1. Vanguard - Best SIPP Provider

Vanguard’s SIPP is simple, straightforward, and low-cost. It is a favourite among DIY investors who favour simple tracker funds and are looking to save on investment fees. There is a £4 a month fee applied if you have less than £32,000 across Vanguard accounts. If you have less than this, an investment platform that offers percentage-based fees may work out cheaper for smaller portfolios.

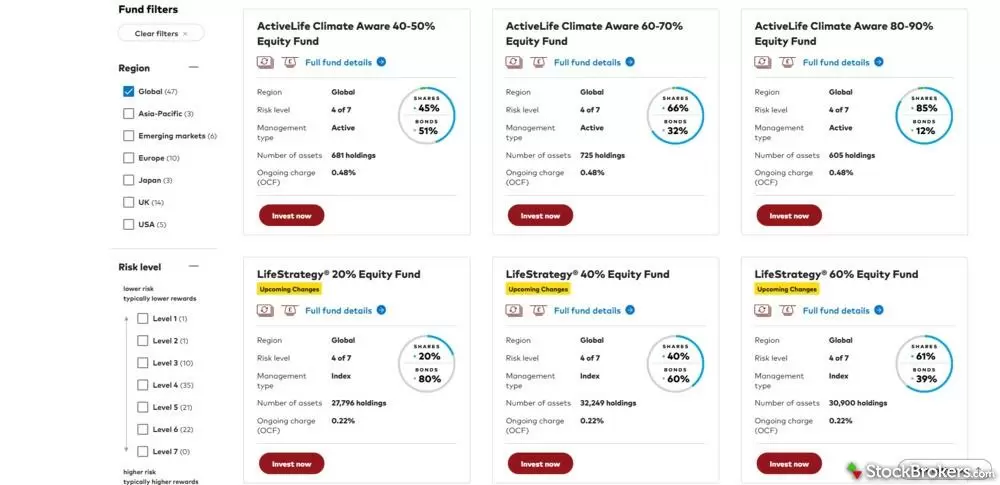

Investment choices: There is a very limited range of investments on the Vanguard platform, but this is no bad thing for newer investors or those who take a hands-off approach. You can’t invest in individual company stocks through Vanguard. Instead, you have access to around 85 Vanguard funds. These funds offer access to global companies and bonds.

Elizabeth's take:

"Vanguard offers a deliberately simplified investment range, focusing exclusively on low-cost mutual funds and ETFs. While this means you can’t buy individual shares, investment trusts, or alternative assets, it creates a streamlined platform that strongly suits long-term, buy-and-hold investors."

Elizabeth Anderson

Vanguard offers a streamlined selection of index funds and ETFs, giving investors simple access to global markets.

Fees: There are typically no dealing fees. Annual management fees for accounts with more than £32,000 invested across Vanguard are just 0.15%, capped at £375 a year, on top of fund fees averaging 0.20% a year. Note, however, that investors with less than £32,000 invested across Vanguard are now charged a £4 monthly fee (£48 a year), which can work out to be expensive for smaller portfolios.

If your portfolio is worth more than £100,000 then a broker with flat fees may work out cheaper and you’d get more investment choices. Annual management fees would be £150 a year on top of ongoing fund charges. Overall, though, Vanguard offers a great starting point for a SIPP.

Platform: The website is easy to navigate and you can filter funds by region, risk level, or management type. There is not yet a mobile app available to all users but one is currently being tested.

