Lloyds Bank Investing Review

Your capital is at risk.

Lloyds is strengthening its position as an accessible, low-cost investment platform, making it a solid option for everyday investors — especially those who value simplicity and already bank with Lloyds. The platform combines ready-made portfolios, a wide choice of funds and shares, and low fixed fees across its ISA, SIPP, and general accounts.

While the tools are basic compared with specialist trading platforms, Lloyds delivers strong value for long-term, hands-off investors looking for straightforward costs and a familiar banking experience.

-

Minimum Deposit:

£1 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| 2026 | #12 |

| 2025 | #15 |

| 2024 | #14 |

| 2020 | #7 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

Cons

- Difficult and time-consuming to open an account.

- £11 per trade for U.K. stocks is expensive.

- Very limited tools and research.

- No interest paid on uninvested cash.

My top takeaways for Lloyds Bank in 2026:

- Lloyds has an impressive 3,143 funds available, so investors who prefer handpicking their mutual funds have a wealth of options. It also offers ready-made investment portfolios, incorporating stocks, bonds, and property, but you must pay in at least £50 a month.

- Lloyds offers low charges on the whole. Platform management fees are just £36 a year, and charges for ready-made portfolios are very low.

- Trading commissions have also reduced, and are zero when buying international shares or signing up for regular dealing.

- Lloyds offers a Save & Invest calculator, where you can see projections of how much your investments could be worth in the future.

- The trading platform itself is fairly basic, but the Lloyds' website offers a good range of research and chart tools.

Lloyds Bank fees

Lloyds performs well on fees overall, especially for long-term investors and those with larger portfolios. Its flat £36 annual platform fee (recently reduced from £40), low SIPP fee cap, and free regular investing make it one of the better-value traditional banks for investing. However, one-off trading charges for U.K. shares remain among the highest in the market, which makes Lloyds less suitable for frequent traders or those investing small amounts.

Flat fees: Low flat fees are economical for investors with large holdings. Lloyds charges a flat management fee of £36 a year (£18 per six months). By comparison, Hargreaves Lansdown charges a management fee of 0.45% for mutual fund investments below £250,000, which works out at £45 a year for those with investments worth £10,000. Therefore, investors with a portfolio worth more than £10,000 may be better with a flat fee charging structure such as Lloyds’. Note that Lloyds waives its £36 platform fee if you’re aged 18 to 25 and have an Invest Wise account, and for private banking customers (those with £250,000 or more in savings or investments).

Lloyds’ SIPP management fees are also on the lower end, at 0.25% of the value of your investments, capped at £16.50 a month (£198 a year). This makes the Lloyds SIPP a very good value in comparison to other platforms. For example, Vanguard’s platform charges are capped at £375 a year and some platforms have no cap.

Regular dealing: If you commit to regular dealing (where you invest in the same asset monthly), then there are no commission charges. It’s common for trading platforms to offer discounted trades for regular investing, but Lloyds is one of a small handful of brokers offering free regular dealing. Rivals AJ Bell and Fidelity, for example, charge £1.50.

