Why you can trust us

Why you can trust us

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Active traders in the U.K. need more than a basic brokerage account. You need advanced charting, complex order types, and competitive trading costs that don’t eat into your returns when you trade frequently. Platforms built for buy-and-hold investors often fall short for traders executing multiple positions per day or week. That’s why choosing the right U.K. trading platform is essential for active traders aiming to capitalize on market opportunities at high volume or high frequency. This guide highlights the top U.K. platforms for active traders, focusing on the tools, costs, and features that can make a tangible difference in performance.

For nearly 25 years, I’ve analyzed brokers that offer advanced charting, fast execution, and seamless usability for fast-paced trading strategies. This guide focuses on the U.K. brokers that deliver the tools, pricing, and platform depth serious day traders require, whether you’re scalping intraday moves or holding swing positions over several days.

As an active trader, I’ve traded millions of pounds' worth in volume across various asset classes, and from firsthand experience I’ve learned that the needs of an active trader are very different from those of a passive investor. When markets are moving fast and you’re entering with large positions for small price moves, timing, speed, and precision are your most important tools.

The best platforms for day traders build these into the design: precision through trade tickets that let you quickly adjust order parameters, and speed through features like one-click trading, pre-set risk and position sizing, and drag-to-modify orders on charts. These are the key factors I look for when testing broker platforms for day trading, alongside account options, pricing, and active trader programs. My review process at StockBrokers.com combines hands-on platform testing, multiple rounds of fact-checking, and the collection of hundreds of data points per broker. Here are my picks for the best brokers for active traders in the U.K. in 2026.