2. InvestEngine - Low-fee ETF-only SIPPs

| Company |

Overall Rating |

Minimum Deposit |

SIPP |

ISA |

InvestEngine InvestEngine

|

|

£100 |

Yes |

Yes |

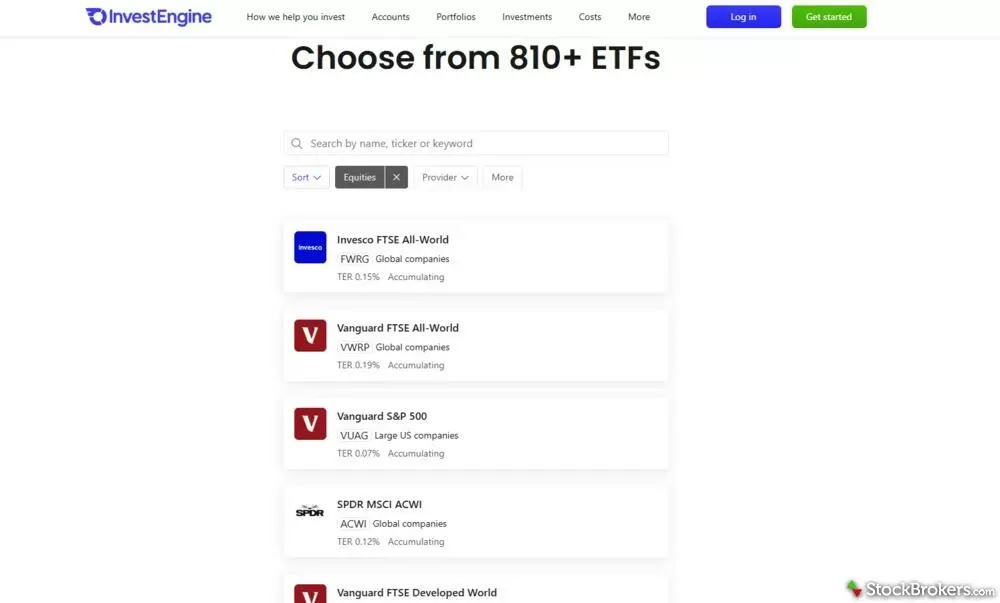

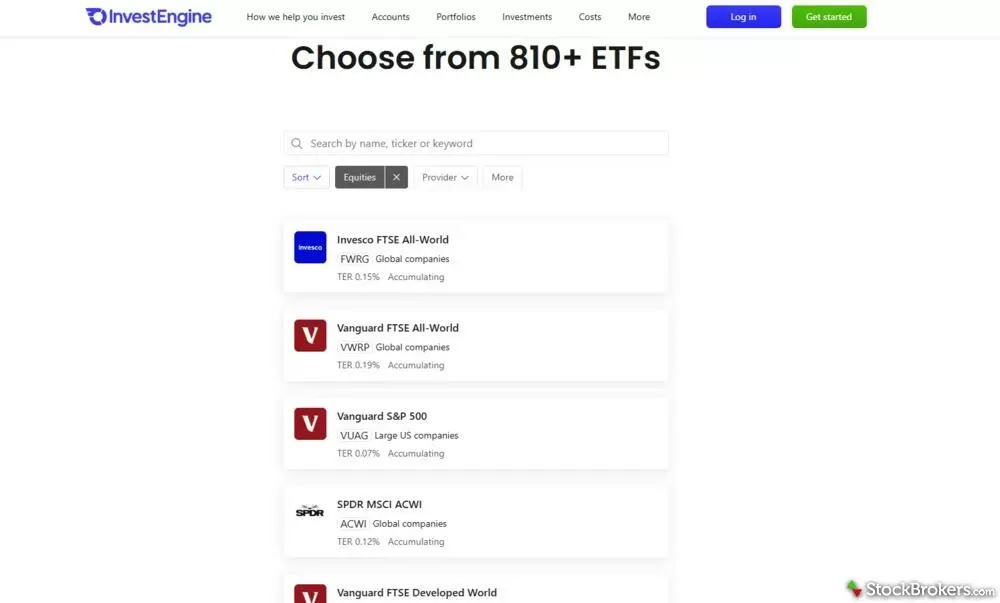

InvestEngine is a standout option for U.K. investors who want a low-cost, long-term SIPP and are comfortable building their retirement portfolio using ETFs only. The platform is built around simplicity and affordability, making it particularly appealing for beginners who want to avoid complex pricing structures and focus on steady pension growth over time. While it doesn’t offer individual shares or mutual funds, the ETF-only approach can still provide broad diversification across global equities, bonds, and thematic sectors.

Fees: What makes InvestEngine particularly strong for pension investing is its pricing model. If you choose the DIY SIPP, there are no platform fees and no dealing commissions, so you only pay the underlying ETF fund charges. For cost-conscious savers, this setup can be hard to beat, especially compared with traditional providers that charge annual platform fees or per-trade costs. InvestEngine also offers managed portfolios for a 0.25% annual fee, although availability can vary depending on product updates.

Trading: InvestEngine’s SIPP is designed primarily for accumulation rather than frequent access. Trades are executed once per day, which encourages a buy-and-hold mindset rather than active trading. The platform also allows you to create multiple named investment “pots,” which is genuinely useful for separating retirement goals (e.g., early retirement vs. later-life income) within the same account.