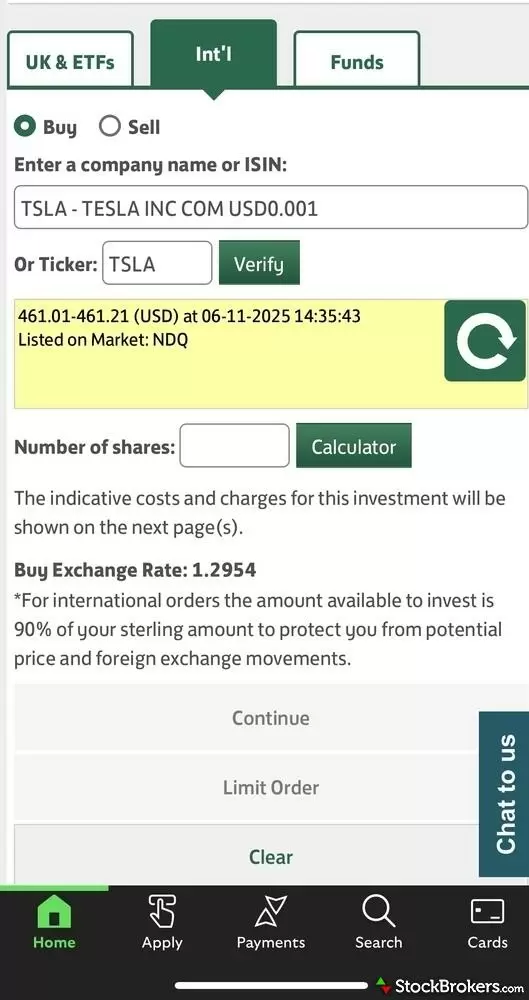

International shares: Lloyds doesn’t charge anything on international share trades. However, a 1% foreign exchange (FX) fee applies. You can buy shares in companies listed on the NYSE and NASDAQ in the U.S. as well as those listed in Paris, Frankfurt, Milan, Amsterdam, or Brussels.

Infrequent investors: If you trade infrequently and are only investing small amounts, then Lloyds can end up being expensive. Lloyds charges £9.50 for buying and selling U.K. shares, investment trusts, bonds, and ETFs, although this has recently dropped from the £11 previously charged. The cost is reduced to £8.50 if you are a Premier or Private Banking customer, and to £8 if you make more than eight trades per quarter (around three a month).

Lloyds’ one-off trading charges are among the highest of investment platforms, despite the fee reduction to £9.50 per trade. However, regular dealing is free and mutual fund trades are a lower rate of £1.50, so Lloyds can still work out to be a good value. But if you’re buying small amounts infrequently, a platform such as Trading 212, XTB, or Freetrade may be better as these don’t charge commission on trades.

FX: Lloyds charges an FX fee of 1% when buying shares or investments in another currency. This is on the higher end compared with other platforms, but it still offers good value as you won’t pay trading commissions.

| Feature |

Lloyds Bank Lloyds Bank

|

|---|---|

| Minimum Deposit | £1 |

| Share Trading: 0-9 Deals/ Month | £9.50 |

| Share Trading: 10-19 Deals/ Month | £8 |

| Share Trading: 20+ Deals/ Month | £8 |

| Annual Platform Fee (Funds): £0 - £250,000 | £36 |

| Annual Platform Fee (Funds): £250K-£500K | £36 |

| Annual Platform Fee (Funds): £500,000 - £1m | £36 |

| Annual Platform Fee (Funds): £1m and over | £36 |

| Bonds - Corporate - Fee | £9.50 |

| Bonds - Government (Gilts) - Fee | £9.50 |

| ETFs - Fee | £9.50 |

| Investment Trusts - Fee | N/A |

| Telephone Dealing Fee | £35 |

Range of investments

Lloyds offers a great range of investments across seven world markets, including U.K. bonds and gilts, more than 850 ETFs, 3,000 funds, and around 4,500 company shares. That said, other platforms such as eToro, Saxo, and Interactive Brokers offer more extensive overseas investment options covering other parts of the world, especially Asia.

Funds and ready-made investments: With an impressive 4,000 funds available, including both mutual funds and ETFs, investors have a wealth of options. Lloyds also offers a ready-made investment portfolio, incorporating stocks, bonds, and property, but you must pay in a £500 minimum lump sum or at least £50 a month. If you don’t like the idea of committing this amount, other platforms such as Hargreaves Lansdown and AJ Bell offer ready-made portfolios for those looking to save £25 a month. Lloyds offers three ready-made portfolios: Cautious, Balanced and Adventurous, depending on your risk tolerance.

ISAs and SIPPs: You can invest through an ISA, Junior ISA, SIPP, or general dealing account. Lloyds does not offer Lifetime ISAs. You can opt for a ready-made ISA or pension.