1. Interactive Brokers - Best day trading platform

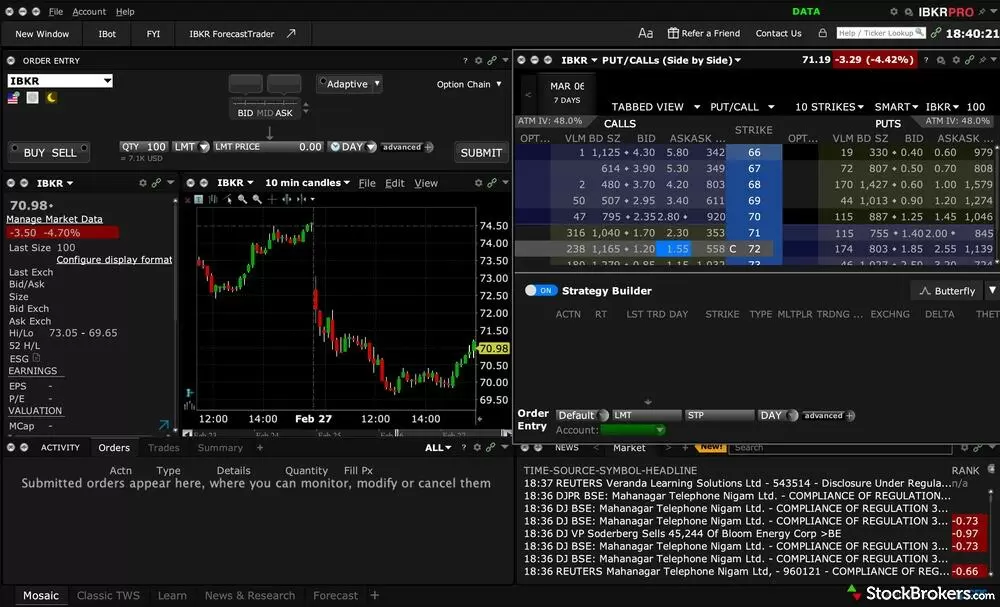

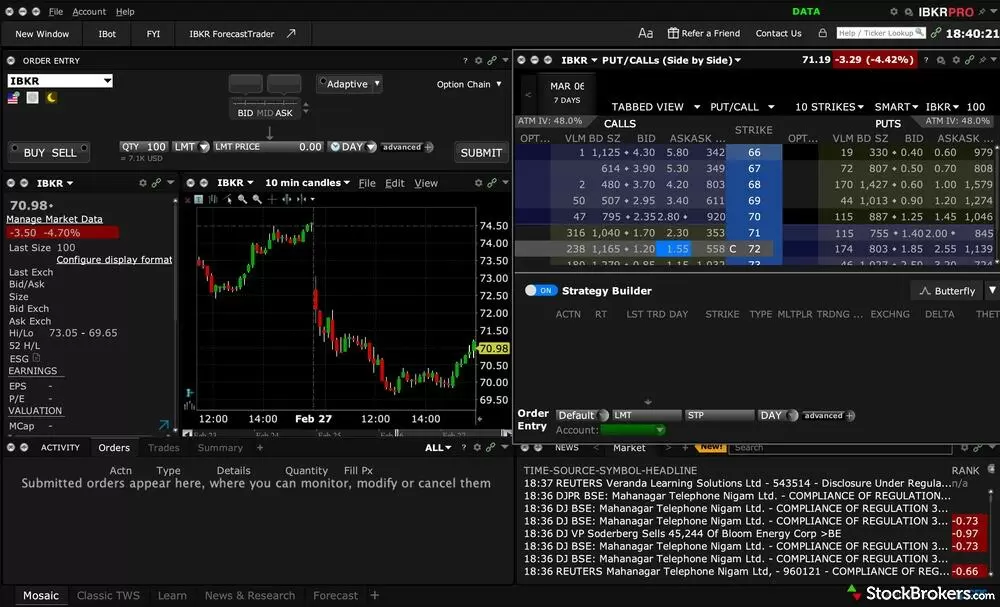

Interactive Brokers is my pick for the best day trading platform in the U.K., thanks to its deep toolkit, competitive pricing, and global market access. Its flagship Trader Workstation (TWS) is a sophisticated platform that feels tailor-made for serious traders, alongside the more streamlined IBKR Desktop. Both desktop platforms support multi-asset trading, including stocks, forex, and options, with advanced charting, real-time analytics, and highly customizable workflows. While the learning curve can be steep, the demo account lets you test features with virtual funds, making it easier to transition into live trading. Interactive Brokers’ web-based Client Portal is useful when you’re away from your main setup, though I prefer the IBKR Mobile app when I’m not using IBKR Desktop or TWS. For most active traders, IBKR Desktop is a solid starting point before graduating to TWS for even more advanced functionality.

Day trading platform: TWS is among the most complete online trading platforms available, but it’s also incredibly complex, whereas IBKR Desktop focuses on a more modern, user-friendly interface. For traders who want granular control over execution, automation, and charting, TWS delivers a comprehensive solution at the cost of a potentially steep learning curve. The Client Portal also provides access to a huge amount of data, learning materials, and account tools. For example, the PortfolioAnalyst section offers detailed performance reporting, highlights top portfolio movers, and includes an ESG score.

Interactive Brokers' Trader Workstation (TWS) provides U.K. investors with a powerful trading platform, featured here with advanced charting and comprehensive options analysis tools. This robust desktop interface is designed for active traders requiring detailed market data and sophisticated order execution capabilities.

Pricing: When it comes to cost-efficiency, Interactive Brokers is also strong. I was impressed by its low commission structure, particularly for active traders. Shares and ETFs are priced at £3 per trade up to £6,000, and 0.05% above that, keeping fees competitive even as position sizes grow. There are also no custody charges and no transaction fees for its lineup of 19,000 mutual funds, which helps reinforce IBKR’s value for U.K. traders who prioritize breadth and cost control. The main caveat is that IBKR can become relatively expensive for very small trade sizes, where minimum commissions represent a higher percentage of trade value. Also, IBKR Lite (with $0 stock commissions) is not available in the U.K., it’s currently offered only to U.S. residents.

Mobile apps: The mobile experience is another highlight, with multiple apps that add flexibility for trading on the move. I tested both IBKR Mobile and GlobalTrader, and found them intuitive while still delivering serious capability. The apps include robust market data, customizable dashboards, and tools such as Impact features that help align investments with ethical preferences. Charting is also strong, with indicators and drawing tools, plus chart previews visible directly within watchlists. Whether you’re trading fractional shares or monitoring a complex portfolio, Interactive Brokers’ mobile apps feel like a seamless extension of its desktop experience which is ideal for staying on top of fast-moving markets.

