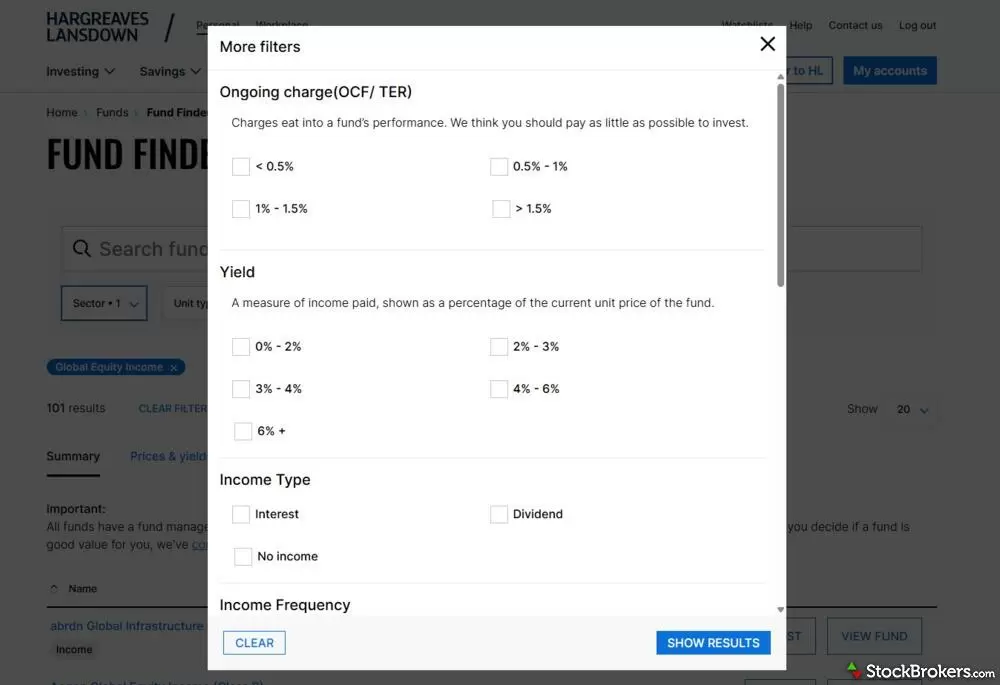

When searching for a fund, you can sort by sector (such as property), region or price. This is a helpful way to narrow down fund choices, particularly if you are motivated by price and looking for funds with ongoing costs below 0.5%.

There are also a range of ready-made funds, where you can buy into standalone investment portfolios created for you. These are simple all-in-one investment fund options for people who want diversification straight away. They are managed by portfolio managers at Hargreaves Lansdown, with annual fees starting from around 0.79% and going above 1% a year in total, taking into account the fund management charge and Hargreaves Lansdown's 0.45% platform fee.

One downside of Hargreaves Lansdown, I find, is that it's difficult to get investment inspiration when searching for individual stocks. When you are ready to trade, you have to know the company or ticker that you want to invest in. You cannot sort stocks by dividend payers, sector, or themes such as ESG.

You can sort funds by ongoing charges, dividend yield, income type and other filters. But it’s not as easy to filter or sort stocks.

If you are still too overwhelmed by the many investment choices offered, Hargreaves Lansdown is one of the only U.K. brokers to offer financial adviser services. This includes personal advice on investments, retirement, inheritance tax, and financial planning. The charges are either 1% to 2% of the value of your assets, plus VAT, which is about in line with industry averages, or a minimum one-off fee of £995 for financial advice or £1,495 for financial planning — whichever is higher.

Hargreaves Lansdown also offers an Active Savings Account, which means you can earn competitive interest rates for cash held in your account through partner banks and offers the benefit of keeping your money in one place. It also offers a cash ISA on its platform, again in partnership with other savings providers.

Hargreaves Lansdown doesn't offer any crypto investments. However, it offers Venture Capital Trusts (VCTs) if you're looking to take more risk with your savings while benefiting from tax relief. VCTs allow you to invest in U.K. start-up companies with growth potential, while benefiting from up to 30% income tax relief. However, they must be held for five years to keep tax relief. VCTs are a high-risk investment option and are typically only considered by experienced investors with a significant amount to invest. It's free to hold VCTs with Hargreaves Lansdown, but you'll pay a £50 transaction fee. They can be held through a Fund and Share account with Hargreaves Lansdown, not in an ISA.

Types of ISAs and SIPPs offered

Hargreaves Lansdown offers one of the most comprehensive ranges of tax-efficient accounts among U.K. brokers. If you're looking to invest through an ISA or pension, here’s what’s available.