For ready-made investment ISAs and investment accounts, Lloyds charges a flat rate of £3 per month (£36 a year), plus ongoing charges of up to 0.1%. These are very low fees in return for getting access to a diversified portfolio created on your behalf.

TradePlan: You have the option of several trade types by setting up a TradePlan through the dealing section of the website when logged in. This includes a stop loss or price lock, where an order is triggered when a share price hits a specified target price.

Financial planning: Lloyds offers financial planning in partnership with Schroders Personal Wealth, if you would like to pay for advice. To access financial advice, you must earn at least £100,000 a year or have £100,000 in savings and pensions.

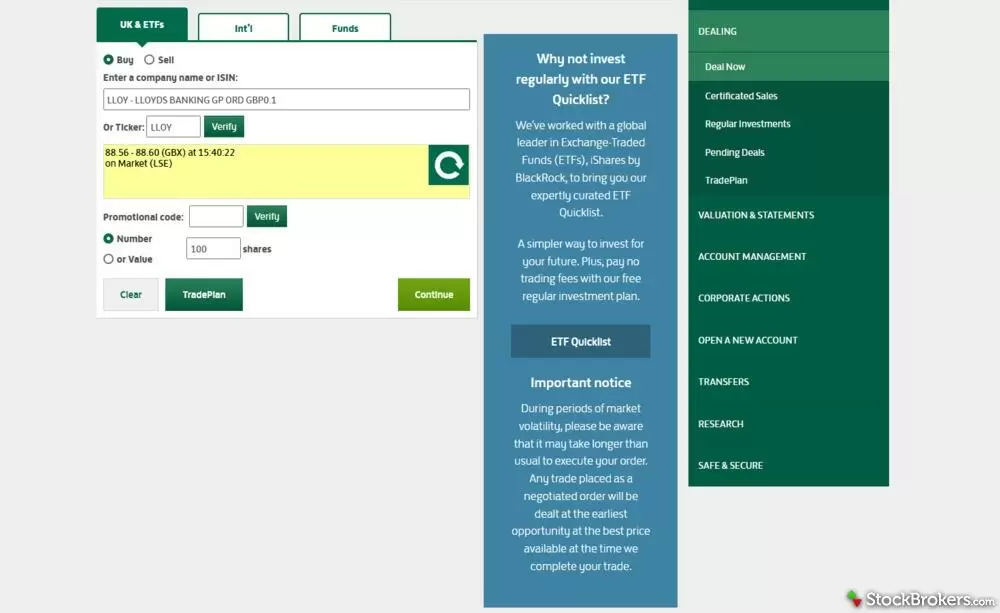

The Share Dealing platform is very basic in design. It’s simple enough to execute a trade, but difficult to get investment inspiration.

| Feature |

Lloyds Bank Lloyds Bank

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | Yes |

Lloyds Bank ISA review

Lloyds offers a simple and good-value range of ISAs, making it a strong choice for long-term savers who want low ISA fees and a straightforward investing experience. While the platform lacks advanced tools, the combination of low costs, ready-made options, and seamless integration with Lloyds’ banking app gives it broad appeal, particularly for newer or more hands-off investors.

Lloyds provides both investment ISAs and cash ISAs, allowing savers to choose between guaranteed interest or market-based growth. It also offers a junior cash ISA, though it does not provide a junior stocks and shares ISA. The cash ISA range includes fixed-rate and easy-access accounts with competitive interest rates, making Lloyds a sensible option for those who want the security of cash savings while still using their ISA allowance.

For investing, the Lloyds stocks and shares ISA comes in two forms: the Share Dealing ISA for those who want to pick their own funds, shares, and ETFs, and the Ready-Made Investments ISA for those who prefer a hands-off approach. The Share Dealing ISA has no minimum investment requirement and gives access to more than 3,000 funds and around 4,500 U.K. and international shares. ISA fees are low, with a flat £36 annual charge, although investors should be mindful that the £9.50 trading fee for one-off U.K. share or ETF trades can make small, infrequent transactions relatively expensive.