2. Saxo - Award-winning platform suite

| Company |

Overall Rating |

Minimum Deposit |

Web Platform |

Mobile App |

Saxo UK Saxo UK

|

|

£0 |

Yes |

|

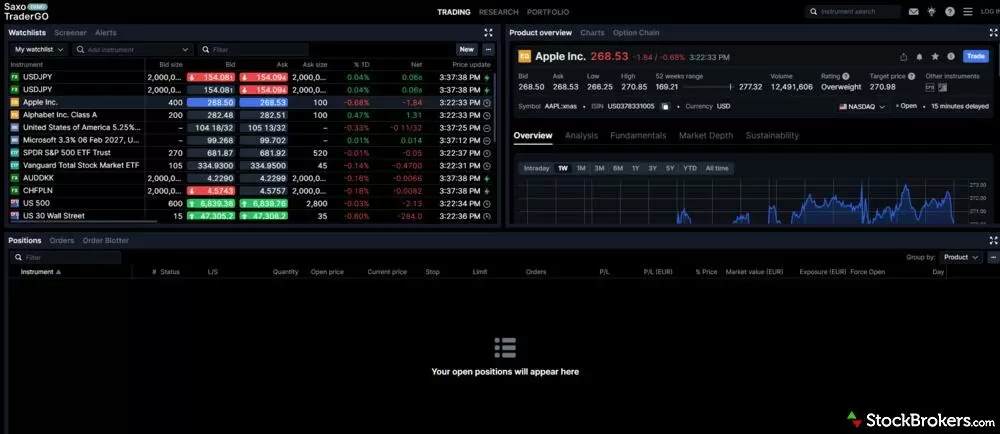

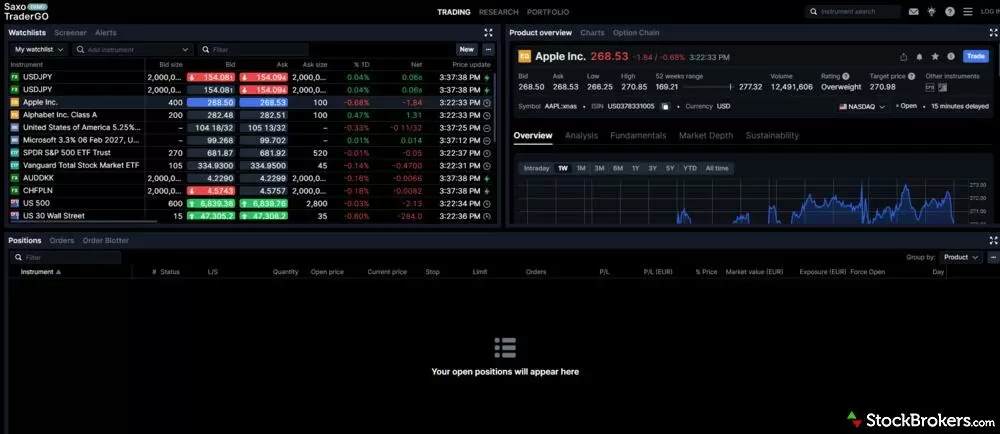

Saxo’s platform suite is an attractive choice for active traders in the U.K., offering sophistication, versatility, and a global reach that few competitors match. SaxoTraderPRO is tailor-made for professional-grade trading, with advanced features like multi-screen support for up to six monitors. Meanwhile, SaxoTraderGO bridges the gap for web and mobile users, providing a seamless, intuitive interface with access to the same broad toolset. In my experience, these platforms deliver an excellent combination of speed and customization for the fast-paced decisions active traders face daily. The integration of market insights, performance tracking, and real-time data helps ensure you’re always one step ahead. That said, one annoying drawback is that Saxo’s platforms still don’t support drag-to-modify orders on charts, a key workflow feature for day traders.

Day trading platform: SaxoTraderGO delivers a clean, data-rich interface with tools for screening stocks by market cap, dividend yield, and popularity, while also surfacing analyst ratings and top movers by region. Charting is powerful, though less intuitive to customize, with 64 indicators and 20 drawing tools available through platform settings. For more advanced needs, SaxoTraderPRO supports multi-monitor setups and is built for professional traders. SaxoInvestor, its simplified option, offers easier navigation, global news, popular stocks, and basic charting tools.

Saxo offers an extensive range of investments, including shares, funds, bonds, forex, commodities, and much more across 50 markets.

