Freetrade Review

Your capital is at risk.

Freetrade is an investment platform known for its commission-free stock trading. Like other zero-commission platforms, it aims to get more people investing by reducing the cost.

You can invest a few pounds without being stung by trading charges, which means Freetrade is a great platform if you are new to investing and want to learn more about the stock market before committing much money. It's now free to hold an ISA on Freetrade, which means you can access tax-free investing without paying the previous monthly fee.

-

Minimum Deposit:

£1 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| 2026 | #6 |

| 2025 | #16 |

| 2024 | #7 |

| 2023 | #6 |

| 2022 | #6 |

| 2021 | #6 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Commission-free trading keeps costs low for beginners.

- Fractional U.S. shares let you invest with just a few pounds.

- User-friendly mobile app makes stock discovery simple and engaging.

Cons

- £5.99 monthly ISA fee adds up on smaller portfolios.

- Missing core investments like mutual funds and bonds.

- Minimal research tools makes it tough for deeper analysis.

My top takeaways for Freetrade in 2026:

- Freetrade is a great starting point for new investors and offers commission-free trading and fractional U.S. shares with only small amounts needed to get started.

- Freetrade offers a free ISA and a SIPP for a competitive flat monthly fee through the Plus plan.

- Freetrade now offers mutual funds, as well as stocks, ETFs, investment trusts, and crypto ETNs.

- The platform is owned by IG, a well-established global online trading provider, but operates separately under the Freetrade brand.

Freetrade fees

For beginner investors, the great thing about Freetrade is that you can invest in fractional shares for U.S. companies, which means you don’t have to purchase one whole stock, as U.S. share prices commonly run into the hundreds of pounds.

For example, you could choose to buy £30 worth of Apple shares, meaning you would own about a sixth of a share at today’s value. You would pay no trading commission, although you’ll pay a currency conversion fee of 0.99% on the Freetrade Basic account (this drops to 0.39% for the Plus account). On a £30 trade, it would mean currency conversion charges of £0.30 for the basic account, so costs are very low.

Freetrade offers three account levels:

Basic account: This level carries no cost and allows you to invest in 6,500 stocks and ETFs through a general investment account or ISA. This is a decent range to choose from, including FTSE 100 and FTSE 250 companies as well as Vanguard and iShares ETFs. FX fees are 0.99% if making a trade in another currency, and interest of 1% is paid on up to £1,000 of uninvested cash.

Standard account: If you want more investment choice, with the ability to buy mutual funds, Freetrade’s ‘standard’ plan costs £5.99 a month, totalling £71.88 a year, although this is discounted to £59.88 if you pay annually, which works out at £4.99 a month.

You’ll get access to more than 6,500 investments, including mutual funds and gilts, and you can earn 3% interest on uninvested cash up to a maximum of £2,000. FX fees are lower than the Basic plan at 0.59% when trading investments in other currencies.

Plus account: Freetrade’s third option, the Plus account, costs £119.88 a year, £9.99 a month if billed annually or £11.99 on a rolling monthly basis. It is for those who want to save through a SIPP (self-invested personal pension). You’ll also earn 5% interest on up to £3,000 of uninvested cash, get access to priority customer service and benefit from lower FX fees at 0.39%.

Freetrade’s flat-rate SIPP fee can work out cost-effective if you have a large amount held in your SIPP, as you’d pay a fixed £119.88 a year, unlike other brokers charging percentage fees where charges can rack up the more you hold. Interactive Investor (ii), another flat-fee broker, charges £156 a year for SIPPs with a value above £50,000. This means Freetrade is cheaper while offering similar investments to ii, including mutual funds, although ii offers a broader range of investments and account types on the whole. CMC Invest, another flat-fee provider, charges £132 a year for its SIPP.

You can set up recurring orders and limit orders on stocks, meaning you buy or sell when a share reaches a specified price, on all plans.

Overall, the basic account should do fine for many investors starting out, particularly if you invest through the free ISA, so you don’t have to worry about potential capital gains tax or income tax further down the line.

