IG Trading Review 2026

Your capital is at risk.

IG is a feature-rich investment platform designed for experienced investors who trade frequently. It offers thousands of shares, investment trusts, and ETFs, along with spread betting and CFDs for higher-risk strategies. You can now also buy crypto through IG as of late 2025.

With commission-free trading on U.K. and U.S. shares and a generous 3.75% interest on uninvested cash, IG is highly competitive on cost. That said, infrequent traders should be mindful of the £8 monthly platform charge that is only waived by making three or more trades a quarter.

IG’s main trading platform is comprehensive, but may feel overwhelming for beginners or those investing smaller sums. However, the simpler IG Invest app is easier for new investors to use.

IG is making moves to appeal to a broader range of U.K. savers and investors. For now, the platform is still most suitable for more experienced investors or frequent traders. New investors, or those looking to invest small amounts, might be better off going through Freetrade, which is owned by IG but operates as a standalone, separate platform.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 Education | Winner |

| 2026 | #3 |

| 2025 | #7 |

| 2024 | #9 |

| 2023 | #1 |

| 2022 | #1 |

| 2021 | #1 |

| 2020 | #2 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Trade 11,000+ shares, trusts, and 2,000 ETFs with £0 commission.

- Pays 3.75% interest on uninvested cash balances.

- Invest via an ISA or SIPP.

- One of the best U.K. stock trading apps for active traders.

Cons

- No mutual funds, bonds, or demo account for share trading.

- Chart tools are limited unless on Pro or £30/month plan.

My top takeaways for IG in 2026:

- IG charges £0 to buy and sell U.S., U.K., EU, and Australian stocks. A foreign exchange fee of 0.7% applies if buying international shares.

- A detailed stock screener tool allows you to filter companies by criteria such as dividend yield, sector, or analyst consensus. I found this to be a good way to get investment inspiration.

- IG offers more than 12,000 shares and ETFs, a wide range of assets for a U.K. broker, but it does not offer mutual funds or bonds.

- The IG Invest app, launched in January 2025, is best for beginner or new investors.

IG is best for:

- Experienced investors making frequent trades

- New investors through the IG Invest app

- Share traders who want access to a wide range of shares and ETFs

- Hands-off investors interested in managed portfolios

- People who prefer to trade through an easy-to-use mobile app

- Those wanting to invest through a free ISA or flat-fee SIPP costing £210 a year (£17.50 a month)

IG fees

IG's fees are extremely competitive, assuming you trade at least three times a quarter.

Active traders pay low trading fees: IG now charges £0 to buy and sell U.S., U.K., EU, and Australian stocks. A foreign exchange fee of 0.7% applies if buying international shares. IG removed its previous £8 fee for share trading in 2024.

IG also pays a generous 3.75% interest on uninvested cash held in GBP on a maximum balance of £100,000, held through an ISA or general dealing account. However, to earn this interest, you must have an open share position at any point in the month or make at least one share trade during the month.

The combination of commission-free trading and interest on cash balances makes IG a competitor to the likes of Trading 212, XTB, or Freetrade (owned by IG).

In contrast, other traditional brokers charge higher fees. Hargreaves Lansdown, for example, charges £11.99 for one-off trades, AJ Bell charges £5, and Interactive Investor charges £3.99.

Keep in mind that these platforms also offer reduced fees for regular dealing, so if you buy the same stock each month, you’ll pay a discounted fee or no fee at all. Halifax, Interactive Investor, and Hargreaves Lansdown do not charge anything at all for regular dealing.

Government fees: Like with all stock trading, the U.K. government charges 0.5% stamp duty when you buy shares. You also pay a £1 .50 government PTM (Panel of Takeovers and Mergers) flat-fee levy if you trade shares with a total value of above £10,000.

IG SIPP: IG’s SIPP, operated by third-party pension provider Options U.K., works out fairly competitively in price, compared with traditional brokers, for those looking to invest through a pension wrapper. IG charges a flat fee of £210 a year (£17.50 a month) for its SIPP. There are no trading fees, and FX fees are 0.7% if you buy shares in another currency. However, IG-owned Freetrade offers a SIPP at £119.88 a year (or £11.99 if paying monthly). So if you’re looking for a simple SIPP and cost is important to you, the Freetrade SIPP works out cheaper. Another option could be CMC Invest, which also offers a flat-fee SIPP at £131.88 a year (£10.99 a month). IG does offer more extensive investment options, although both Freetrade and CMC Invest offer enough for most investors.

| Feature |

IG IG

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Platform Fee (Funds): £0 - £250,000 | N/A |

| Annual Platform Fee (Funds): £250K-£500K | N/A |

| Annual Platform Fee (Funds): £500,000 - £1m | N/A |

| Annual Platform Fee (Funds): £1m and over | N/A |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | £0 |

| Telephone Dealing Fee | £50 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

IG offers more than 12,000 shares and ETFs, a wide range of assets for a U.K. broker. Bonds are not offered directly but can be accessed through ETFs. You can own shares outright, or through spread betting and CFDs, which means you can speculate on share price movements without ever owning the stock.

