Interactive Investor Review

Your capital is at risk.

Interactive Investor (ii) is a top choice for U.K. investors who value cost transparency and a wide investment selection, thanks to its flat-fee model and robust research tools. The fixed monthly fee structure can offer excellent value for those with medium or larger portfolios, especially ISA and SIPP investors looking to avoid percentage-based platform charges.

With thousands of investments to choose from and a strong, research-rich web platform, ii suits investors who like to be hands-on with their portfolio and want the support of expert insights. While beginners with smaller portfolios may find cheaper options elsewhere, Interactive Investor remains one of the most comprehensive and cost-effective platforms for long-term, engaged investors.

-

Minimum Deposit:

£1 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 Website | Winner |

| 2026 | #2 |

| 2025 | #1 |

| 2024 | #1 |

| 2023 | #13 |

| 2022 | #11 |

| 2021 | #11 |

| 2020 | #3 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Flat fees: Core £5.99, Plus £14.99, Premium £39.99 suit larger portfolios.

- Lower FX and trading costs on Plus and Premium (FX from 0.25%).

- Strong research and tools, with advanced charting and education.

Cons

- Monthly fee makes ii less appealing for small or inactive accounts.

- Fund trades not free on Core and Plus plans.

- FX fees higher than the cheapest competitors.

My top takeaways for Interactive Investor in 2026:

- Interactive Investor is best for cost-conscious investors with medium to large portfolios, thanks to its flat-fee pricing, which often works out cheaper than percentage-based ISA fees or SIPP fees on rival platforms.

- All accounts are now covered by a single monthly plan, with pricing based on Core (£5.99 per month for portfolios up to £100,000), Plus (£14.99 per month with no investment limit), or Premium (£39.99 per month with no investment limit). This pricing structure covers trading accounts, ISAs, and SIPPs under one subscription.

- SIPP investors benefit from the same flat-fee structure, making ii a strong choice for hands-on retirement investors who want full control over their pension without paying ongoing percentage-based SIPP charges.

- Interactive Investor offers over 17,000 UK and international investments across 17 global exchanges, including shares, ETFs, mutual funds, investment trusts, and bonds.

- The website includes advanced charting tools, with over 100 indicators, drawing tools, and the ability to compare multiple companies on a single chart.

- Research and educational content are industry-leading, making ii a strong fit for investors who value in-depth market insights and guidance.

Interactive Investor fees

Interactive Investor offers excellent value for investors with medium to large portfolios, thanks to its predictable flat-fee structure. Your monthly plan covers your Trading Account and ISA, and it can also cover a SIPP under the same subscription. Unlike percentage-based ISA fees or SIPP fees charged by many rivals, ii’s monthly plans can become significantly cheaper as your portfolio grows. However, ii is not the cheapest choice for beginners, as platforms like Trading 212, Freetrade, and eToro offer commission-free trading with no monthly subscription fees, making them better suited to smaller accounts.

Flat-fee pricing structure: Interactive Investor appeals to investors who prefer flat monthly fees rather than charges based on the size of their portfolio. Flat fees make long-term costs easier to predict and can be substantially cheaper once your account reaches around £30,000–£50,000.

ISA fees:

Interactive Investor’s Stocks and Shares ISA pricing is now based on its Core, Plus, and Premium plans rather than portfolio size alone.

- Core: £5.99 per month, covering portfolios up to £100,000

- Plus: £14.99 per month, no investment limit

- Premium: £39.99 per month, no investment limit

These monthly fees cover both the general trading account and the ISA. Regular investing is free across all plans, helping long-term investors keep costs down.

Junior ISAs are also more generous than before: Plus members can open fee-free Junior ISAs for up to five family members, while Premium members can open an unlimited number of fee-free Junior ISAs.

SIPP fees:

Interactive Investor’s SIPP pricing now follows the same Core, Plus, and Premium structure as its other accounts, removing the previous portfolio-size-based tiers.

- Core: £5.99 per month (up to £100,000 invested)

- Plus: £14.99 per month (no investment limit)

- Premium: £39.99 per month (no investment limit)

This flat-fee approach makes ii particularly attractive for investors with larger pension pots who want predictable costs and full control over their retirement investments, especially compared with platforms that charge ongoing percentage-based SIPP fees.

Trading fees:

Trading fees at Interactive Investor now vary by plan, with meaningful savings for Plus and Premium members. The fee for trading U.K. and U.S. shares is £3.99 per trade for Core and Plus, and £2.99 for Premium.