You can open a stocks and shares ISA, which lets you invest in shares, funds, ETFs, bonds, and investment trusts. It’s ideal for building a long-term portfolio with tax-free growth. For those aged 18–39, there’s the lifetime ISA (LISA), which allows you to invest up to £4,000 per year and receive a 25% government bonus toward a first home or retirement.

Parents and guardians can open a Junior ISA (JISA) for children under 18. The Junior ISA is fee-free at Hargreaves Lansdown, with no dealing or platform charges. This makes it one of the best-value junior investment ISAs, although one downside is you have to do a paper application to open one if transferring from another provider. But once it's up and running you can trade online, although you'll also need to return a W-8BEN paper form by post to invest in U.S. shares.

On the pension side, Hargreaves Lansdown offers a full self-invested personal pension (SIPP). It gives you control over your retirement savings, with access to the same wide investment range available in the ISA. There’s also a junior SIPP for children, which allows contributions up to £2,880 per year (with a 20% tax top-up from HMRC, bringing the total to £3,600). Hargreaves Lansdown is just one of a very small number of investment platforms offering junior SIPPs.

These account types give investors and families a wide range of tax-efficient wrappers for long-term planning, all managed within one unified platform.

Hargreaves Lansdown also offers its own easy-access cash ISA, in partnership with Shawbrook, and also offers access to rates from other providers through its Active Savings Account.

| Feature |

Hargreaves Lansdown Hargreaves Lansdown

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | Yes |

Hargreaves Lansdown ISA review

The Hargreaves Lansdown stocks and shares ISA is a great option for both beginners and experienced investors. You can start with a £100 lump sum or £25 a month. Hargreaves Lansdown is also just one of a handful of brokers offering Lifetime ISAs.

You can invest in thousands of shares, funds, ETFs, and bonds. Or, if you don’t want to choose your own investments, there are ready-made portfolios managed by Hargreaves Lansdown’s team.

Platform: The app and website are detailed and easy to use. Customer service is reliable, with quick phone support, though there’s no in-app chat at the moment.

Hargreaves Lansdown also lets you access cash ISAs from other banks through its platform. Rates over 4% are currently available, so you can earn competitive interest without managing multiple accounts.

Pricing: Platform fees are 0.45% for mutual funds under £250,000, with the rate tapering to 0% on amounts over £2 million. For £15,000 in funds, you’d pay £67.50 a year, plus separate fund manager charges.

So if you have £15,000 invested in mutual funds, you’d pay Hargreaves Lansdown a fee of £67.50 a year. This is on top of separate fees to the fund manager (these are typically less than 0.5% to 1% a year).

For shares or ETFs, the platform fee is 0.45% but capped at £45 a year, making it good value for larger portfolios. Share and ETF trades cost £11.95, so this isn’t ideal for small or one-off trades. However, if you invest at least £25 a month through regular investing, you’ll pay no trading charges. There are no trading charges for mutual funds.

Overall, Hargreaves Lansdown offers a great stocks and shares ISA. However, if you have a high amount invested in mutual funds, you may find a cheaper platform elsewhere.

Mobile trading apps

Hargreaves Lansdown’s mobile app is straightforward to use, although in my opinion is more basic compared to other platforms such as Interactive Brokers and Saxo. There are no charting tools, and you can’t overlay different stocks or indices to compare historical performance.

The news tab is updated regularly, and you can also read investment ideas in articles written by Hargreaves Lansdown analysts.

Elizabeth's take:

"In my testing of the app, I found it easy to see the performance of my investments, create a watchlist, and find information about funds. I also found it easy to place a trade. However, it's not easy to filter or sort stocks or ETFs, so I feel this is an area that could be improved."

The Hargreaves Lansdown mobile app is easy to use but not as extensive as other brokers such as IG, Trading 212, Saxo or IBKR.

Trading platforms

The website for Hargreaves Lansdown offers a huge range of helpful articles and calculators, such as a useful pension tax relief calculator and an inheritance tax calculator.

