CMC Invest Review

Your capital is at risk.

CMC Invest is an app offering commission-free trading on stocks and shares, making it a strong competitor to the likes of Freetrade, XTB, and Trading 212. CMC Invest’s investment ISA charges are on the high end for those investing small amounts, although it offers a cash ISA for free (paying 3.95% interest currently). The SIPP fees are low at £132 a year, making it cheaper than many other flat-fee pension providers.

-

Minimum Deposit:

£1 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| 2026 | #16 |

| 2025 | #12 |

| 2024 | #11 |

| 2023 | #9 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Commission-free trading.

- Can hold GBP, USD, and EUR in your wallet.

- You can trade through an ISA and SIPP account.

- Offers mutual funds.

Cons

- No web platform.

- £50 fee for phone trading is high.

- Flat-fee monthly charges are on the more expensive end.

- Interest on cash balances is 2%, lower than other platforms.

My top takeaways for CMC Invest in 2026:

- The CMC invest app is clean and easy to use, with solid ESG tools, but there’s no website or desktop trading platform, and research tools are limited.

- CMC Invest offers commission-free trading and low forex fees, but its monthly charges of £6.99 for its stocks and shares ISA or £10.99 for the SIPP can make it less cost-effective for smaller portfolios.

- For those with more than £100,000, in a SIPP, CMC Invest works out very competitive on price.

- CMC Invest offers more than 3,500 investments in U.K. and U.S. shares, about 1,000 mutual funds, and around 400 ETFs and investment trusts.

- CMC Invest also offers a standalone cash ISA paying a competitive interest rate.

CMC Invest fees

There are three plans for CMC Invest customers.

- Core: £0 a month

- Plus: £6.99 a month

- Premium: £10.99 a month

Core: With the Core option, you can open a general investment account and pay no monthly management charges. You can invest in more than 3,500 stocks, ETFs, and investment trusts. There are no transaction costs and you get unlimited free trades. The Core plan also offers access to CMC Invest's Cash ISA, currently paying an interest of 3.95%.

Like other platforms offering commission-free trading, CMC Invest makes its money by charging a fee for foreign exchange (FX) conversions when buying international shares. It adds 0.99% to the FX rate on the Core plan. So, if you invested $1,000 into AAPL (Apple), CMC Invest’s 0.99% FX fee would cost you approximately £7.40 on the currency conversion, assuming an exchange rate of 1 GBP = 1.35 USD. This is in line with many other investment platforms, although higher than some such as Trading 212, which only charges 0.15% FX fees on its Invest and ISA accounts.

Plus: The Plus plan, at £6.99 a month, allows you to invest through a flexible stocks and shares ISA. You also get access to a wider range of stocks than the free Core plan, at more than 6,100, including mid-cap stocks, as well as mutual funds. With Plus, you can also hold cash in U.S. dollars and euros to reduce trading fees when buying overseas stocks.

The Plus plan can work out to be a good value if you have a large investment portfolio in an ISA, although other platforms offer cheaper flat fees or no fees at all. Trading 212 or XTB, for example, offer free ISAs while Freetrade now also offers a free ISA after removing its £5.99 a month charge. So it might make sense to go with other providers rather than CMC Invest, although CMC Invest offers mutual funds whereas other brokers don't.

Premium: The Premium plan, costing £10.99 a month, means you can invest through a SIPP in addition to an ISA or general dealing account. You get access to the same range of investments with Plus, including small-cap U.K. shares and mutual funds.

The Premium plan works out to be cost effective if you have a decent amount in a SIPP (more than £100,000). For example, rival Interactive Investor (ii) charges £21.99 a month for its SIPP. CMC Invest also charges no fees for buying and selling, whereas ii charges £4.99 (although there are no trading fees if you set up regular investing).

You earn 2% interest on any money sitting in your account that is not invested in the free core plan, 3% on its Plus plan and 4% on its Premium plan. However, this is lower than many other platforms such as IG, XTB, and Trading 212.