International shares:

- Core: £9.99 per trade

- Plus: £7.99 per trade

- Premium: £5.99 per trade

Funds:

- Core: £3.99 per trade

- Plus: £1.49 per trade

- Premium: Free

Plus members receive one free trade per month, while Premium members receive two free trades per month, further reducing costs for active investors.

With ii’s regular investing service, investors can make up to 25 free monthly trades when contributing at least £25 per month, which is particularly cost-effective for long-term fund investors.

FX fees:

Interactive Investor has significantly simplified and reduced its foreign exchange (FX) fees.

- Core: Flat 0.75% FX fee

- Plus: 0.75% on amounts up to £50,000, reduced to 0.25% on amounts above £50,000

- Premium: Flat 0.25% FX fee

These lower and more transparent FX fees improve ii’s competitiveness for international investors. For example, a £20,000 international trade would cost £150 in FX fees on the Core plan, compared with £50 on the Premium plan, which is a substantial saving for frequent overseas traders.

While FX fees remain higher than ultra-low-cost platforms such as Trading 212 or Interactive Brokers, ii’s improved structure is far more competitive than before, particularly for Plus and Premium members.

Real-time data costs: Real-time market data is not free. Users must pay extra for live prices, which can make pre-trade comparisons more difficult compared with platforms that include real-time pricing at no additional cost.

| Feature |

Interactive Investor Interactive Investor

|

|---|---|

| Minimum Deposit | £1 |

| Share Trading: 0-9 Deals/ Month | £3.99 |

| Share Trading: 10-19 Deals/ Month | £3.99 |

| Share Trading: 20+ Deals/ Month | £3.99 |

| Annual Platform Fee (Funds): £0 - £250,000 | £71.88 / £179.88 |

| Annual Platform Fee (Funds): £250K-£500K | £179.88 |

| Annual Platform Fee (Funds): £500,000 - £1m | £179.88 |

| Annual Platform Fee (Funds): £1m and over | £179.88 |

| Bonds - Corporate - Fee | £3.99 |

| Bonds - Government (Gilts) - Fee | £3.99 |

| ETFs - Fee | £3.99 |

| Investment Trusts - Fee | £3.99 |

| Telephone Dealing Fee | £49 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Interactive Investor offers one of the strongest investment ranges of any U.K. platform, making it excellent for investors who want variety, depth, and flexibility. With access to thousands of global shares, ETFs, funds, investment trusts, and bonds, ii is well-suited to hands-on investors who want full control over their portfolios. The only notable omissions are cryptocurrency trading and CFDs, which means traders looking for high-risk products may prefer a different platform.

Interactive Investor offers more than 11,000 stocks, 3,400 mutual funds, 2,400 ETFs, and 265 investment trusts on its platform, as well as bonds and gilts. This broad market coverage makes ii suitable for nearly any investing style.

Interactive Investor has many materials to help people get started, including explainer articles and model portfolios. To help narrow down the wide list of funds, ii offers a Super 60 rated list, which incorporates funds, investment trusts, and ETFs, and ACE 40, a sustainable rated list that includes funds, investment trusts, self-employed pensions, and ETFs.

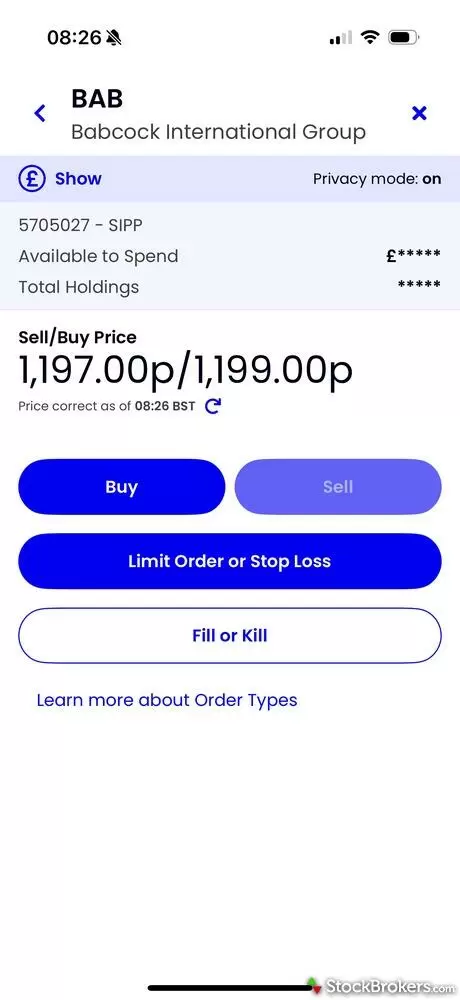

Interactive Investor's trade ticket presents clear order details before you place a trade.