Pricing: Saxo offers the best pricing for active traders with its VIP and PRO accounts, where you can access its lowest pricing. However, steep minimum deposits mean these tiers are best suited for traders with £250,000+ portfolios.

Market access: One of Saxo’s key strengths is its market access and breadth of trading tools. With 23,500+ stocks across 50 global exchanges, the range of investment options is exceptional. Beyond equities, Saxo supports ETFs, forex, commodities, and derivatives, including options and futures, which are useful for both high-growth strategies and hedging. I found its technical analysis toolkit robust enough for serious chart work, even if customization could be more streamlined. This depth is rare among U.K. brokers, and Saxo’s global reach is especially compelling for traders accessing markets such as Tokyo or Hong Kong.

Research: Saxo’s research and educational resources further strengthen its appeal for serious traders. Its in-house strategy team produces timely, actionable content via daily market feeds, articles, and the Saxo Market Call podcast. News integrations from Dow Jones and other premium sources keep users current on global developments, while webinars and video guides offer deeper dives into strategy and market structure. These resources helped me interpret and react to complex market moves, and one of my favorite aspects is how thoughtfully the content is organized within the platform. Combined with trading-volume discounts, Saxo rewards frequent trading and larger portfolios, making it a strong partner for committed U.K. traders in 2026.

3. IG - Great for advanced charting

| Company |

Overall Rating |

Minimum Deposit |

Web Platform |

Mobile App |

IG IG

|

|

£0 |

Yes |

|

IG would be my pick if advanced charting is a top priority, as its tools are well suited to active traders in the U.K. Whether you’re day trading or executing swing strategies, IG’s ProRealTime charting suite delivers professional-grade capability alongside IG’s modern web platform, which features integrated analysis from TipRanks and trading signals from PIA First and Autochartist. I found features such as multi-timeframe analysis, customizable indicators, and historical data overlays invaluable for spotting trends and making more informed decisions.

Day trading platform: IG’s online trading platform is intuitive and beginner-friendly, with a clean layout that includes live prices, news, and quick access to watchlists and educational tools. Investors can screen stocks by dividend yield, sector, or analyst ratings, and view sentiment data from other IG clients. Basic charting is available by default, while advanced users can access ProRealTime, IG’s premium charting suite, which is free with frequent trading (at least three trades a month to avoid the subscription fee).

IG's web trading platform equips U.K. traders with an intuitive interface featuring advanced charting and the ability to seamlessly drag and modify orders directly on the chart. The platform also emphasizes pre-trade risk management with a detailed dealing ticket that clearly displays margin requirements and risk/reward ratios before execution.

Trading tools: IG’s integrated trading environment also helps it stand out. The ability to trade directly from charts is a game-changer, and the drag-and-drop workflow for modifying orders is ideal for managing positions in fast-moving markets, especially for intraday trading. I’ve found this approach keeps me focused on execution and strategy rather than toggling between screens, which is critical on small timeframes (for example, when you need to adjust a stop-loss quickly). Combined with integrated research and trading signals, IG keeps you equipped with actionable insights.

Education and research: Another reason I rate IG highly is its educational and research offering. The IG news portal delivers up-to-the-minute market analysis, while IG Academy provides webinars, courses, and live trading sessions to sharpen your skills. I also appreciate the platform’s live-streamed trading show, which builds a sense of community while delivering expert commentary. If you’re serious about refining your craft and staying connected with other traders, IG provides strong support.

4. XTB - Best for low costs and interest on cash

| Company |

Overall Rating |

Minimum Deposit |

Web Platform |

Mobile App |

XTB XTB

|

|

£0 |

Yes |

|

XTB offers a compelling proposition for active traders who want to keep costs low. With commission-free stock and ETF trading up to €100,000 per month and 4.25% interest on uninvested GBP cash, it’s a strong option for frequent traders looking to minimize friction and earn yield on idle capital. XTB’s xStation 5 platform provides the core tools needed for active trading, though it doesn’t match the depth of IBKR’s TWS or Saxo’s professional suite.

Day trading platform: xStation 5 is XTB’s proprietary web platform, featuring an economic calendar, upcoming dividend announcements, and access to multiple asset classes including indices, stocks, commodities, and currencies. You can create up to 16 charts at once to track different instruments, which is useful for active traders monitoring multiple positions. However, the charting tools and indicator library are less extensive than competitors like IG and Interactive Brokers, and you can’t overlay different stocks or indices on the same chart for direct comparison. The platform still leans heavily toward its CFD roots, which can make navigating to cash stocks and ETFs less intuitive. A demo account with £100,000 in virtual funds is available if you want to test the platform before committing real capital.