That said, it isn’t a complete SIPP solution yet. Employer contributions and limited company payments are not currently supported, and withdrawals must be initiated via paper forms rather than fully managed in-app. For investors focused on building a pension pot with minimal fees and simple ETF diversification, though, InvestEngine remains one of the most compelling low-cost SIPPs available.

InvestEngine offers access to more than 800 ETFs, giving investors exposure across equities, bonds, and some commodities.

3. Interactive Investor - Best SIPP for flat fees

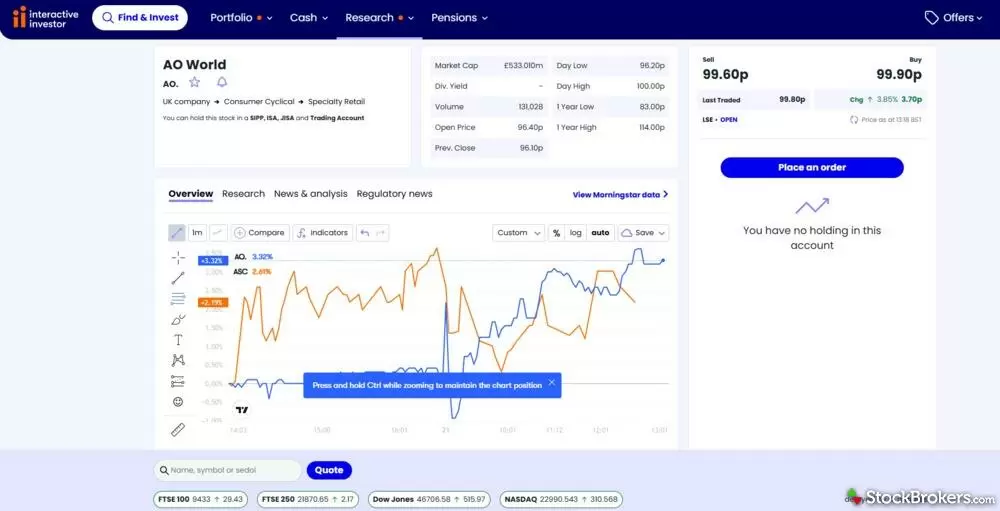

Interactive Investor (ii) is a strong SIPP provider for U.K. investors with a larger pension pot who want predictable costs and access to a wide investment range. Its flat-fee structure is most compelling once your SIPP reaches around £55,000 or more, as it can work out cheaper than percentage-based pension platforms that scale charges as your balance grows. For hands-on retirement savers who plan to build and manage their own portfolio, ii is a practical and cost-transparent option.

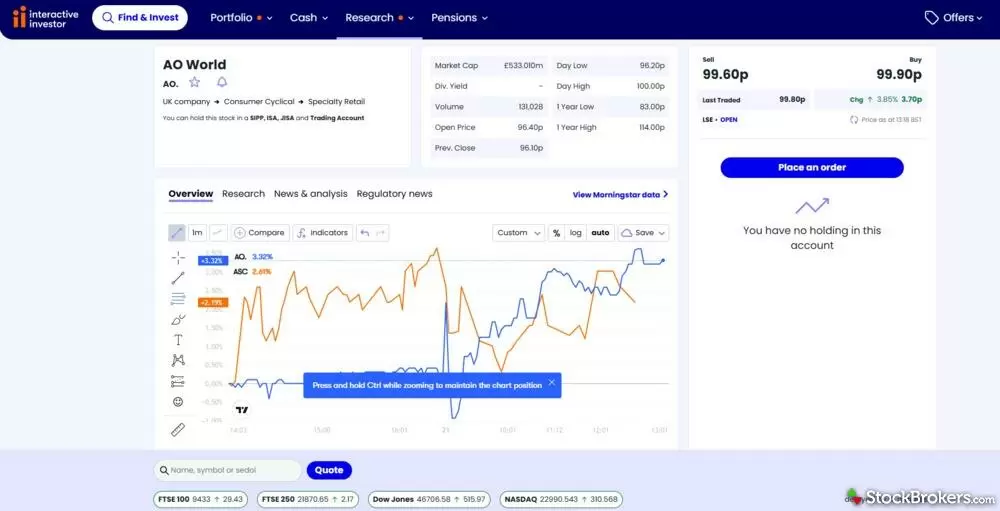

Investment choices: Through its SIPP, you can invest in thousands of assets including U.K. and international shares, ETFs, mutual funds, investment trusts, and bonds. There’s also the option to use ready-made portfolios if you’d rather not select everything yourself, which helps make the platform more accessible to newer or less confident investors while still offering long-term flexibility.

