Trading 212 Review

Your capital is at risk.

Trading 212 is an investing platform growing in popularity in the U.K., thanks to its easy-to-use app, commission-free share trades, and generous interest rates paid on unvisited cash.

If you’re looking for a simple investment app for shares or ETFs, I think Trading 212 is a great option. You can invest through a stocks and shares ISA or general investment account. However, Trading 212 doesn’t offer SIPPs or pensions.

Trading 212 is easy enough to use, even for users with little investing experience. However, there’s also the option to open a practice account while you get to grips with the platform. Overall, I think Trading 212 offers a great way to invest in U.S. and European shares and funds at low cost.

-

Minimum Deposit:

£1 -

ISA:

Yes -

SIPP:

No

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 Overall | Winner |

| #1 Stocks and Shares ISA | Winner |

| #1 Beginners | Winner |

| 2026 | #1 |

| 2025 | #2 |

| 2024 | #2 |

| 2023 | #5 |

| 2022 | #5 |

| 2021 | #4 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Tax-free investing via an ISA.

- High interest rate on cash balances.

- User-friendly mobile app with practice accounts available.

- Commission-free stock and ETF trading, including fractional shares.

Cons

- Does not offer a SIPP.

- Limited educational materials when researching investments.

- Only offers stocks and ETFs; does not offer mutual funds or bonds.

My top takeaways for Trading 212 in 2026:

- Trading 212 is best for investors who want a simple, low-cost way to trade stocks and ETFs. Due to its relative simplicity compared with other platforms, it could be a good choice for beginners.

- Trading 212’s charging structure is simple – it charges no fees for buying and selling shares. However, you'll be charged a small currency conversion fee if you buy a stock listed overseas.

- Trading 212 offers around 13,000 investments, although this is limited to stocks and ETFs. It doesn’t offer mutual funds but you can get exposure to a diversified range of investments through the many ETFs available.

- There is the added benefit that Trading 212 offers a flexible ISA that pays competitive interest on cash.

- Trading 212 offers more than 50 charting tools on its mobile app, which is appealing to experienced investors looking to analyse trends and historical performance.

Trading 212 fees

Trading 212 is very competitive on fees, particularly when compared to traditional brokers.

Trading 212 is among a handful of newer brokers, such as XTB and Freetrade, that have disrupted the investment market by offering commission-free stock trading. Investors don’t have to worry about paying dealing fees, meaning you can buy or sell small amounts of shares without your investment being swallowed up by charges.

Commission free trading: Trading 212’s charging structure is simple – there are no fees for buying and selling shares. There are also no platform or management fees on its ISA or standard Invest account.

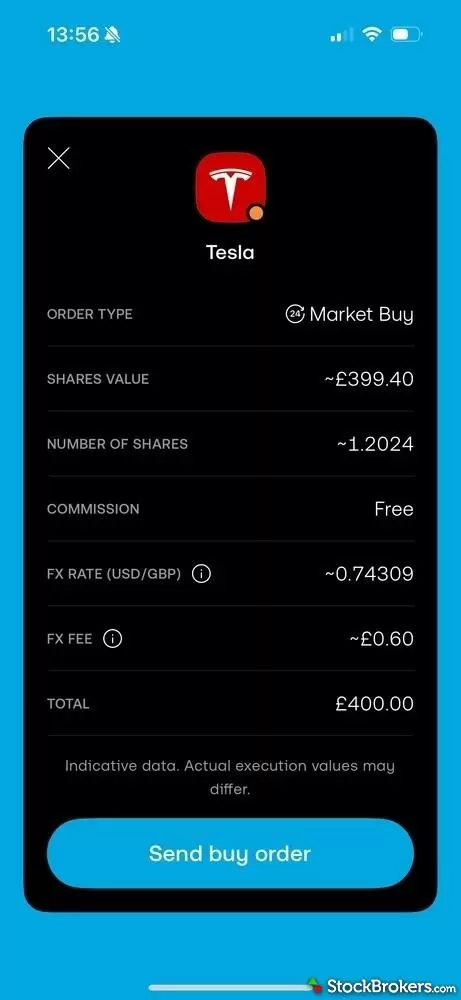

However, you'll be charged a small currency conversion fee if buying a stock listed overseas. For example, if buying Apple in U.S. dollars, you would pay 0.15% when buying (and 0.15% when selling) for converting pounds to dollars. On $500 worth of shares, for example, you’d pay a currency conversion fee of around £0.75 each way.