Freetrade offers a free ISA and a wide range of investments that are easy to find in the mobile app or on the web platform.

| Feature |

Freetrade Freetrade

|

|---|---|

| Minimum Deposit | £1 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Platform Fee (Funds): £0 - £250,000 | £59.88 |

| Annual Platform Fee (Funds): £250K-£500K | £59.88 |

| Annual Platform Fee (Funds): £500,000 - £1m | £59.88 |

| Annual Platform Fee (Funds): £1m and over | £59.88 |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | £0 |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | £0 |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Freetrade’s investment options are limited to stocks, ETFs and investment trusts for the free account, and extends to mutual funds for the paid accounts. Gilts are also only available to customers of the paid Standard or Plus accounts. Having said that, there are more than 6,500 U.K., U.S. and European stocks and ETFs to choose from in the Basic account, so most investors should still find plenty of choice.

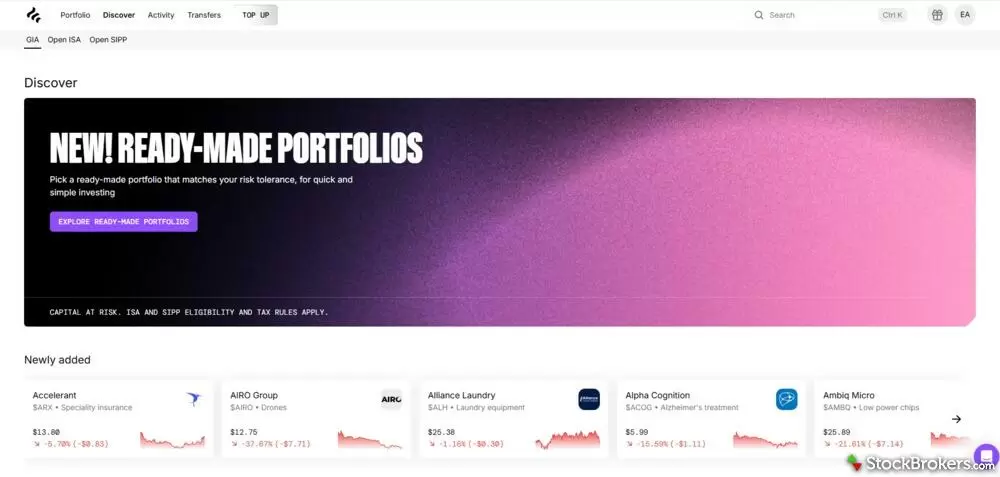

Freetrade now also offers ready-made portfolios for those looking for a quick way to diversify their investments. However, ready-made portfolios are only available on the paid-for plans, not the free standard plan. Freetrade's ready-made portfolios are simply three Vanguard LifeStrategy funds, so it might be worth considering whether you can access the same funds on another platform for lower cost (such as through InvestEngine or Vanguard directly).

Like eToro, Robinhood, and XTB, Freetrade also offers the chance to buy fractional shares – a great option for investors not wanting to commit much money when starting out. However, fractional share trading is only available on U.S. stocks, and not on U.K. and EU-listed shares or ETFs, which is a shame, but something Freetrade says it’s working on offering eventually.

Crypto ETNs are now available through Freetrade's general investing account, meaning you can get exposure to cryptocurrencies such as Bitcoin. However, these are high-risk products and come with high management fees of around 2%.

Freetrade differs from rivals XTB and Trading 212 by offering a SIPP. So investors tempted by the SIPP offering may prefer to keep their ISA or other investments with Freetrade for ease.

| Feature |

Freetrade Freetrade

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Freetrade ISA review

Now that Freetrade has removed its monthly ISA fee, the Freetrade ISA offers great value to investors, whether you’re just starting out or already have experience.

The Freetrade ISA is flexible, and you have the choice of more than 6,500 U.K., U.S. and European stocks and ETFs to invest in. While you can’t invest in mutual funds through the free account, a broad-based ETF could give the same level of diversification.