Fees: The SIPP costs £12.99 per month (£155.88 per year) for accounts above £50,000, and £5.99 per month for accounts below that threshold. If you already hold an ISA or trading account with ii, the SIPP fee can drop to around £5 per month, depending on your total balance across accounts. Compared with percentage-fee providers, this flat pricing can offer meaningful savings at higher balances.

Platform: ii offers excellent educational content, a strong web platform, and a capable mobile app that supports regular portfolio monitoring and basic trading. The website is easy to use and I found it relatively simple to figure out ii's services and charges navigating through it. Regular investing can help reduce dealing costs, and one-off trades are typically £3.99, making it a solid fit for long-term investors who want control without paying premium percentage fees.

Interactive Investor's charting tools on its web platform provide a wide range of indicators and comparison features for research.

4. Freetrade - Best for choice and simplicity

| Company |

Overall Rating |

Minimum Deposit |

SIPP |

ISA |

Freetrade Freetrade

|

|

£1 |

Yes |

Yes |

Freetrade’s SIPP is a strong flat-fee alternative to Interactive Investor (ii), and is particularly appealing if you want a simple pension account with commission-free investing. Like ii, it uses predictable monthly pricing, but it removes dealing charges on shares and ETFs, which can help keep costs low if you invest regularly or build your portfolio gradually.

Investment choices: Through the Freetrade SIPP, you can invest in over 6,200 U.K., U.S., and European shares and ETFs, but you won’t find mutual funds or bonds, which limits flexibility for investors who want a wider mix of assets.

Fees: Freetrade’s SIPP costs £11.99 per month (£143.88 per year), or £9.99 monthly (£119.88 annually) if paid upfront. This fee also includes access to a Freetrade ISA. The platform is easy to use and offers a good way to get stock inspiration, although I would prefer to be able to search and sort ETFs by theme or country.

5. Lloyd's Bank - Best for larger SIPP portfolios

| Company |

Overall Rating |

Minimum Deposit |

SIPP |

ISA |

Lloyds Bank Lloyds Bank

|

|

£1 |

Yes |

Yes |

Lloyds’ SIPP is a sensible option for long-term retirement savers who want straightforward pricing and a familiar, bank-led experience. It’s particularly well suited to existing Lloyds customers who prefer keeping their pension and day-to-day banking in one place, rather than using a specialist trading platform.

Investment choices: Lloyds offers access to thousands of funds, plus shares, ETFs, investment trusts, and bonds and gilts, giving you plenty of scope to build a diversified pension portfolio. If you’d rather not pick investments yourself, Lloyds also offers ready-made portfolios, although these require a minimum contribution commitment.

Fees: Lloyds charges 0.25% per year on SIPP holdings, capped at £16.50 per month (£198 per year), alongside a flat £36 annual platform fee for share dealing accounts. Regular investing is free and international share dealing has no commission, though one-off trades in U.K. shares still cost £9.50, which makes Lloyds less ideal for frequent trading.

Other SIPPs I tested

6. AJ Bell - Hands-on investors

| Company |

Overall Rating |

Minimum Deposit |

SIPP |

ISA |

AJ Bell AJ Bell

|

|

£250 |

Yes |

Yes |

AJ Bell is a strong all-round SIPP provider for investors who want wide investment choice, reliable support, and plenty of guidance along the way. You can invest in thousands of funds, shares, ETFs, trusts, and bonds, with platform fees that stay reasonable for most long-term savers. The main drawback is trading costs for shares and ETFs, which can add up if you invest small amounts irregularly, although regular dealing reduces this.

7. Hargreaves Lansdown - Long-term investors

Hargreaves Lansdown is one of the most established SIPP providers in the U.K. and a strong choice if you want maximum investment choice and plenty of support. You can invest in thousands of funds, shares, ETFs, bonds, and trusts, with ready-made portfolios available if you’d rather not build your own. Fees are best suited to long-term investors: funds cost 0.45% a year (tiered as your balance grows), while shares and ETFs are capped at £200 a year in a SIPP. The main drawback is dealing fees, with share and ETF trades costing £11.95 unless you use regular investing.