CMC Invest also charges £50 for telephone trades, which is quite high. Its aim is to encourage customers to invest through the app.

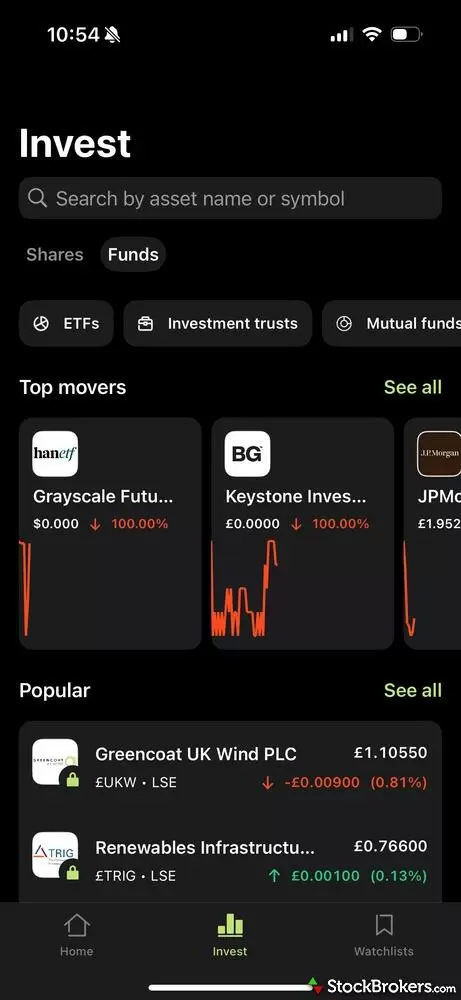

Through the CIC Invest app, you can sort shares by most popular, sector or ESG score. You also sort ETFs, investment trusts and mutual funds on the same themes.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Minimum Deposit | £1 |

| Share Trading: 0-9 Deals/ Month | £0 |

| Share Trading: 10-19 Deals/ Month | £0 |

| Share Trading: 20+ Deals/ Month | £0 |

| Annual Platform Fee (Funds): £0 - £250,000 | £83.88 / £131.88 |

| Annual Platform Fee (Funds): £250K-£500K | £83.88 / £131.88 |

| Annual Platform Fee (Funds): £500,000 - £1m | £83.88 / £131.88 |

| Annual Platform Fee (Funds): £1m and over | £83.88 / £131.88 |

| Bonds - Corporate - Fee | N/A |

| Bonds - Government (Gilts) - Fee | N/A |

| ETFs - Fee | £0 |

| Investment Trusts - Fee | £0 |

| Telephone Dealing Fee | £0 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

CMC Invest offers more than 3,500 U.K. and U.S. shares, about 1,000 mutual funds, and around 400 ETFs and investment trusts. More markets may be added at a later date as the platform develops. CMC Invest's range of investments is on the lower end compared with other platforms, but still offers a good amount for investors to find an investment that suits them.

You can also search for shares with a high ESG score through the app. You can set your ESG preferences by saying, for example, that you don’t want to invest in firms that support gambling or palm oil. CMC Invest will alert you if one of your assets doesn’t match your values.

When you pay money into your account, the funds are credited to your account instantly. I found this great to get going quickly. There were no issues opening or funding my account.

CMC Invest does not offer ready-made investments but you can get access to a diversified portfolio through ETFs or mutual funds (through the paid-for plans).

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | No |

| Bonds - Government (Gilts) | No |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

CMC Invest ISA review

CMC Invest’s stocks and shares ISA offers a good investment range, but the price of £6.99 a month (£83.88 a year) means it is on the expensive side, especially if you only have a small investment portfolio. Freetrade, XTB, Trading 212 and IG offer ISAs for free. Other platforms charge percentage fees for their ISAs, such as Vanguard which charges 0.15% or a minimum of £4 a month.