This is much cheaper than other platforms, such as Halifax Share Dealing and Interactive Investor, which charge more than 1% for currency conversions.

It's worth bearing in mind that you'll pay tax when buying shares in U.K.-listed shares. A stamp duty of 0.5% applies when buying (not selling), and is paid automatically when you place a trade. There is no stamp duty on ETFs.

Trading 212 allows you to hold multiple currencies in your investment account so you don’t always have to incur foreign exchange fees every time you buy shares in another country. Examples of the 13 different currencies you can hold include U.S. dollars (USD), euros (EUR), pound sterling (GBP), and the Swiss Franc (CHF).

Interest rate on cash: A major benefit of Trading 212 is that it pays 4.05% interest on cash held in its accounts, paid daily. This top interest rate applies to cash held in GBP (pounds). On cash held in U.S. dollars (USD), the interest rate is 3.8%, and on euros (EUR) the interest is 2.2%. These rates are often higher than other investment platforms and high-street banks.

Miscellaneous fees: There are no charges for withdrawing money from Trading 212. You're also not charged inactivity fees if your account lies dormant, which some other platforms charge.

Trading 212 does not charge commission on trades. It charges a 0.15% FX fee when buying shares in companies listed overseas.

| Feature |

Trading 212 Trading 212

|

|---|---|

| Minimum Deposit | £1 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Platform Fee (Funds): £0 - £250,000 | £0 |

| Annual Platform Fee (Funds): £250K-£500K | £0 |

| Annual Platform Fee (Funds): £500,000 - £1m | £0 |

| Annual Platform Fee (Funds): £1m and over | £0 |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | £0 |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Trading 212 offers about 14,000 investments, which is a huge range for investors. This includes the choice of 9,000 company shares, 4,500 ETFs, and more than 300 investment trusts. One big drawback is that Trading 212 doesn’t offer mutual funds (also called open-ended funds). This may be a downside for investors looking for further diversification, although you can still get diversification through ETFs.

A big draw is that Trading 212 is one of just a few newer platforms — along with Freetrade, Robinhood, and XTB — to offer fractional shares, making it easier to buy small amounts of individual company shares.

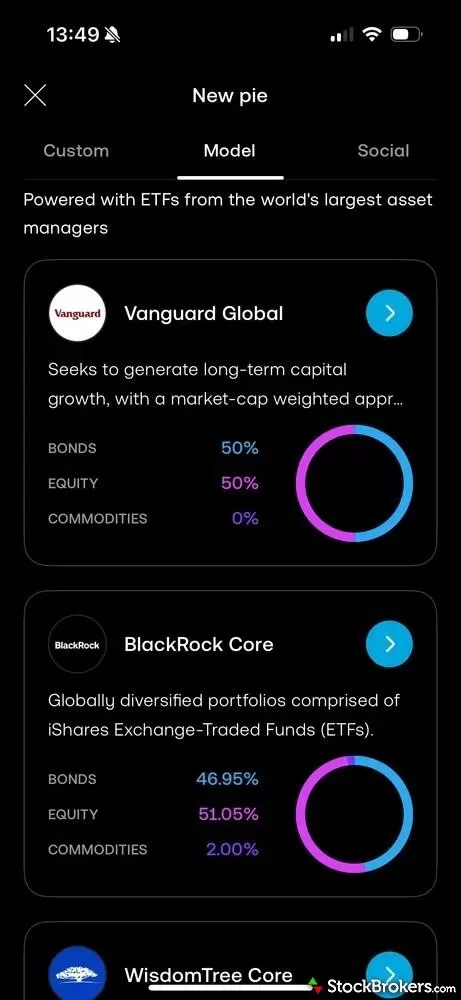

Trading 212 doesn’t offer ready-made portfolios as such. But you can invest in a mixed allocation ETF by selecting the ‘browse all ETFs’ section at the bottom of the app on the search page. You can also invest in a ‘Model Pie’, found in the portfolio section, where you can invest in a diversified range of ETFs curated by large asset managers such as BlackRock and WisdomTree. You can set up regular investments into a pie from a debit card or from cash in your account, allowing you to invest automatically daily, weekly or monthly.