Pricing: This is where XTB competes the most for the average day trader. Commission-free trading on stocks and ETFs up to €100,000 in monthly volume means most active traders won’t pay per-trade fees. Above that threshold, a 0.2% commission applies with a €10 minimum, which can add up quickly on larger trades. There are no custody or platform charges for accounts under €250,000. An FX fee of 0.5% applies when buying shares in other currencies, though XTB offers USD and EUR accounts to help reduce this if you trade international shares regularly. The 4.25% interest on uninvested GBP is competitive with leading savings accounts, giving idle cash some yield between trades.

Mobile app: The XTB app is straightforward, with real-time prices, news, market sentiment, and your watchlist on the homepage. Charting is more limited than on the web platform, but you can add indicators and annotate charts. I found the app easy to use for placing trades and monitoring positions, though it doesn’t match the polish of IG or Saxo’s mobile offerings. One quirk: the ISA can only be opened through the app, not the web platform.

5. Trading 212 - Zero commissions and simplified platform interface

| Company |

Overall Rating |

Minimum Deposit |

Web Platform |

Mobile App |

Trading 212 Trading 212

|

|

£1 |

Yes |

|

Trading 212 has built its reputation on commission-free trading, making it an appealing option for active traders who execute frequently and want to eliminate per-trade costs. While the platform lacks the advanced tools found at IBKR, Saxo, or IG, it delivers a straightforward trading experience that works well for traders running simpler strategies at high frequency. The platform also pays 4.05% interest on uninvested GBP cash, giving idle capital some yield between trades.

Day trading platform: The Trading 212 web platform lets you buy and sell in real time with extensive charting tools powered by TradingView, including 50+ indicators such as Simple Moving Average for analysing historical price trends. You can add notes and customize chart layouts, though you can’t overlay different stocks or indices on the same chart to compare performance directly which is a feature many competitors offer. The website feels more basic in appearance and functionality than Interactive Brokers or IG, but for traders focused on placing simple trades and managing positions, it covers the essentials. A demo account with £5,000 in virtual funds is available for testing strategies without risking real capital.

Pricing: This is where Trading 212 excels. There are no fees for buying or selling shares, and no platform or management fees on its ISA or standard Invest account. The main cost to watch is the 0.15% currency conversion fee when buying shares listed in another currency, which is meaningfully cheaper than the 1%+ conversion costs charged by many traditional platforms. For active traders measuring performance in basis points, eliminating transaction costs can make a real difference across high trade counts.

Mobile app: Trading 212’s mobile app holds a 5-star rating on StockBrokers.com and is widely regarded by users. It offers 50+ charting tools, which is unusually extensive for a mobile app and appealing for traders who want to analyse trends on the go. The interface is intuitive, execution is fast, and managing watchlists and orders works smoothly. You can also view top winners and losers, most-owned stocks, and find investment inspiration quickly. The trade-off is that the overall experience is geared more toward simplicity than sophistication, so don’t expect the depth of tools you’ll find in IBKR Mobile or SaxoTraderGO.

FAQs

What is the best platform for day trading in the UK?

Interactive Brokers is my top choice for active day traders in the U.K. in 2026. The combination of Trader Workstation (TWS) and IBKR Desktop delivers advanced charting, real-time analytics, complex order types, and API access for algorithmic strategies. With access to 170+ markets across 36 countries and competitive pricing for frequent traders, IBKR covers nearly every need an active trader might have. The learning curve is steep, but the depth of the toolkit rewards traders who invest the time to master it.

Saxo and IG are also excellent choices depending on your priorities. Saxo stands out for global market access and its SaxoTraderPRO multi-monitor workflow, while IG’s ProRealTime charting suite and drag-to-modify orders functionality make it a strong fit for traders who prioritize technical analysis and fast execution.

What stock brokers offer automated trading?

Interactive Brokers is the standout choice for automated trading in the U.K. The platform supports algorithmic strategies through its API, third-party integrations, and the thinkScript-style automation available within TWS. You can build, backtest, and deploy custom trading algorithms across multiple asset classes.