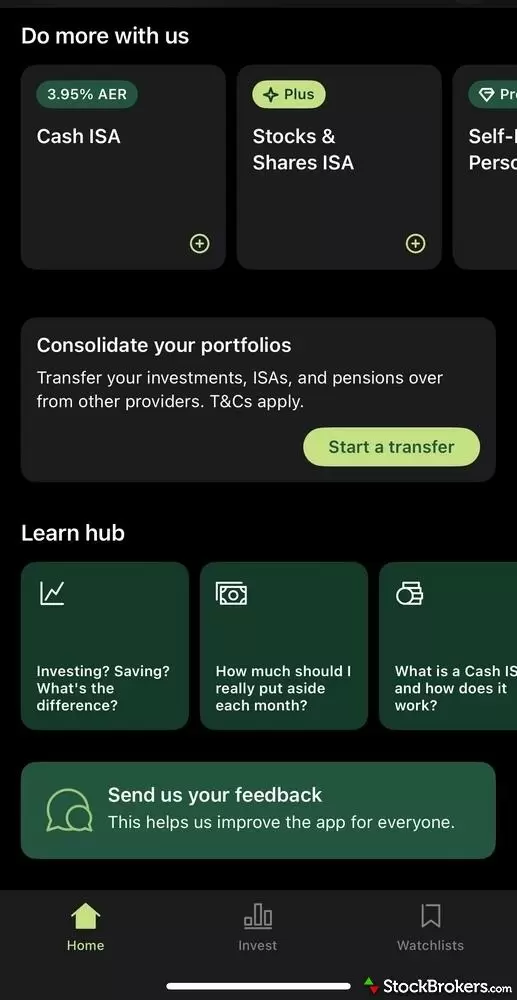

However, CMC Invest’s cash ISA is free to hold and pays interest of 3.95%, although this is variable so can go down at any time if wider interest rates drop.

Both the cash and investment ISA offered by CMC Invest are flexible, which is a bonus. It means you can withdraw and pay in money again within the same tax year, without affecting your annual £20,000 ISA allowance. This is a feature not always offered by other ISA providers.

Mobile trading apps

The CMC Invest mobile app is very basic on the whole. There are links to articles, but these take you outside the app and to the web browser.

Elizabeth's take:

"I found CMC Invest's guides on how to get started very useful. The app clearly explains in three steps how to discover stocks, use the search function, and buy or add an investment to your watch list. There is also a handy guide on how to view your performance and activity, illustrated with screenshots."

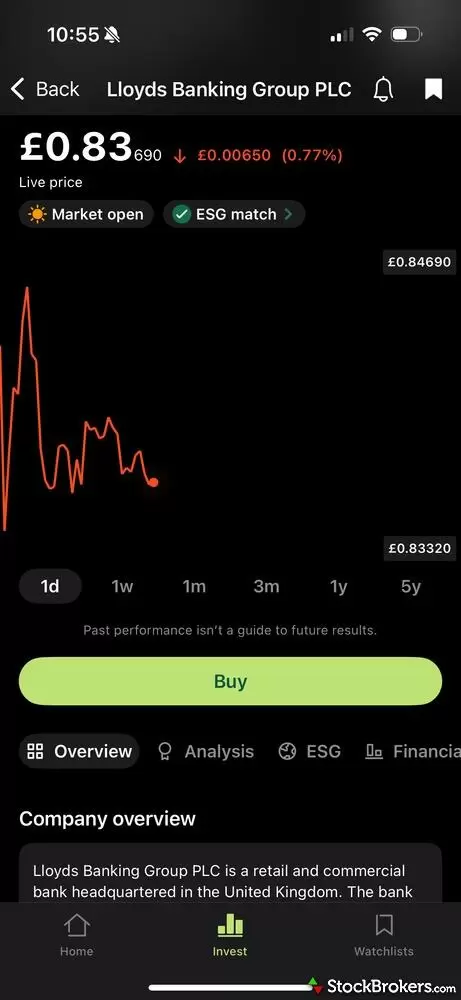

The app offers live pricing, which is a great feature not always offered by traditional platforms including Fidelity and Barclays.