You can also build your own Pie, or copy one built and shared by other Trading 212 users. However, these are probably best left to more experienced investors. A new investor may find it simpler to select their own handful of investments, or invest in a diversified ETF managed by a professional fund manager.

You cannot directly buy crypto through Trading 212. But as of 8th October 2025 you can invest in crypto ETNs (exchange-traded notes) as U.K. financial regulator, the FCA, is opening up crypto ETNs to everyday investors. These give exposure to cryptocurrency performance without directly owning currencies.

Trading 212 offers a free virtual debit card through its Invest account, allowing you to spend uninvested cash. It currently pays 1.5% cashback (capped at £15 a month) and includes the ability to hold 13 different currencies, meaning you can avoid FX fees when buying overseas shares or spending abroad.

You can also get a physical debit card, with a one-off issue fee of £4.95, allowing you to withdraw money from cash machines. ATM withdrawals are free up to £400 per month. After that, a 1% fee is charged.

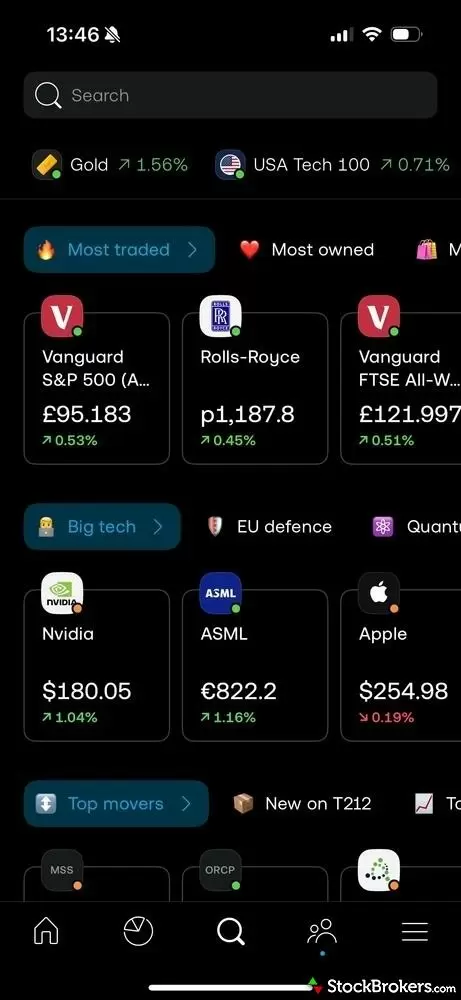

Trading 212 offers thousands of stocks and ETFs. Through the ‘search’ tab on the mobile app, you can view investments by most popular, by sector or you can browse all stocks and ETFs.

| Feature |

Trading 212 Trading 212

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Mutual Funds | No |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Trading 212 ISA review

Trading 212 has a fantastic ISA offering that is one of the best options available for U.K. investors. It’s flexible, low-cost, and easy to use, in my opinion.

Trading 212 Cash ISA

Trading 212 offers a cash ISA that currently pays 3.85%, which is higher than the rates offered by most high street banks. It’s straightforward, flexible, and completely free of platform charges, making it attractive for savers who want a simple, tax-free home for their money.

A big benefit of the Trading 212 ISA is flexibility. You can withdraw and replace funds within the same tax year without affecting your overall £20,000 ISA allowance. This isn’t common among ISA providers, and it gives you more control over your savings.

Another handy feature is the ability to move money between the cash ISA and the stocks and shares ISA. This makes it easy to start with guaranteed interest and later switch into investing when you’re ready, although it's not immediately obvious how to transfer money between accounts. To move funds from one to the other, go to "Menu" on your account, tap "Manage Funds," choose the amount you want to transfer and the account to transfer it to, then confirm the transfer.

When I tested the platform, withdrawing money from my ISA to my bank account was quick and easy, and there were no withdrawal fees.