The Ready-Made Investments ISA is aimed at investors who want a simple, pre-built portfolio. You can choose from three options — Cautious, Balanced, or Adventurous — depending on your risk level. This ISA requires either a £500 initial deposit or at least £50 per month, and it charges a flat £3 monthly fee (£36 a year) plus small ongoing fund costs of up to 0.1%. These low ISA fees make it one of the more affordable ready-made investment options among major U.K. banks.

Opening and managing an ISA is easy for existing Lloyds customers, as it can all be done from within the main banking app under the “Save & Invest” section. For those who prefer keeping their banking and investing in one place, this integration is a notable advantage and adds to Lloyds’ appeal as a simple, beginner-friendly ISA provider.

Mobile trading apps

The Lloyds mobile trading experience is functional but very limited, making it suitable only for simple account management rather than research or active investing. While it allows you to view your holdings, place basic trades, and access guidance, the app lacks the discovery tools, charting features, and investment inspiration offered by modern trading platforms.

Like with its sister brand Halifax, you need to have registered for online banking before logging into the share dealing mobile app for the first time. You access your share dealing account through the main Lloyds app, where you’ll find your share dealing account on the main home screen. Tap on your share dealing account to open your investments.

It’s not easy to search for funds or investment ideas. Ideally, you’ll already know what you want to invest in, likely by having done research elsewhere. There is a prominent link to Lloyds’ ETF Quicklist for ETF inspiration, but this takes you away from the mobile app and directs you to the website via a browser.

Educational guides and tools have been given more prominence by Lloyds recently to encourage more of its current account holders to invest. Lloyds offers a Save & Invest calculator, where you can see projections of how much your investments could be worth in the future. It also offers in-app written guides that aim to teach the basics about investing.

The Lloyds Share Dealing app is very basic in design. It's simple to place a trade but difficult to get investment inspiration.

Are you new to investing?

We thoroughly tested 17 top U.K. brokerages to find the best choices for beginner investors. Read more in our guide.

Trading platforms

Lloyds’ web trading platform is serviceable but feels outdated, offering only basic functionality and very limited charting or research tools. While it works for straightforward account management and simple buy-and-sell orders, it lacks the modern features, data, and investment discovery tools found on more advanced platforms. As a result, Lloyds is not well suited to active traders or investors who rely heavily on research and chart analysis.

It’s difficult to get investment inspiration or guidance, although counter-intuitively, there is plenty more material on the main Lloyds’ website when you’re not logged in.

Elizabeth's take:

"There are limited charting options on Lloyd's trading platform if you like to use charts to analyse historical trends and events. You can't show corporate events on a stock chart, such as dividends or earnings dates — a feature offered by many other online investment platforms. It's also very hard to get investment inspiration. Ideally, you need to already know what to invest in before logging in."