You can create a watch list through the app, but it’s not particularly easy. You have to search for a stock to add, and then tap on the top right of the screen to favourite it, rather than pulling stocks through the watch list. In addition to filtering by sector, it would be great if the app could make it easier to filter stocks by country.

I do like the fact you can easily see a company’s ESG score through the app, as environmental, social, and governance considerations are becoming increasingly important to investors.

CMC Invest offers limited research on the app, although you can see analyst ratings and sentiment about individual stocks. Chart tools are very basic.

Trading platforms

The CMC Invest website currently exists to explain more about its product and to give general information about investing, how to open an account, and the fees it charges. The app is where all the action happens — you cannot trade through the website. Investors who prefer to trade through a web app may find Interactive Brokers or IG more suited to their purposes.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Web Platform | No |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 0 |

| Charting - Drawing Tools | 0 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Forex trading

If your interests lie with trading forex rather than equities, see the detailed CMC Markets review on our sister site, ForexBrokers.com.

Education

The ‘learn’ hub on the CMC Invest website includes articles on the different investment types and a video on how a stocks and shares ISA works, as well as articles on what investing terms such as IPOs mean. The content is offered in partnership with investment insight platform Finimize

However, there are no webinars or podcasts, and you can’t read analyst opinions. For more in-depth stock market coverage, I suggest having a look at other platforms such as Fidelity, Hargreaves Lansdown and AJ Bell, which offer much more research material and articles.

The educational offering on the app is limited, with links directing you away from the app to the main CMC Invest website.

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | No |

| Education (Retirement) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

CMC Invest is best suited for long-term U.K. investors who want low-cost access to U.S. and U.K. shares without needing advanced trading tools or frequent trades. The platform is fairly new, having launched in 2022, and is still finding its feet. For people investing through a general investment account, the selling points are that you can trade for free and there are no service fees.

If you are investing through a stocks and shares ISA, CMC Invest’s charges are on the higher end. CMC Invest's SIPP, however, is competitive on fees, and works out to be cheap if you hold a large amount in a SIPP. The flat monthly charges could work out cheaper than more established brokers such as AJ Bell, Vanguard, or Hargreaves Lansdown, which all charge percentage-based fees.

CMC Invest also offers a flexible cash ISA paying one of the top interest rates, so this could suit people with cash savings looking to keep on top of inflation.

Finally, I appreciated the fact that ESG considerations are easily embedded into the app, making it easy for investors to ensure their investments reflect their values.

CMC Invest Star Ratings

| Feature |

CMC Invest CMC Invest

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- AJ Bell Review

- Interactive Brokers UK Review

- Trading 212 Review

- Lloyds Bank Investing Review

- IG Trading Review 2026

- Freetrade Review

- Saxo Review

- Hargreaves Lansdown Review

- Fidelity UK Review

- Barclays Smart Investor Review

- Halifax Share Dealing Review

- XTB UK Review

- Capital.com Review

- Vanguard UK Review

- eToro UK Review

- Interactive Investor Review

Popular Guides

More Guides

- Best SIPP Providers of 2026

- Best Crypto Brokers & Apps for March 2026

- Best Lifetime ISAs of 2026

- Best Junior SIPPs for 2026

- Best Cash ISA Accounts & Rates for 2026

- Best Stocks and Shares ISAs for 2026

- 5 Best Demo Trading Accounts in the UK for 2026

About CMC Invest

CMC Invest was launched in 2022 as an online broker that aims to offer high value for money and transparent charges. It is part of CMC Markets, which was founded in 1989 and is listed on the London Stock Exchange. CMC Markets operates in 12 countries and is headquartered in the U.K.