SIPPs: Interactive Investor’s SIPP offers a vast selection of investment options, with access to the same assortment of equities and markets as its other account types. For those who prefer a hands-off approach, ready-made portfolios are also available.

Ready-made portfolios: Interactive Investor offers the Super 60 fund list, which contains simple, one-fund options picked by investment managers at ii. There is also the option to invest in ii's Managed ISA, where you can opt for ready-made portfolios tailored to your risk tolerance, and how you want to invest — whether you prefer active or passive investments. Fees are £5.99 monthly for an ISA plus 0.12% to 0.26% in ongoing annual charges, depending on the portfolio you choose. In total, there are 10 portfolios you can choose from. On a £20,000 investment in ii’s cheapest ready-made ISA portfolio, you’d pay total annual fees of £97.88. I think this is good value and becomes even better value the more money you have invested. On a £45,000 investment, for example, you’d pay a total annual fee of £130.38.

To invest in ii's Managed ISA you need to pay an initial lump sum of £250 or pay in increments of £50 a month until £250 is reached.

| Feature |

Interactive Investor Interactive Investor

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Interactive Investor ISA review

Interactive Investor’s stocks and shares ISA is best suited to those who prefer flat fees, and especially those with larger portfolios.

Pricing: ii’s ISA pricing is based on its plan you choose. Core costs £5.99 per month (up to £100,000 invested). Plus is £14.99 per month (no investment limit), and Premium is £39.99 per month (no investment limit). Dealing charges and FX fees vary by plan, and regular investing is free.

The monthly fee can be cheaper than percentage-based platforms if you invest £30,000 or more. For example, Hargreaves Lansdown charges fees of 0.45% if you invest in mutual funds. On a portfolio of £30,000, for example, you’d pay annual platform charges of £135 compared with Interactive Investor’s charge of £59.88 (£4.99 a month). However, it’s worth pointing out that Hargreaves Lansdown annual platform fee is capped at £45 if you invest in shares or ETFs, so a shares-only portfolio could work out cheaper than Interactive Investor.

Some platforms, such as Freetrade, XTB, and Trading 212, have no platform charges for their ISAs. So if you're just starting out or only have a small amount to invest, Interactive Investor would likely work to be more expensive for you, especially when you could go with another platform that doesn't charge for its ISA.

With Interactive Investor’s £11.99 Investor plan (or £19.99 Super Investor plan), you can also open junior ISAs at no extra cost. This offers a good way to manage multiple accounts for your family.

Platform: Investment choice is broad. You can buy funds, shares, ETFs, investment trusts, and bonds. Or you can pick from 10 ready-made managed portfolios based on how much risk you want to take and whether your priority is sustainable investing. They invest in assets such as shares, bonds, and property.

Interactive Investor’s website and app are very user-friendly, and the customer service is reliable. I like the wide range of guides and other learning materials on the website.

Overall, ii’s ISA suits investors with larger portfolios who want fixed, predictable fees. You’ll pay £71.88 a year on the Core plan (covering portfolios up to £100,000), £179.88 a year on the Plus plan, or £479.88 a year on the Premium plan, regardless of how much you invest. Regular investing is free across all plans, which helps keep trading costs low as your investments grow.

Mobile trading apps

Interactive Investor’s mobile app is clean, reliable, and easy to use, but it is far more basic than the desktop experience. You can access your watchlists, find investments, view basic research, and see stock price and market movements through the app. Ideally, though, I’d like to see it offer more extensive charting features and more research to customers.