8. Saxo - Best for global trading

| Company |

Overall Rating |

Minimum Deposit |

SIPP |

ISA |

Saxo UK Saxo UK

|

|

£0 |

Yes |

Yes |

Saxo is a premium SIPP provider built for experienced investors who want global market access and advanced trading tools. Through Saxo’s SIPP, you can invest across 50 stock exchanges and access a huge range of shares, ETFs, bonds, and mutual funds. However, Saxo’s pricing model includes custody and percentage-based trading fees, which can work out expensive for smaller portfolios. The platform is powerful, but the learning curve may feel steep for beginner traders.

Compare the best SIPP providers

How to open a SIPP account

Choose a provider that fits your investing style

The first step is deciding what type of SIPP you need. Some providers are best if you want low fees and a simple ETF-based approach, while others suit investors who want access to individual shares, mutual funds, investment trusts, and bonds. It’s also worth checking whether the platform supports regular monthly investing, as this can reduce dealing fees and make it easier to build your pension gradually.

In this guide, I’ve prioritised SIPPs that are strong for pension accumulation, meaning they’re best for building your retirement pot, rather than providers that focus primarily on drawdown tools and retirement income features.

Decide how you’ll fund your SIPP

You can typically fund a SIPP by making a lump sum contribution, setting up monthly payments, or transferring an existing pension. If you’re transferring a pension, double-check whether your current plan has any valuable features that you could lose by moving it, such as guaranteed annuity rates or protected retirement ages. In some cases, keeping an old workplace pension and opening a SIPP for new contributions can be a sensible approach.

It’s also worth checking whether your chosen provider accepts employer contributions (or limited company contributions if you’re self-employed), as not all SIPPs do.

Apply and verify your identity

To open a SIPP, you’ll normally need your personal details, including your National Insurance number, plus a U.K. bank account for deposits and withdrawals. Most providers offer online identity checks, though some traditional platforms still require paperwork for certain transfers or withdrawals. Once your account is approved, you can deposit funds immediately or begin the pension transfer process.

Understand how tax relief works

Tax relief is one of the biggest advantages of investing through a SIPP. Most providers automatically claim basic-rate tax relief on your behalf. This means if you contribute £80, HMRC tops it up to £100 in your pension. If you pay higher or additional-rate tax, you may be able to claim extra relief through your tax return, which can make SIPPs especially valuable for higher earners.

Choose investments and set a long-term plan

After your money arrives, you’ll need to select investments. Many beginners start with diversified ETFs or funds, as these spread risk across many companies or bonds. Some providers also offer ready-made portfolios if you’d prefer a hands-off option.

Once your SIPP is set up, the most effective approach is usually consistent investing and minimal tinkering. A SIPP is designed for long-term growth, so regular contributions and an annual check-in are often more impactful than reacting to short-term market swings.

FAQs

What are some tips for choosing a SIPP provider?

When choosing a SIPP provider for saving into a pension, first consider how much you have in your pension already. If you have a small amount, a provider that charges percentage fees might work out best. If you have a large amount, perhaps more than £70,000, a platform that charges a flat monthly fee might work out cheaper.

Also consider carefully what markets or equities you want to invest in. Not all providers offer mutual funds, although ETFs offer the same potential for diversification by spreading your money across many companies, sectors or countries. If you don’t want to make any investment decisions, a platform that offers ready-made SIPP portfolios may be right for you, such as Hargreaves Lansdown, AJ Bell, Fidelity, Vanguard and others.

What are the SIPP contribution limits for 2025?

The maximum you can pay into a pension and benefit from tax relief is £60,000 or as much as your annual income — whichever is lowest. If, for example, you earn an income of £40,000 a year, then you can pay up to £40,000 into a pension (including tax relief).

The only exception to this limit is that you can also make use of unused pension allowance from the previous three tax years, in addition to the current tax year. If you earn £40,000 a year and haven't paid anything into a pension for the past four years, that’s potentially £160,000 you could pay in.

For very high earners, you start losing some pension annual allowance if your annual income is above £260,000. The SIPP annual contribution limit falls to £10,000 a year on an annual income above £360,000.

If you don’t work and are a non-U.K. taxpayer, you can pay up to £2,880 into a pension with tax relief taking the total to £3,600 a year.