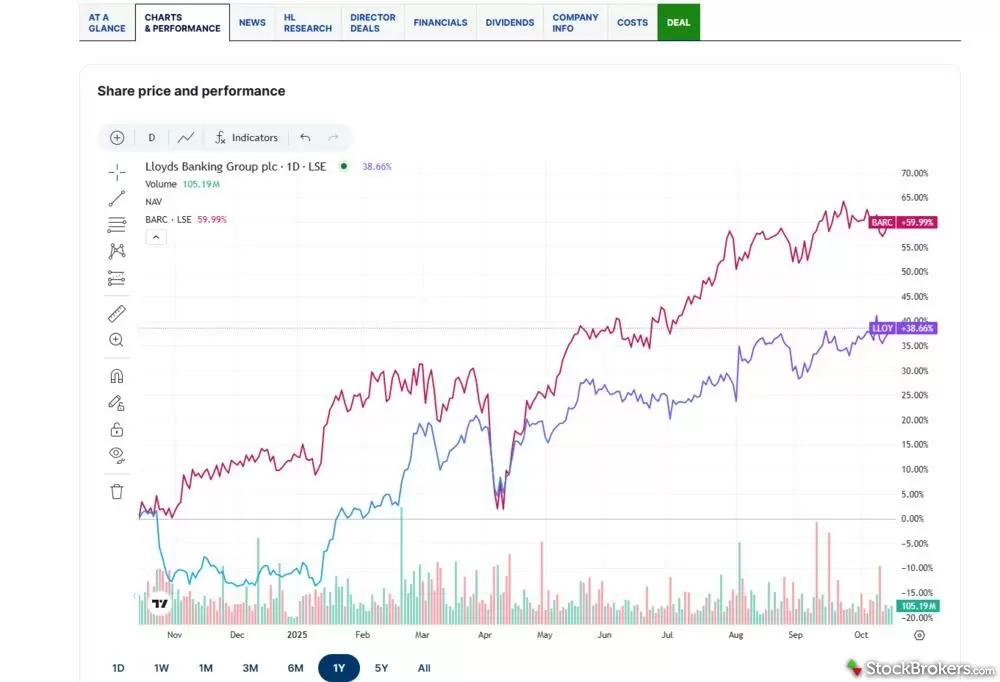

Hargreaves Lansdown has improved its chart tools in the past year and now offers more than 100 indicators and drawing tools. You can overlay different stocks on the same chart to compare historical performance between two or more companies, a feature that is not available on the mobile app.

Bear in mind though that charting tools are not likely to be needed by most everyday investors, so the lack of in-depth chart tools should not necessarily put you off unless you are an active trader.

You can overlay different companies on a single chart to compare historical performance easily.

| Feature |

Hargreaves Lansdown Hargreaves Lansdown

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 109 |

| Charting - Drawing Tools | 11 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | No |

Education

Hargreaves Lansdown is known for its extensive array of educational material. It offers many guides and articles to people looking to learn more about investing and the stock market.

There are more than 200 videos on its YouTube channel that explain investing FAQs and feature fund manager interviews. However, I’d like to see the broker offer a video demonstrating how new customers can get the most from the platform, which would be very useful. Currently, no video walkthroughs appear to exist either on the website or YouTube channel.

I've always found the customer service excellent at Hargreaves Lansdown when I've had a question. You can get through to someone quickly on the phone, although there is no in-app chat service.

| Feature |

Hargreaves Lansdown Hargreaves Lansdown

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

Final thoughts

Hargreaves Lansdown is a very safe choice if you are looking to invest through an ISA, SIPP, or general investment account. It is also one of just a few brokers offering lifetime ISAs and junior SIPPs, which is good if you are looking to open a pension for a child (although the child will require a separate login and password, which can be a hassle).

If you invest in funds — as many new investors looking for diversification do — Hargreaves Lansdown’s annual service fee of 0.45% is on the higher end. But it’s only really an issue once your investments grow to be worth tens of thousands of pounds. On an investment portfolio worth £100,000, for example, you’d pay £450 a year to Hargreaves Lansdown in service fees. In comparison, Vanguard would charge £150 and AJ Bell would charge £250.

However, if you only invest in shares and ETFs, Hargreaves Lansdown can work out very cost effective as there are no service fees through a general dealing account, or are capped at £42 a year through a stocks and shares ISA. Additionally, Hargreaves Lansdown's junior ISA is a great choice if you are investing for a child, as there are no platform service charges or trading fees.

Hargreaves Lansdown Star Ratings

| Feature |

Hargreaves Lansdown Hargreaves Lansdown

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- CMC Invest Review

- Trading 212 Review

- Interactive Investor Review

- IG Trading Review 2026

- Vanguard UK Review

- Capital.com Review

- AJ Bell Review

- Barclays Smart Investor Review

- Lloyds Bank Investing Review

- Saxo Review

- eToro UK Review

- Halifax Share Dealing Review

- Fidelity UK Review

- Freetrade Review

- Interactive Brokers UK Review

- XTB UK Review

Popular Guides

More Guides

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Crypto Brokers & Apps for March 2026

- Best Junior SIPPs for 2026

- Best SIPP Providers of 2026

- Best Cash ISA Accounts & Rates for 2026

- Best Lifetime ISAs of 2026

- Best Stocks and Shares ISAs for 2026

About Hargreaves Lansdown

Headquartered in Bristol, Hargreaves Lansdown has been around for more than 40 years and is the U.K.’s biggest stockbroker for private investors. More than £130 billion is invested through its platform by around 1.8 million customers. The company was founded by Peter Hargreaves and Stephen Lansdown in 1981 and is now listed on the FTSE 100.