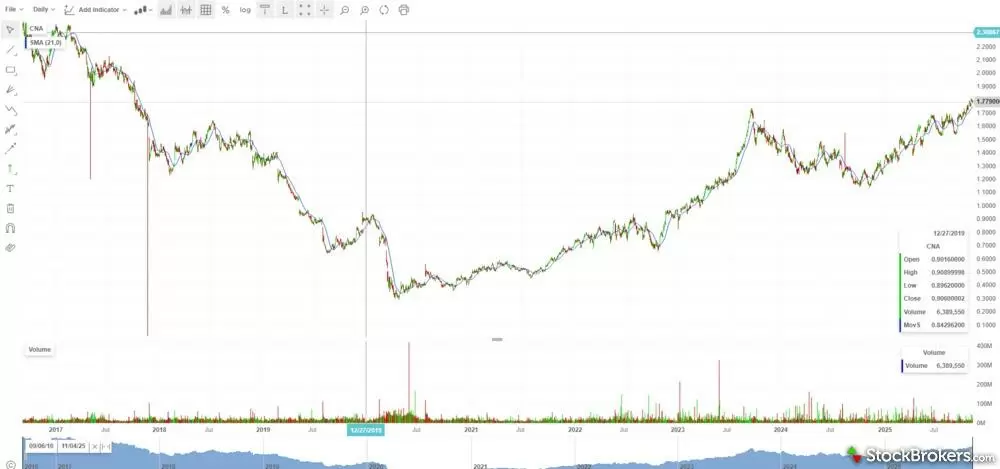

The trading platform also lacks drawing tools or indicators, and you cannot overlay charts over each other to compare different stocks or indices. However, the Lloyds general website offers more in-depth chart tools and research material. It would be great if Lloyds could improve the customer experience by adding these features, which newer platforms all offer, in its share dealing platform. Traders who wish to extensively trade using a web app would be better served by a broker such as Interactive Brokers, Saxo, or IG.

Lloyds offers advanced chart tools on its website, although these can’t be accessed through the Share Dealing account when logged in.

| Feature |

Lloyds Bank Lloyds Bank

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 93 |

| Charting - Drawing Tools | |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

Educational and research material is limited on the Lloyds Share Dealing platform. There are a few guides on how to get started, such as investing for beginners and how to understand risk, but these do not go into extensive detail.

The investing hub of the main Lloyds website offers more, including news articles, top-searched companies, and insights on the economy or a particular company. This is a section of the Lloyds investing platform that is growing. However, there are no webinars and only a limited number of videos for investors looking for investment guidance and inspiration. The stock screener is also more basic compared with the offerings of other platforms, with limited filtering options such as the ability to sort by price or daily change, rather than by theme or sector.

Lloyds does not offer real-time market data — prices are delayed by 15 minutes.

| Feature |

Lloyds Bank Lloyds Bank

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Final thoughts

Lloyds Share Dealing is a solid choice for long-term, hands-off investors who want low, predictable fees and the convenience of managing banking and investing in one place. The platform particularly suits those who value flat pricing, free regular investing, and access to a wide range of mutual funds, ETFs, and ready-made portfolios. Lloyds also offers competitive SIPP fees and a straightforward stocks and shares ISA, making it an appealing option for retirement savers or anyone looking to build long-term wealth with minimal complexity.

However, Lloyds is less suitable for active traders or investors who rely on robust tools and research. The one-off trading fee of £9.50 for U.K. shares remains high, the platform does not offer real-time pricing, and charting capabilities are extremely limited compared with competitors such as IG, Interactive Investor, or Saxo. Investors who prefer regular market analysis, investment inspiration, or advanced trading features will likely find the platform too basic for their needs.

For everyday investors, particularly those already banking with Lloyds, the combination of low ISA fees, free regular investing, broad fund availability, and a simple user experience makes Lloyds worth considering. But anyone focused on frequent trading, deep research, or international market variety may be better served by a more comprehensive investment platform.

Lloyds Bank Star Ratings

| Feature |

Lloyds Bank Lloyds Bank

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Barclays Smart Investor Review

- Vanguard UK Review

- Saxo Review

- eToro UK Review

- Freetrade Review

- AJ Bell Review

- Trading 212 Review

- XTB UK Review

- Fidelity UK Review

- IG Trading Review 2026

- Interactive Investor Review

- Interactive Brokers UK Review

- Hargreaves Lansdown Review

- Capital.com Review

- Halifax Share Dealing Review

- CMC Invest Review

Popular Guides

More Guides

- Best Cash ISA Accounts & Rates for 2026

- Best Junior SIPPs for 2026

- Best Crypto Brokers & Apps for February 2026

- Best Lifetime ISAs of 2026

- Best SIPP Providers of 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Stocks and Shares ISAs for 2026

About Lloyds Bank Share Dealing

Lloyds Share Dealing is operated by Lloyds Banking Group, which traces its roots back to 1765 when Taylors & Lloyds opened as a private bank in Birmingham. Lloyds Banking Group owns Bank of Scotland, Lloyds Bank, Halifax, and Scottish Widows.