IG Smart Portfolios: There are five IG Smart Portfolios to choose from based on your risk appetite, ranging from a conservative portfolio to an aggressive portfolio. These are built exclusively with BlackRock's iShares ETFs, allowing you to invest in managed, broadly diversified portfolios with exposure to many global markets.

Total costs per fund are £100 a year if you hold less than £20,000, and 0.5% on the first £50,000 as long as you have at least £75,000 invested (with nothing above this). This means management fees are capped at £250 a year, although you’ll still pay a small cost of around 0.13% to cover external fund charges. For example, if you held a £40,000 portfolio, the total annual fees will be around £288 a year.

This means if you are looking to invest in a ready-made portfolio, IG is worth considering, as the costs are competitive against other platforms. Hargreaves Lansdown, for example, would charge around £300 a year in fees for £40,000 invested in one of its all-in-one portfolio tracker funds.

Cryptocurrency: IG now offers crypto trading to all customers in partnership with Uphold. Previously, it was only available to professional traders.

IG currently offers 35 cryptocurrencies to retail investors, and the crypto offering is fully integrated into the IG trading platfom and the IG Invest app, making it easy to buy.

IG's charges are 1.49% on all crypto trades, similar to other platforms such as Revolut and eToro, which also offer crypto trading.

It's important to note that the Financial Conduct Authority (FCA) does not regulate crypto investments, so you are not protected if a platform that exchanges or holds crypto goes out of business.

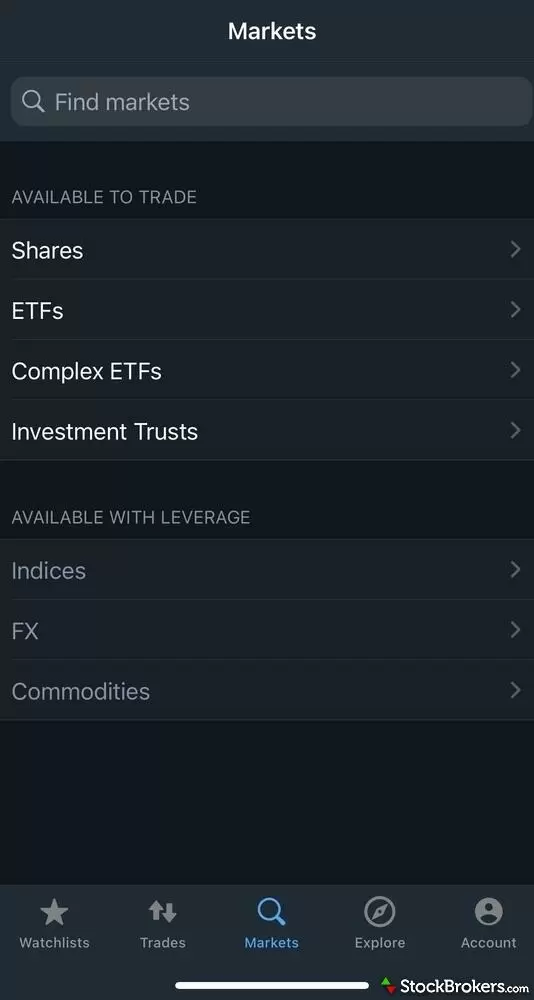

Forex/CFDs: IG also provides access to the forex market, offering CFDs from 17,000 markets. IG is a major player in this space and even ranks as our top pick for U.K. residents in 2026 on our sister site ForexBrokers.com. For a more in-depth dive into its forex offering, check out our IG forex review.

| Feature |

IG IG

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Mutual Funds | No |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | Yes |

| Spread Betting | Yes |

| Crypto Trading | Yes |

| Advisor Services | No |

IG ISA review

IG’s ISA is a good option for investors with some experience who trade relatively frequently.

IG has more than 13,000 global investments you can choose from, including crypto.