The FX fee of 0.99% on foreign currency trades in the free ISA is more expensive than some other platforms. Trading 212, for example, has a 0.25% FX fee. However, if you’re only trading small amounts, the price difference may be relatively small.

Freetrade’s app and website are easy to use, making it suitable for beginners, although one downside is that fractional share trading is only available on U.S. shares, and not U.K. shares or ETFs.

Another downside of Freetrade is that it only pays 1% interest on uninvested cash up to £1,000 in the free Basic plan. Other platforms, such as Trading 212 and XTB, offer higher interest rates on uninvested cash so this is worth considering.

Mobile trading apps

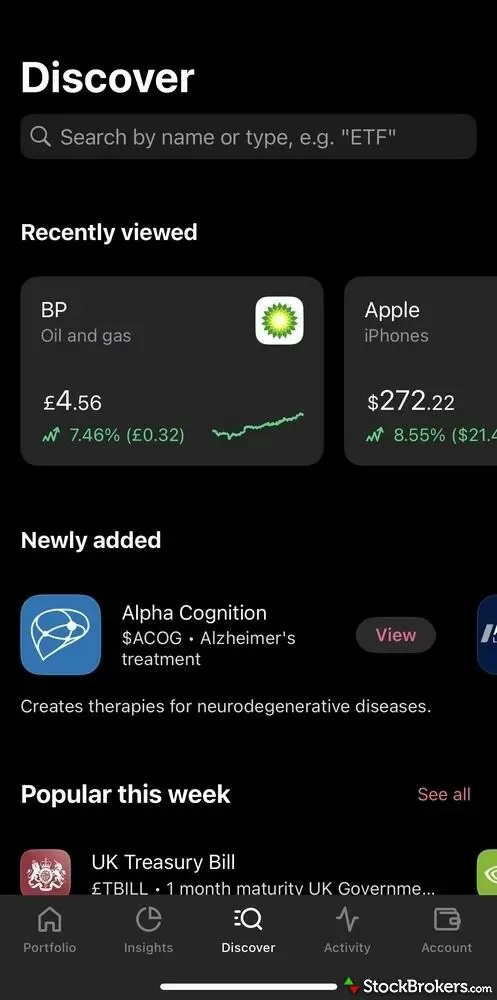

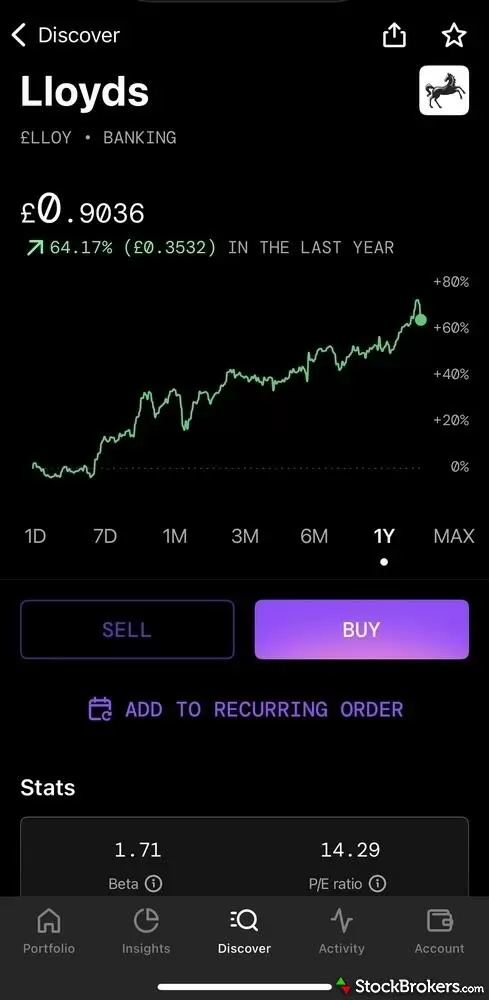

I like Freetrade’s mobile app, although it’s not as advanced as other platforms such as eToro, IG, or Interactive Investor, which offer better research and chart tools.