For traders who want a simpler approach, eToro's copy trading feature allows you to automatically mirror the trades of experienced investors, though this isn't true algorithmic trading and doesn't support custom strategies.

Most other U.K. brokers, including Saxo, IG, XTB, and Trading 212, are geared primarily toward manual trading. IG does offer some automation through ProRealTime's ProBuilder language, but it's more limited than what IBKR provides. If automated trading is a core part of your strategy, Interactive Brokers is the clear leader.

Can I use multiple trading platforms at once?

Yes, and many active traders do exactly this. Maintaining accounts with multiple brokers lets you take advantage of the strengths of each platform. For example, you might use Interactive Brokers for low-cost execution and API trading, Saxo for broad international market access and research, and IG for ProRealTime charting when running technical analysis.

The key is understanding each broker’s fee structure, execution policies, and platform strengths so you can route the right trades to the right account. Also keep an eye on inactivity fees if you’re not trading regularly, since some brokers, like XTB, may charge monthly fees after prolonged dormancy.

What day trading platform offers the best charting features?

IG is my top pick for charting thanks to its ProRealTime integration, which delivers professional-grade tools such as multi-timeframe analysis, customizable indicators, historical data overlays, and the ability to trade directly from charts with drag-and-drop order modification. For active traders who place at least three trades per month, ProRealTime access is free, adding exceptional value.

Interactive Brokers is a close second. TWS offers 120+ chart indicators, advanced drawing tools, and the ability to create custom studies, while IBKR Desktop provides a more streamlined charting experience for traders who find TWS overwhelming.

Saxo’s SaxoTraderPRO includes 64 indicators and 20 drawing tools, plus multi-monitor support for up to six screens, though I found chart customization less intuitive than IG or IBKR. Trading 212 also deserves mention for offering 50+ TradingView-powered charting tools, even on its mobile app, which is impressive for a zero-commission platform, despite lacking the depth of the top three.

Is day trading legal in the UK?

Yes, day trading is completely legal in the U.K. There are no pattern day trader (PDT) rules like those in the United States, which require a minimum account balance of $25,000 for frequent trading. U.K. traders can execute as many trades as they like without regulatory restrictions on frequency or account size.

However, day trading profits are subject to Capital Gains Tax (CGT) unless you trade within a tax-advantaged account like a Stocks and Shares ISA. The CGT allowance for the 2025/26 tax year is £3,000, and gains above this threshold are taxed at 10% for basic-rate taxpayers or 20% for higher-rate taxpayers. Some traders opt for spread betting through platforms like IG, as spread betting profits are currently tax-free in the U.K., though this involves trading derivatives rather than owning underlying shares.

What are some good educational resources for beginner day traders?

Several U.K. brokers offer strong educational content for traders just getting started. IG Academy provides structured courses organized by experience level with videos, quizzes, and progress tracking. Interactive Brokers offers its Traders' Academy portal and the IBKR InvestMentor mobile app, which delivers bite-sized lessons on market fundamentals. Saxo produces high-quality research and educational webinars through its in-house strategy team, including the Saxo Market Call podcast.

The key for beginners is to start with a demo account, available at most brokers including Interactive Brokers, XTB, and Trading 212, so you can practice strategies without risking real capital.

What day trading platform has the cheapest trading fees?

Trading 212 offers the lowest costs for active traders, with zero commission on all stock and ETF trades and no platform fees. The only charge is a 0.15% currency conversion fee when buying shares listed in another currency, which is significantly cheaper than most competitors.

XTB is also highly competitive, offering commission-free trading up to €100,000 in monthly volume. Above that threshold, a 0.2% fee applies with a €10 minimum. XTB also pays 4.25% interest on uninvested GBP cash, which can offset costs for traders holding cash between positions.

Interactive Brokers charges £3 per trade up to £6,000 and 0.05% above that, which is low but not free. However, for very high-volume traders, IBKR's tiered pricing can become extremely competitive, and the platform's execution quality and access to global markets may justify the cost for serious active traders. The cheapest option depends on your trading volume and whether you prioritize zero commissions or platform depth.

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

Steven Hatzakis is a well-known finance writer with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Interactive Brokers

Interactive Brokers

Saxo UK

Saxo UK

IG

IG

XTB

XTB

Trading 212

Trading 212