Vanguard UK Review

Your capital is at risk.

Vanguard U.K. Investor is part of the Vanguard group, one of the world’s largest fund managers. The platform is built around low costs, simplicity, and long-term investing, offering a range of index funds and ETFs that have made Vanguard a global favourite among cost-conscious investors. As such, Vanguard is particularly appealing to beginners and long-term savers who want a reliable, low-maintenance way to grow their money.

-

Minimum Deposit:

£500 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 SIPP Provider | Winner |

| 2026 | #15 |

| 2025 | #20 |

| 2024 | #17 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Excellent value for portfolios above £32,000.

- Great for low-cost, diversified investing.

- Ideal for beginners seeking simple, long-term options.

Cons

- Limited to Vanguard funds and ETFs only.

- Website experience could be improved.

- £4 monthly fee is steep for small portfolios.

- Other platforms may be cheaper for larger portfolios.

My top takeaways for Vanguard UK Investor in 2026:

- Vanguard has a £4 monthly fee for investors with less than £32,000 across all its accounts. If you have less than £32,000 held on the Vanguard platform, this fee will make the platform more expensive than some competitors. However, Vanguard's simplicity will appeal to many.

- Vanguard offers a range of accounts, including SIPPs and ISAs, for tax-efficient investing.

- There is no ability to buy shares, investment trusts, or to invest in alternative assets, such as commodities or crypto with Vanguard.

- Vanguard has increased the educational material on its website in the past few years, featuring around 100 articles on a range of topics, such as how ETFs work.

Vanguard fees

Vanguard is widely recognised for its low costs, but its fee structure is most beneficial for investors with medium to large portfolios. While charges are simple and transparent, the minimum monthly fee can make Vanguard expensive for small balances, especially compared with platforms that charge no custody fees at all.

Platform fees: Vanguard charges a straightforward platform fee of 0.15% per year, applied across all the accounts you hold on the platform. This fee is capped at £375, meaning once your combined investments exceed £250,000, you will not pay more than £375 annually. Vanguard does, however, have a minimum charge of £4 per month, which means that small portfolios—typically those under £10,000—can face proportionally high costs.

The minimum fee does not apply to junior ISAs, where the standard 0.15% platform charge is used instead. For example, a £5,000 Junior ISA would cost just £7.50 per year, working out to less than £1 per month.

Fee example: On a total investment of £1,000, for example, you’d pay fees of £48 with Vanguard — equivalent to a 4.8% annual percentage platform charge. In comparison, AJ Bell charges platform fees of 0.25%, equal to £2.50 in this example, and Hargreaves Lansdown charges up to 0.45% (£4.50), while a platform such as Trading 212 or XTB don't charge platform fees for the ISAs.

Management fees: Like all investment platforms, there are separate annual management fees for each fund you invest in. These average at 0.2% across Vanguard’s funds but the cheapest fund is just 0.07%. Vanguard has cut fees on several ETFs in 2025. For example, the Vanguard FTSE All-World UCITS ETF, which invests in 3,600 company stocks worldwide and is one of the most popular ETFs on Vanguard's U.K. platform, has dropped to 0.19% from 0.22%.

Trading fees: There are no fees for buying, selling, or switching funds. Vanguard places bulk deals twice a day, and your purchase will be included in that for free. However, if you want to buy or sell an ETF in real-time, you’ll pay a £7.50 fee.

There are no exit or transfer fees.

Vanguard offers great value for money for investors with mid to large portfolios. However, if you have a portfolio worth more than £100,000 then a platform that charges a flat fee — such as Halifax, Interactive Investor (ii), or even Hargreaves Lansdown — may be more economical. Halifax, for example, charges £36 a year for its ISA or share dealing account although you do pay trading charges, unlike with Vanguard. Another option could be InvestEngine, which offers a similar service to Vanguard but doesn't charge platform fees.

You should weigh up how often you’ll be trading and your investment choices when working out which is the better value.

| Feature |

Vanguard UK Investor Vanguard UK Investor

|

|---|---|

| Minimum Deposit | £500 |

| Share Trading: 0-9 Deals/ Month | N/A |

| Share Trading: 10-19 Deals/ Month | N/A |

| Share Trading: 20+ Deals/ Month | N/A |

| Annual Platform Fee (Funds): £0 - £250,000 | £48 - £375 |

| Annual Platform Fee (Funds): £250K-£500K | £375 |

| Annual Platform Fee (Funds): £500,000 - £1m | £375 |

| Annual Platform Fee (Funds): £1m and over | £375 |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | N/A |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Vanguard offers a deliberately simplified investment range, focusing exclusively on low-cost mutual funds and ETFs. While this means you can’t buy individual shares, investment trusts, or alternative assets, it creates a streamlined platform that strongly suits long-term, buy-and-hold investors.

You can invest across global markets, including the U.K., U.S., Europe, and emerging markets, through diversified funds and ETFs rather than picking individual securities. These can be held in a Vanguard ISA, SIPP, junior ISA, general account, or self-employed pension.