There are no platform or management charges for an IG Stocks and Shares ISA. This means you can hold investments in the ISA without paying an ongoing fee, which puts IG broadly in line with low-cost competitors such as Trading 212 and Freetrade. However, investors should still consider other potential costs, including FX fees when investing overseas and trading spreads, which may be higher than on app-based platforms depending on how you invest.

IG’s ISA is flexible, meaning you can withdraw money and put it back in the same tax year without it affecting your overall £20,000 annual ISA allowance. This is a benefit, although many other platforms also offer a flexible stock and shares ISA, so it is not unique to IG.

Mobile trading apps

IG offers two mobile apps: IG Trading and IG Invest.

IG Trading is likely to be more suitable for experienced investors and traders. IG Invest is better for beginners and novice investors.

IG Trading

I found IG’s primary mobile app, IG Trading, very comprehensive. While I found it easy enough to use in my testing, the app could feel complex for new investors. You can see your watch list, search investments, and set up an alert. You can add money to your account through Apple Pay, if you have an iPhone, or through a debit card or manual bank transfer.

When selecting individual stocks, you can set a price alert, buy, and see recent news through the app. There is also a useful ‘Explore’ section where you can see the latest market news, a calendar of key global economic events that could impact markets, and a ‘Top 100 Traders’ feature. This allows you to see the current long or short positions of IG’s top 100 traders, who are selected based on their number of trades placed, longevity of success, and total profit. It is a good way to see what other experienced traders are doing to get inspiration. The traders are refreshed every three days.

There are also some chart tools on the app, allowing you to toggle between candlestick and line view, although the ability to compare different stocks or indices on a single charge is lacking. I was pleasantly surprised to see that you can also add your own drawings and annotations to your chart, a feature not currently offered by most platforms.

The IG Trading app is more comprehensive than the IG Invest app and includes leveraged products such as CFDs.

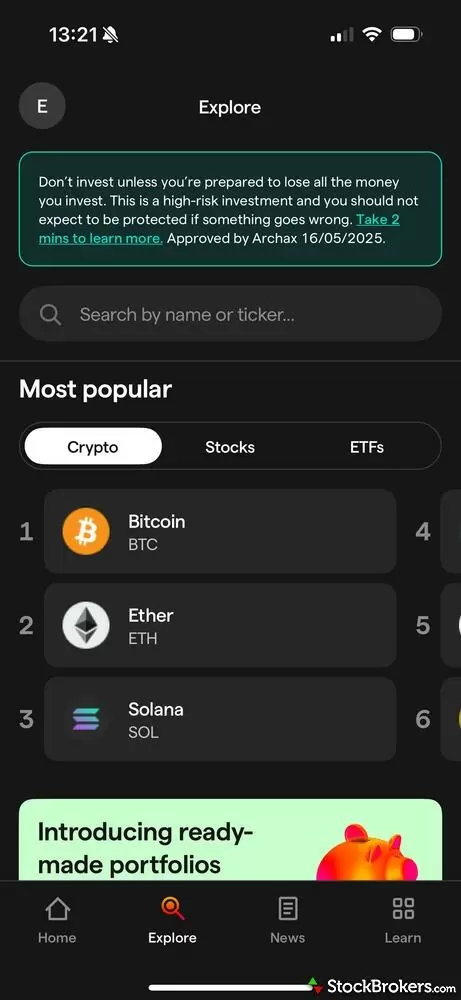

IG Invest

Separate from the IG Trading app, there is a newer app called IG Invest, which launched early in 2025 and is much simpler to use. You can view your watchlist of companies, see the top news, and explore the most popular investments. Through the app, you can easily invest in shares, crypto, or ETFs in the U.K., U.S., Australia, Europe, and Asia. ETFs allow investors to diversify their money for a low cost, so they can offer a great way for new investors to get started.

I particularly liked the ‘lessons’ section on the IG Invest app, which explains how assets such as stocks, bonds, and ETFs work. I found the content easily digestible, explained in bite-sized form across about 10 slides on average. The lessons explain very simply the basics of investing to new investors or experienced investors looking to refresh their knowledge.

Through the IG Invest app you can invest in crypto, shares and ETFs. You can also specify the investments you want when setting up your account.

Trading platforms

I was pleased with how easy the platform is to use – even beginner investors are not likely to have a hard time. When I logged into IG on the website, I was taken to a home screen that features live prices, news, and links to courses. When clicking on my account, I was taken to my Workspace. This is where I can see my watch list, search for investments, and be notified of upcoming earnings announcements.