You can search for stocks or ETFs, see newly added funds, and what stocks or ETFs are popular that week.

Companies are also organised by themes, like gaming stocks or firms with female CEOs. This is uncommon among investment platforms and I found it an interesting way to find new companies around themes of interest to you.

However, I found there to be little research material. There is also no educational material on the app, such as written guides or videos explaining key investing terms or trends. I think this is an area where Freetrade could do better, following other platforms such as Interactive Brokers and eToro.

The Freetrade mobile app is easy to use, although lacking the research depth and materials of other platforms.

Trading platforms

Freetrade's web trading platform is cleanly laid out with tabs at the top, making it easy to check your portfolio, discover investments, view recent activity, transfer an account to Freetrade, and top up your account.

Elizabeth's take:

"Freetrade's website is easy to use. I particularly like the ‘discover’ page where you can view newly-added stocks or view companies by sectors such as big tech, dividend income, AI, or companies that are popular with investors that week. Mutual funds are now also available to view, although these can only be accessed through a paid-for account."

When logged into my account, I can see my recent activity, top up my account, view my watchlist, and view my investments. Currently, there are no chart tools or ways to overlay different stocks or indices to compare recent historical performance on the free or paid-for accounts. This is an area where I think Freetrade could improve, as rivals such as eToro or Trading 212 offer great chart options.

| Feature |

Freetrade Freetrade

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 0 |

| Charting - Drawing Tools | 0 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

Freetrade offers a range of useful articles and guides on its website aimed at beginner investors. These include guides on what a stock is and how your investments are taxed. There are no official Freetrade educational videos, but many customers have uploaded user video guides on YouTube.

The educational material is aimed at novice investors. Those with more experience will find better research materials on other platforms such as Fidelity, Interactive Investor, Saxo, and Interactive Brokers. Another downside is that there is no educational material or resources available on the app.

Research material is limited on the app and website when looking at financial information for specific companies. You can access analyst ratings and estimates through the paid-for Standard and Plus plans, but even on these paid plans, the research and educational resources are more limited than other platforms.

The research and educational material are more limited than other platforms. Chart tools are lacking. However, there are useful written guides on the website aimed at beginner investors.

| Feature |

Freetrade Freetrade

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

Overall, Freetrade is a great platform to help you get to grips with investing. You will not lose money to expensive charges thanks to the commission-free trading offered, although the price of your chosen investment may go down, of course, as stock markets fluctuate.

The Freetrade app is simply laid out and easy to use. It's great that Freetrade now offers a free ISA, which will appeal to investors looking for tax-efficient investing. The Freetrade SIPP could also offer great value to those with large portfolios.

However, sophisticated investors may find other platforms offering a wider range of investment options and chart tools, such as the best brokers for active trading, more suitable.

Freetrade Star Ratings

| Feature |

Freetrade Freetrade

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Vanguard UK Review

- Interactive Brokers UK Review

- Trading 212 Review

- XTB UK Review

- Hargreaves Lansdown Review

- AJ Bell Review

- Capital.com Review

- Saxo Review

- IG Trading Review 2026

- Fidelity UK Review

- Interactive Investor Review

- Halifax Share Dealing Review

- CMC Invest Review

- Lloyds Bank Investing Review

- eToro UK Review

- Barclays Smart Investor Review

Popular Guides

More Guides

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Cash ISA Accounts & Rates for 2026

- Best Junior SIPPs for 2026

- Best Crypto Brokers & Apps for March 2026

- Best SIPP Providers of 2026

- Best Stocks and Shares ISAs for 2026

- Best Lifetime ISAs of 2026

About Freetrade

Freetrade launched in the U.K. in 2019 and reports that 1.5 million people have used its platform since that time, investing a total of £1.3 billion. Freetrade is growing quickly and is expanding across Europe. On January 16, 2025, Freetrade announced that they struck a deal with IG Group to be acquired for £160 million, a deal which still requires regulatory approval. Once acquired, the company says that it will remain independently operated by the same management team.