Vanguard offers a streamlined selection of index funds and ETFs, giving investors simple access to global markets.

Funds

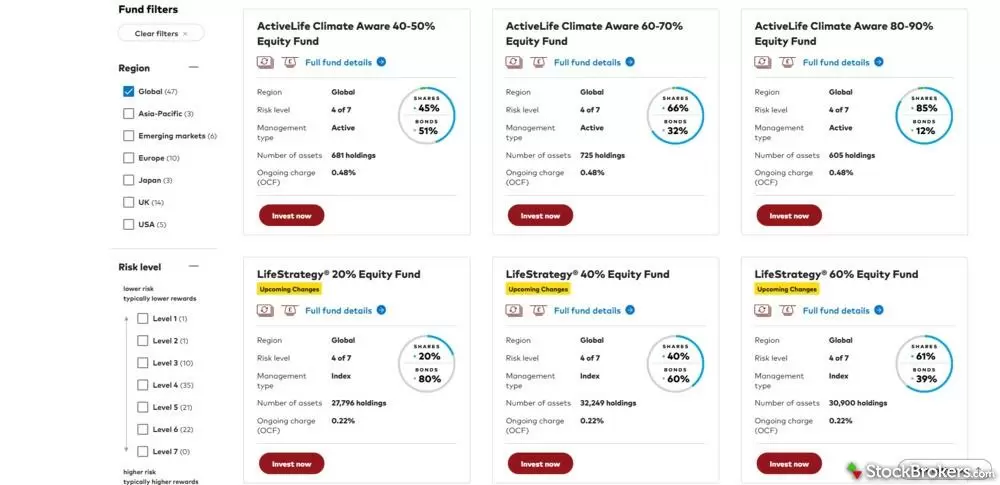

Funds are the heart of Vanguard’s platform, and the selection, around 90 index funds and ETFs, is designed to offer broad global diversification at very low cost. Popular choices include the FTSE 100 Index Fund, the S&P 500 UCITS ETF, and the FTSE All-World UCITS ETF, which now has a reduced fee of 0.19%.

Vanguard’s well-known Lifestrategy range is especially appealing for beginners. These all-in-one portfolios combine global equities and bonds in different proportions (such as 20%, 60%, or 80% equity) and automatically rebalance, making them a simple starting point for long-term investors.

Vanguard’s LifeStrategy funds offer low-cost, diversified portfolios for long-term investing that you can track.

Vanguard also offers a “Managed ISA” option, matching investors with one of five portfolios to reflect their saving goals and attitude to risk for an average cost of 0.52%. These investments are regularly monitored and adjusted by Vanguard to suit your risk level and investment preferences.

Vanguard's Managed Personal Pension (SIPP) works in a similar way, creating an investment plan for you depending on your attitude to risk, the age you plan to retire, and how much you'd like to invest. Total fees are around 0.62% a year, including Vanguard's 0.15% platform fee and fund management fees of 0.47%.

| Feature |

Vanguard UK Investor Vanguard UK Investor

|

|---|---|

| Share Trading | No |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | No |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | Yes |

Vanguard ISA review

Vanguard’s stocks and shares ISA is a great choice for new investors looking for simplicity. You get access to a wide range of low cost, diversified funds and ETFs. You can invest in a diversified fund such as the Lifestrategy range, or can select the Managed ISA option where the portfolio is rebalanced when needed, according to your risk profile.

It’s easy to sign up for the ISA, and the Vanguard ISA is flexible, giving you the ability to withdrawal money and replace it within the same tax year. There is perhaps a higher entry point than other platforms. You can invest from £100 per month or with a minimum £500 lump sum.

Charges are on the low side, averaging about 0.41% a year. If you invested £50,000 in a Lifestrategy fund, for example, you’d pay Vanguard platform fees of £75 (0.15%) and an average fund management cost of £130 (0.26%), meaning total annual charges of £205.

Vanguard’s ISA can work out more costly than other platforms if you hold less than £20,000, due to the minimum £4 monthly fee. But some think £4 a month is a small price to pay for an easy-to-access diversified investment ISA.

An alternative to Vanguard could be InvestEngine, which offers Vanguard funds and ETFs (in addition to ones from other providers) but doesn’t charge a platform fee.

With Vanguard’s ISA you can view fees, compare fund performance at a glance, and see and manage your holdings.