Trading 212 Stocks and Shares ISA

Trading 212’s stocks and shares ISA is designed for investors who want to grow their money in the markets without paying trading or platform fees. You can invest in thousands of companies worldwide, including more than 5,000 in the U.S., 1,000 in the U.K., and hundreds more across Europe and Canada. If you prefer instant diversification, there are also over 4,000 ETFs available. These are easy to sort by sector, equity or fixed income, or mixed allocation.

Uninvested cash inside the ISA earns 4.05% interest, which is actually higher than the rate on Trading 212’s own cash ISA. To benefit, you’ll need to enable the ‘interest on cash’ feature in the app. The only fee to be aware of is a 0.15% currency conversion charge when buying overseas stocks or ETFs. Trading 212's virtual card is not available through the ISA.

Trading 212's ISA is also flexible, allowing you to withdraw and replace money within the same tax year without losing your allowance. Combined with fractional share trading and no dealing fees, I think Trading 212 offers one of the most accessible and cost-effective stocks and shares ISAs in the U.K.

One drawback is that it's not easy to set up regular investing with Trading 212. You can set up the auto-invest when investing in a pie, but not for individual stocks or ETFs. You can, however, create a pie and hold one ETF and set up auto investing that way.

Mobile trading apps

Trading 212’s mobile app is highly rated by users, and has a rating of 4.7 stars out of 5 based on more than 300,000 ratings on the Apple store and 4.3 stars out of 213,000 ratings on the Google Play store.

Elizabeth's take:

"I found the app fun to use – particularly as you can open a demo account funded with £5,000 of virtual money, allowing you to test your own investment hunches without losing any cash. I also liked the fact that it’s easy to get investment inspiration by seeing top winners and losers, the most owned stocks, and new companies on the platform."

Trading 212 offers more than 50 charting tools on its mobile app — an unusually large amount on mobile compared to other brokers. This is appealing to experienced investors looking to analyse trends and historical performance but hard to use fully on a small screen.

You can also easily see your portfolio by selecting the ‘pie’ symbol and view your portfolio’s performance over time in chart form. I like the fact it's really easy to see your overall return, and the individual performance of each of your investments.

You can also ask questions to other users, or discuss investments, through the social tab on Trading 212. However, there are so many new posts constantly coming through that I find this section hard to navigate and get any meaningful use from.

Pies offer a way to invest in a diversified portfolio operated by professional asset managers, or you can create your own.

Trading platforms

The Trading 212 website is comprehensive, allowing you to buy and sell in real time. I liked the fact you can easily see top winners and losers, and there are extensive charting tools available for free to all users, powered by TradingView. This includes more than 50 indicators such as Simple Moving Average to help you analyse historical trends in the price of a stock you are researching. Click on the settings option on the top right of a chart to discover the full range of charting tools.

One criticism I have is that you can’t overlay different stocks or indices on the same chart to easily compare historical performance. Many other brokers offer this.

I think the website feels more basic in appearance and functionality compared to brokers such as Interactive Brokers or Hargreaves Lansdown. But for investors looking to execute simple trades and manage their portfolios, the website offers all you need. Trading 212 typically appeals to younger investors, who are likely to trade on the app anyway.

Trading 212 offers many ways to customise a chart on its mobile app. You can add notes, compare historical performance and change the layout.

| Feature |

Trading 212 Trading 212

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | |

| Charting - Drawing Tools | |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

Trading 212 offers a good range of educational articles on topics such as using indices for investing, how to read financial statements, and an explanation of different asset classes.

A new AI analysis section on the app analyses your portfolio, summarising high performers and under performers. This can be found in your portfolio section. Selecting ‘full analysis’ can be a useful way to see the overall risk level of your portfolio and whether it is more suited to growth or income.