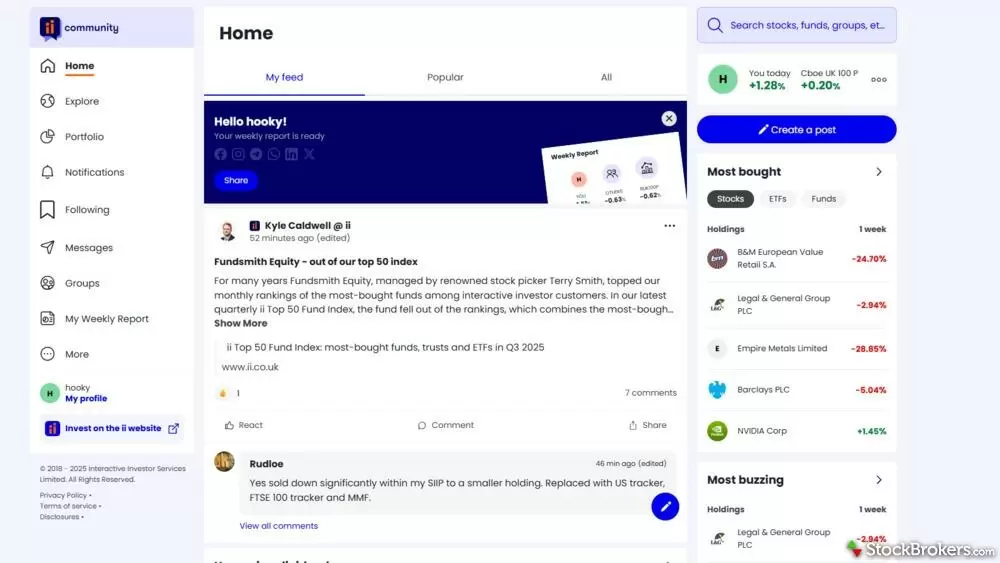

Interactive Investor also offers an ii Community mobile app, where you can discuss investments, stocks, and see the portfolios of other users. This is taking a similar approach to the likes of eToro, which already has an active social community. However, I think it’s a shame the community forum is not available in the main ii app. You have to download the separate ii Community app, which makes accessing it less convenient.

Overall, ii’s mobile experience is solid but simple. It’s ideal for investors who mainly check balances or place occasional trades on the go. However, active traders or investors who rely heavily on mobile charting may find the app lacks the depth offered by competitors.

Interactive Investor's community hub provides a space for investors to discuss markets and compare strategies.

Trading platforms

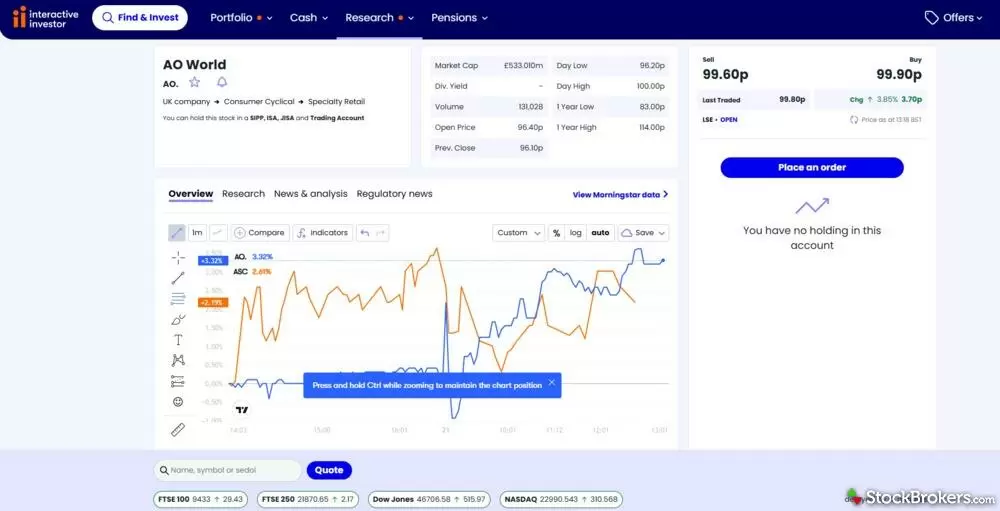

Interactive Investor’s web platform is one of the best in the U.K., offering powerful tools, excellent usability, and advanced charting features suited to both beginners and experienced traders. I found the website both easy to navigate and laid out to make it easy to understand Interactive Investor’s services and charges. Through the ii website, you can see an overview of your portfolio, set price alerts for up to 10 investments, search for investments, and create up to 10 watch lists. You can also hold up to nine international currencies in your account to avoid paying foreign exchange, or FX, fees on every overseas trade.

Elizabeth's take:

"I was pleased to find plentiful and useful guides explaining how to get the most from the platform – for example, explaining how to set up and manage a watch list. Interactive Investor is one of the easiest platforms to use and get to grips with, in my opinion, thanks to its focus on helping the customer as much as possible."