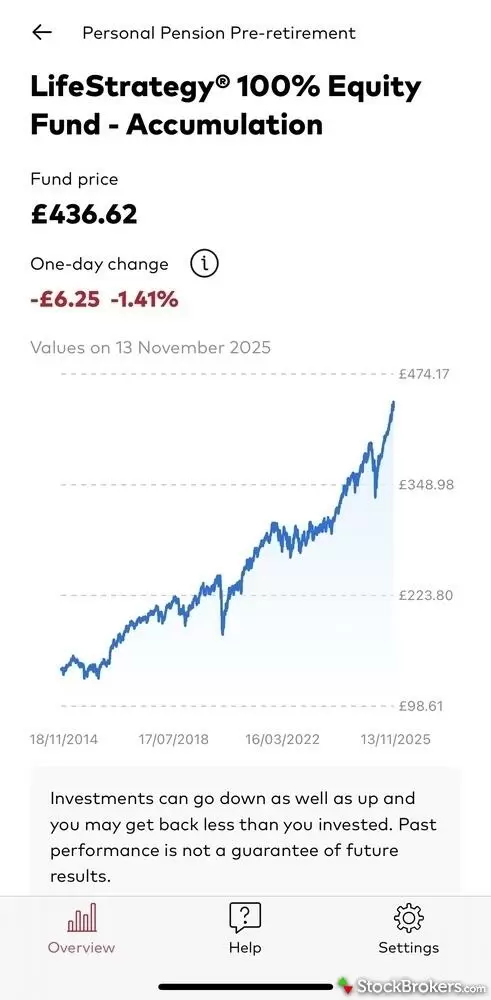

Mobile trading apps

Vanguard’s mobile app is functional but extremely basic, offering only the essential features needed to manage a long-term portfolio. It works well for investors who simply want to check their balance or make regular contributions, but it lacks many of the tools and features offered by more modern investing apps.

One downside is that you can't open an account in the mobile app, you have to go through the website.

Elizabeth's take:

"In my testing, I found the app quite comprehensive. It’s great to see all my accounts on the go, without having to log into the platform on a web browser, as used to be the case before the mobile app was introduced. It means I can check my accounts more frequently. You can see in bullet points where the bulk of your investments are held, such as in equity funds, cash, or ready-made portfolios."

Trading platforms

Vanguard’s trading platform is intentionally simple, offering a clean and straightforward website that prioritises ease of use over advanced tools or research features. While this minimal approach makes the platform accessible for beginners and long-term passive investors, it lacks many of the analytical tools, market data, and educational content found on more comprehensive investment platforms.

I found it easy to open an account in just a matter of minutes. You can link to another account, which means you can view another person’s account (with permission) and they can see yours. This is handy for couples when managing their household finances. Other investment platforms, such as Hargreaves Lansdown and AJ Bell, also offer this feature. You can also see Junior ISA accounts you may hold for any children. Vanguard doesn't offer junior SIPPs.

Research, help, and support are more limited than at other brokers. But Vanguard’s lack of extensive investor options means it is easy enough for even a novice investor to figure out. You can filter funds by risk appetite, asset class, or geographical location. Just pick a fund and start investing. There are no charges for switching investments if you feel you have made an error. It’s worth doing some reading elsewhere on the difference between accumulation and income choices and how to decide whether you want to lean towards equities or bonds. Interactive Investor, Hargreaves Lansdown, Fidelity or AJ Bell are helpful for this type of guidance.

| Feature |

Vanguard UK Investor Vanguard UK Investor

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | No |

| Charting - Indicators / Studies | 0 |

| Charting - Drawing Tools | 0 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

Vanguard’s educational offering is solid but limited, providing useful written guidance for beginners while lacking the breadth and variety found on more comprehensive platforms. However, Vanguard has increased the educational material on its website in the past few years, featuring around 100 articles on a range of topics such as how ETFs work, teaching your children about the value of money, and how to choose between income and accumulation.

There are no podcasts or webinars. I think it would be great if Vanguard could offer more variety of educational content on its website and app.

You can create a Portfolio Valuation Report from your account. This includes a pie chart showing your asset allocation — such as how much you have in U.K. equities and other global equities — along with gains and losses since your initial investment. This is created in a matter of seconds and is helpful for seeing all your funds and total gains or losses in an understandable list format.

| Feature |

Vanguard UK Investor Vanguard UK Investor

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

Vanguard is basic in functionality and choice but offers a very good service for less experienced investors and those looking for simple long-term investments — perhaps those looking ahead to retirement. Fees in general are low, although if you have only a small amount to invest, there will likely be other cheaper platforms. Vanguard is worthy of consideration by savers looking to take a hands-off approach to investing, either through an ISA, SIPP, or general investment account.

Vanguard Star Ratings

| Feature |

Vanguard UK Investor Vanguard UK Investor

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Hargreaves Lansdown Review

- XTB UK Review

- Interactive Investor Review

- Fidelity UK Review

- IG Trading Review 2026

- Capital.com Review

- Saxo Review

- Interactive Brokers UK Review

- eToro UK Review

- Lloyds Bank Investing Review

- AJ Bell Review

- Trading 212 Review

- Halifax Share Dealing Review

- Barclays Smart Investor Review

- Freetrade Review

- CMC Invest Review

Popular Guides

More Guides

- Best Cash ISA Accounts & Rates for 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best SIPP Providers of 2026

- Best Stocks and Shares ISAs for 2026

- Best Lifetime ISAs of 2026

- Best Crypto Brokers & Apps for March 2026

- Best Junior SIPPs for 2026

About Vanguard

Vanguard pioneered index investing when it launched in the U.S. in 1975, founded by legendary investor John Bogle, who is credited with inventing the index fund. Vanguard launched its U.K. retail platform in 2017 and says it has gained more than 30 million customers since then.