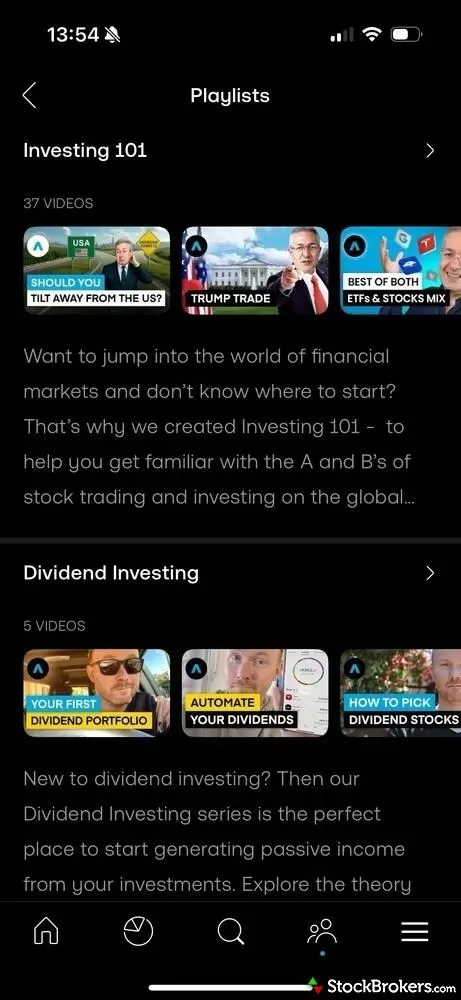

There are around 40 videos available to view on the app aimed at helping newer customers understand how the stock market works, covering topics such as how to choose your first investment, how to pick dividend stocks, and technical analysis for beginners.

However, there are no webinars for people looking for more in-depth information or answers to questions. Overall, I found the educational experience offered more basics than other platforms such as eToro and IG, but there is enough to help new customers get started.

Trading 212 has around 40 videos on its mobile app to help users learn about investing. There is also a ‘Learn’ section, but this redirects away from the app to the Trading 212 website.

| Feature |

Trading 212 Trading 212

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Are you new to investing?

We thoroughly tested 17 top U.K. brokerages to find the best choices for beginner investors. Read more in our guide.

Final thoughts

Trading 212 is a great platform for investing in the stock market, whether you're a new or experienced investor. It also offers a high interest on uninvested cash, which may help tempt people new to investing. Trading 212’s key selling point is the fact you can buy and sell stocks at no cost, except a small charge of 0.15% if you are buying shares in a currency not held in your account. Although, bear in mind that 0.5% stamp duty is always charged when buying U.K. stocks.

Another advantage is that you can start with a practice account, meaning you can apply different trading strategies without having to worry about losing real money. This feature is especially beneficial to beginners. This type of practice trading, also called paper or virtual trading, is typically offered by brokers that offer CFD trading.

One main drawback of Trading 212 is that it doesn’t offer a SIPP, meaning investors can’t benefit from tax relief on investments earmarked for retirement. Trading 212 also doesn't offer telephone support, but does respond promptly in the in-app chat function.

Overall, Trading 212 offers a great way to get to grips with investing in stocks and ETFs. When you are ready to trade, you can buy fractional shares so you can invest with lower amounts of money and won’t have to worry about trading fees. You can also set up auto investing, allowing you to invest regularly whether it's daily, weekly, or monthly.

However, more experienced investors looking for a wider range of assets — such as mutual funds, bonds, or a wider range of overseas investments — may prefer another platform that offers a more complete experience.

Trading 212 Star Ratings

| Feature |

Trading 212 Trading 212

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Fidelity UK Review

- Barclays Smart Investor Review

- AJ Bell Review

- Freetrade Review

- Hargreaves Lansdown Review

- IG Trading Review 2026

- Vanguard UK Review

- CMC Invest Review

- XTB UK Review

- Saxo Review

- Interactive Brokers UK Review

- eToro UK Review

- Halifax Share Dealing Review

- Capital.com Review

- Interactive Investor Review

- Lloyds Bank Investing Review

Popular Guides

More Guides

- Best Crypto Brokers & Apps for March 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Cash ISA Accounts & Rates for 2026

- Best SIPP Providers of 2026

- Best Junior SIPPs for 2026

- Best Stocks and Shares ISAs for 2026

- Best Lifetime ISAs of 2026

About Trading 212

Trading 212 launched commission-free trading in the U.K. in 2017, the first broker to offer it, and has been in existence since 2005. The Bulgaria-based broker offers three main services: investing, ISAs and CFDs.