Can I transfer my SIPP to another provider?

Yes, you can transfer a SIPP to another provider if you feel there is another that suits you better or if you are looking to save on fees. You also don’t need to go through a financial adviser. Simply find the provider you wish to switch to and start the transfer process from your new account.

crisis_alertWatch out for scams!

Always choose a SIPP provider that is regulated by the Financial Conduct Authority (FCA). It is illegal for a company to cold-call you about pensions. Don’t sign up for any SIPP provider that contacts you out of the blue and promises investment returns that are too good to be true. All the investment platforms we review on UK.StockBrokers.com are trusted providers.

Be mindful that some providers charge exit fees when you move your SIPP away from them. However, providers attempting to attract new clients, such as Bestinvest or Fidelity, offer to cover the cost of some or all of your exit fees when you switch to them. In any case, it is always good policy to check for any set-up costs and ongoing charges with your new provider.

One available option is to sell your investments and convert them to cash to transfer to the new SIPP provider to then reinvest. Alternatively, you may be able to transfer your investments directly to another provider without selling them first if the new one offers the same investments. Do be aware that transferring your investments directly is more complicated and the process is likely to take longer than simply transferring the holdings as cash.

You can transfer funds between SIPPs at any time if you are under the age of 55. That said, if you are aged over 55 and have already started withdrawing money from your SIPP, there may be some restrictions.

Is there a penalty for withdrawing from SIPP?

There is usually a penalty if you withdraw from your SIPP before the age of 55, unless you have a serious health condition that allows you early access to your funds. You will pay tax of 55% on the amount you want to withdraw, so you’ll lose more than half of what you take out - a severe penalty for early withdrawal.

Once you are above the age of 55, there should be no longer be any penalties for withdrawing from your SIPP. However, there still may be income tax to pay depending on how much you earn per year.

What are the best-performing SIPP funds in the UK?

The three best-performing investment funds in the U.K. in the first half of 2024 were Neuberger Berman 5G Connectivity Fund Acc, Janus Henderson Global Tech Leaders, and Alger Focus Equity Z Fund US, according to investment data firm Morningstar. These are not specific SIPP funds, but they can be held in SIPPs.

Top 5 performing funds of 2024:*

- Neuberger Berman 5G Connectivity Fund Acc +30.45%

- Janus Henderson Global Tech Leaders +29.96%

- Alger Focus Equity Z Fund US +29.96%

- L&G Global Technology Index Trust Acc +29.51%

- Alger American Asset Growth US +28.81%

* 1 January - 30 June, Source: Morningstar

crisis_alertImportant disclaimer:

Please remember that past performance may not be a good prediction of future results. A fund which previously performed well may falter and decline in the future for various reasons. Always use due diligence and your best judgement before investing into a fund or stock.

According to SIPP provider Interactive Investor, these were the most popular SIPP funds, by category, held by its customers in July 2024:

Mutual funds:

- Vanguard LifeStrategy 80% Equity A Acc

- Fundsmith Equity I Acc

- Vanguard LifeStrategy 60% Equity A Acc

ETFs:

- Vanguard S&P 500 UCITS ETF (VUSA)

- iShares Core MSCI World ETF USD Acc (SWDA)

- Vanguard FTSE All-World UCITS ETF (VWRL)

Investment trusts:

- Scottish Mortgage (SMT)

- Alliance Trust (ATST)

- F&C Investment Trust (FCIT)

Is my SIPP pension protected?

As long as your SIPP provider is fully regulated by the Financial Conduct Authority (FCA) then your money is protected by the Financial Compensation Scheme (FSCS) up to the value of £85,000. Search the FCA’s financial services register to see if a provider is registered there and what would happen to your money if the company fails.

While you won’t get compensation if your investment goes down and you lose money, the FSCS may cover poor investment management.

Who is the best SIPP provider for commercial property?

You cannot directly hold commercial property through self-directed investment platforms – commercial property is a specialist type of investment. That said, you can invest in commercial property investment funds (called real estate investment trusts or REITs) through many of the best online brokers in the U.K. To buy and hold commercial property directly you’ll need a regulated specialist provider such as Standard Life or Barnett Waddingham.

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

Steven Hatzakis is a well-known finance writer with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

AJ Bell

AJ Bell

Hargreaves Lansdown

Hargreaves Lansdown

Saxo UK

Saxo UK