I could also find analyst consensus for individual stocks, operated by third-party vendor TipRanks, and see sentiment among other experienced IG customers – for example, you can see whether they collectively have long or short positions in a particular stock.

A stock screener tool allows you to filter companies by criteria such as dividend yield, sector, or analyst consensus. I found this a good way to get investment inspiration, and the stock screener is much more in-depth than those offered by many other platforms.

Chart tools are more on the basic side unless you have a Pro account. ProRealTime carries a fee of £30 a month, but is free if your trading activity is consistent and has fairly high value during the month. Through ProRealTime, you can overlay stocks and compare historical performance to an index such as the FTSE 100.

| Feature |

IG IG

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 33 |

| Charting - Drawing Tools | 19 |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | Yes |

Education

The educational guides and materials offered by IG are one of the platform’s key strengths. IG invests heavily in content, education and tools to help understand markets. The IG Academy offers free courses, webinars, and seminars that are designed for traders of all levels. I found a huge range of helpful material, such as the basics of technical analysis and how to identify key chart patterns.

Elizabeth's take:

"I believe IG’s educational material is the best of any U.K. broker. Everything is easily explained across written, video, and audio formats. You can join live webinars and in-person trading seminars that run weekly, for free, and you can also watch webinars repeatedly. They are organised according to level, whether you are a beginner, intermediate, or advanced investor."

In the newer IG Invest app, there are seven lessons available. In my view, they are perfectly pitched at new investors without being too overwhelming. They explain the basics of investing, such as explaining how shares and ETFs work, over a few slides. They also offer some guidance on how much you may want to think about investing, such as following the 50/30/20 rule, where you allocate 50% of your income to key bills, 30% to ‘nice-to-haves’ such as eating out and new clothes, and 20% towards investing and saving.

You can also watch Trade Live with IG, a TV show live-streamed daily from 07:30 - 10:00. Presenters Angeline Ong and Rich McDonald offer stock analysis, market trends, real-time analysis of overnight news, company results, and answer questions from viewers. It’s a good way to encourage community engagement as viewers and IG users are encouraged to comment and ask questions in a live chat stream.

IG does not offer a demo account for share trading, but does offer a demo account for spread betting and CFDs. These are complex instruments that should only be considered by investors who are willing to take high risk and don’t mind losing money. Most everyday investors would stick to share dealing and buying funds.

Investing in education and research tools is a priority for IG, which offers some of the best educational material among investment platforms. The Invest app makes it easy to learn the basics of investing through the Learn section.

| Feature |

IG IG

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

Final thoughts

IG provides a fantastic share dealing experience that is very competitive on price now that it offers commission-free trading. It has excellent learning materials that are helpful for both beginner and sophisticated investors.

IG is one of a small, but growing, number of FCA-registered U.K. brokers offering the option to buy and hold direct cryptocurrencies. However, many platforms plan to offer cryptocurrency exchange-traded notes (cETNs) now that the FCA has allowed U.K. retail investors to invest in them.

IG appeals more to experienced traders than beginner investors, but it is making moves to appeal to a wider range of investors through the IG Invest app. IG also offers its IG Smart Portfolio range for those who want a hands-off approach and don’t want to create their own portfolios. These ready-made portfolios can offer good value, particularly for those with larger portfolios above £50,000, as there are no extra platform management fees above that amount.

IG is a top-rated broker on the following guides

- Best Investment Platforms in the UK for 2026

- Best UK Trading Platforms for Beginners of 2026

- Best UK Day Trading Platforms of 2026

- Best Stock Trading Apps UK of 2026

IG Star Ratings

| Feature |

IG IG

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Vanguard UK Review

- AJ Bell Review

- Barclays Smart Investor Review

- Hargreaves Lansdown Review

- Freetrade Review

- Saxo Review

- Fidelity UK Review

- Interactive Brokers UK Review

- CMC Invest Review

- eToro UK Review

- Lloyds Bank Investing Review

- Halifax Share Dealing Review

- XTB UK Review

- Capital.com Review

- Interactive Investor Review

- Trading 212 Review

Popular Guides

More Guides

- Best Stocks and Shares ISAs for 2026

- Best SIPP Providers of 2026

- Best Lifetime ISAs of 2026

- Best Crypto Brokers & Apps for March 2026

- Best Junior SIPPs for 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Cash ISA Accounts & Rates for 2026

About IG

IG has a longstanding reputation, having been around since the 1970s. It was the first company to offer financial spread betting in 1974. IG now has more than 310,000 customers worldwide with a physical presence in 18 countries. It also recently acquired the Freetrade platform.