The website offers a wide range of charting tools with more than 100 indicators available and a good number of drawing tools. These allow you to monitor simple moving averages and to use indicators such as the Relative Strength Index to help determine whether a stock has become overbought or oversold. These tools aren’t available on the mobile app and are probably not needed for most investors, but they are useful if you are a more hands-on trader and like to analyse market trends.

Interactive Investor's charting tools on its web platform provide a wide range of indicators and comparison features for research.

You can also compare the historical performance of stocks, and you can overlay one company over the other to draw better comparisons. This is a great feature not offered by all platforms.

The Interactive Investor web platform also offers a good way to sort and filter stocks, funds, and ETFs. You can narrow down the selection by filtering by sector, region, market cap, or dividend yield. However, for funds I think it would be good if Interactive Investor offered a way to filter by ongoing charges or by active or passive.

| Feature |

Interactive Investor Interactive Investor

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 104 |

| Charting - Drawing Tools | |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | No |

Education

Interactive Investor excels in education, offering accessible content for beginners, advanced analysis for traders, and high-quality expert research. Its Learn hub features market insights, share tips, and articles from its own in-house experts and external contributors. ii also publishes detailed reports that look at the wider U.K. savings and pensions landscape to strive for change.

It’s clear that overall, ii believes it has a duty to provide the support, intelligence, and investment choices to help Britons make better financial decisions. It offers educational content that is detailed, easy to understand, and available in accessible formats, from articles to videos. Regular webinars are also on offer, including Lunchtime Live with Bloomberg columnist Merryn Somerset Webb, and the website has an area where you can watch previously recorded webinars.

Interactive Investor also has a partnership with Trading Central to showcase ‘market buzz’, giving real-time information on companies seeing a higher number of mentions on social media, news, and websites. Trading Central also offers other technical insights into specific companies, giving ratings for value, growth, quality, and an overall rating that reflects whether the general view is bullish or bearish. For those looking to invest in individual stocks, this offers a useful way to see the general prospects of a particular company, although, of course, returns are never guaranteed with investing.

There is also the ii community, which you can access when logged into the web platform. Here, you can see an overview of the recent performance of your portfolio and can discuss your investments, or ask questions to other ii users. There are groups you can join, such as novice investors, to get more tailored support from other users.

Interactive Investor has recently launched a new investment coach tool, where you complete a short quiz to determine your investor profile. You'll then get bespoke content, videos, and an outline of your next best actions to build confidence. It will be interesting to see whether this is picked up by users.

| Feature |

Interactive Investor Interactive Investor

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

Interactive Investor remains a strong choice for investors who value flat-fee pricing, transparency, and high-quality research. The introduction of the Core, Plus, and Premium plans meaningfully improves value across the board, particularly for international investors and families managing multiple accounts.

The Core plan is more competitive than before, supporting portfolios up to £100,000 for £5.99 per month. Plus and Premium plans unlock lower trading and FX fees, free trades, and generous family benefits, making ii especially attractive for engaged, long-term investors with larger or more complex portfolios.

While investors with very small portfolios may still find better value on commission-free platforms, Interactive Investor continues to stand out as one of the most comprehensive and cost-effective flat-fee platforms in the U.K. market.

Interactive Investor Star Ratings

| Feature |

Interactive Investor Interactive Investor

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- AJ Bell Review

- IG Trading Review 2026

- Saxo Review

- Barclays Smart Investor Review

- eToro UK Review

- XTB UK Review

- Fidelity UK Review

- Halifax Share Dealing Review

- Hargreaves Lansdown Review

- Capital.com Review

- Interactive Brokers UK Review

- Trading 212 Review

- Vanguard UK Review

- Freetrade Review

- Lloyds Bank Investing Review

- CMC Invest Review

Popular Guides

More Guides

- Best SIPP Providers of 2026

- Best Stocks and Shares ISAs for 2026

- Best Cash ISA Accounts & Rates for 2026

- Best Lifetime ISAs of 2026

- Best Junior SIPPs for 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Crypto Brokers & Apps for March 2026

About Interactive Investor

Interactive Investor was founded in 1995 and has more than 400,000 customers — around the same as rival AJ Bell — who hold a total of around £55 billion through the platform. Its company mission is to offer transparent and fair fees to its customers. Interactive Investor was bought by institutional investor Abrdn in 2022.