DEGIRO Review

Your capital is at risk.

Editor's note: DEGIRO suspends onboarding of U.K. clients

DEGIRO has announced that account onboarding for new clients in the U.K. is “temporarily unavailable.” We will update our information here as it becomes known.

StockBrokers.com readers who are seeking a broker may compare our top choices for new investors in the U.K. here: Best U.K. Trading Platforms for Beginners.

Despite a subpar trading platform, DEGIRO offers cheap stock trading, charging only £1.75 + a £1 handling fee per trade, with a maximum charge of £5. Fees for trading funds, however, are more costly. DEGIRO lags competitors in fundamental research and education, and does not offer ISA or SIPP accounts.

-

Minimum Deposit:

£0 -

ISA:

No -

SIPP:

No

DEGIRO pros & cons

Pros:

- Low commissions on share trading.

- U.S. shares can be traded commission-free.

- €0.75 per contract for trades on futures and options ($0.75 for U.S. options/futures).

- 208 European ETFs where first trade can be commission-free, subject to terms.

Cons:

- DEGIRO’s mobile app and trading platform are mediocre and don’t offer anything special.

- There is a lack of fundamental research except for basic company information.

- SIPP and ISA accounts are not available.

Overall summary

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Overall Rating | N/A |

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Commissions & fees

DEGIRO's fees for trading individual stocks in the U.K., Europe, and the United States are significantly lower than most offerings from other major U.K. online brokers, which helped it stand out in our review of best trading platforms in the U.K. The fee structure makes DEGIRO an attractive option for frequent traders or investors seeking a "no-frills" broker.

Stock pricing: The fee for trading individual shares in the U.K. is £1.75 + 0.014% per trade, with a maximum charge of £5. For U.S. markets, share trading is commission-free, while for European markets, the charges range from €2.00 + 0.118% up to €10.00 + .0168%. There is also an annual charge of €2.50 per calendar year per exchange traded on (outside of the LSE).

Fund pricing: Fees for trading funds range from €7.50 plus 0.10% for exchange-listed investment funds up to €75.00 plus 0.10% for non-exchange-listed investment funds. There is also an annual charge for holding unit trusts/funds (a custodial fee of 0.2% per annum).

Market data: By default, customers receive free delayed market data for available exchanges. To access real-time streaming market data, customers must subscribe to each exchange individually, by paying €2.50 to €10.00 per month (£4.50 for the U.K.).

Bottom line: Traders focused on stocks will appreciate DEGIRO’s industry-leading fees. Traders with a mixed approach of stocks and funds may find more to their liking at FinecoBank, which offers competitive commissions for stocks and better commissions for funds. For a no-frills, basic but user-friendly option with super low fees, investors may also want to look at the low/zero commissions offered by Capital.com, Trading 212 and Freetrade.

Scenario pricing: When calculating annual share dealing costs, trading frequency and account balance are the two most important factors to consider. Assuming a £30,000 portfolio in a traditional, taxable share dealing account, here are five scenarios of how much DEGIRO would cost based on trade frequency (assuming each trade is £5,000):

- 5 trades per year = £13.75

- 12 trades per year = £33

- 36 trades per year = £99

- 120 trades per year = £330

- 3 fund trades per year = £67.5

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | £1.75 + £1 handling fee |

| Share Trading: 10-19 Deals/ Month | £1.75 + £1 handling fee |

| Share Trading: 20+ Deals/ Month | £1.75 + £1 handling fee |

| Annual Custody Fee: £0 - £250,000 | 0.20% |

| Annual Custody Fee: £250K-£500K | 0.20% |

| Annual Custody Fee: £500,000 - £1m | 0.20% |

| Annual Custody Fee: £1m and over | 0.20% |

| Bonds - Corporate - Fee | € 2.00 + €1 handling fee |

| Bonds - Government (Gilts) - Fee | € 2.00 + 0.06% (most of EU), € 5.00 + 0.05% (Germany) |

| ETFs - Fee | €2 + 0.03% |

| Investment Trusts - Fee | € 2.00 + €1 handling fee |

| Telephone Dealing Fee | £8.50 surcharge £1.75 + £1 handling fee |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Mobile trading apps

DEGIRO's mobile app, like the desktop platform, is extremely basic in terms of research offered. However, on the plus side, the app is very user-friendly and straightforward to navigate. (See our picks for Best Mobile Trading Apps.)

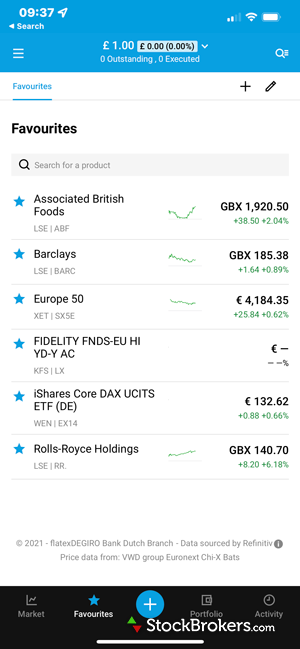

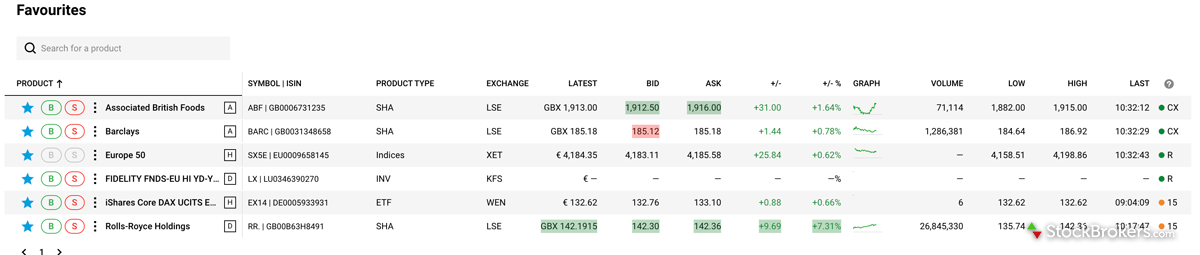

The ability to create watchlists (described as "Favourites" on the DEGIRO platform) and trade directly from the mobile app is useful. The “Favourites” automatically synchronise between the website and the mobile app, which is not the case on some competitors’ apps.

In the charting package, pulling up an interactive chart takes you out of the app into a third-party website, which is far from convenient, whilst the charting tools are rather cumbersome in this format.

On the plus side, the DEGIRO app has face and touch ID for easy login, a nice feature.

Other platforms & tools

DEGIRO has a minimalistic platform, trailing top competitors such as Saxo and Interactive Brokers.

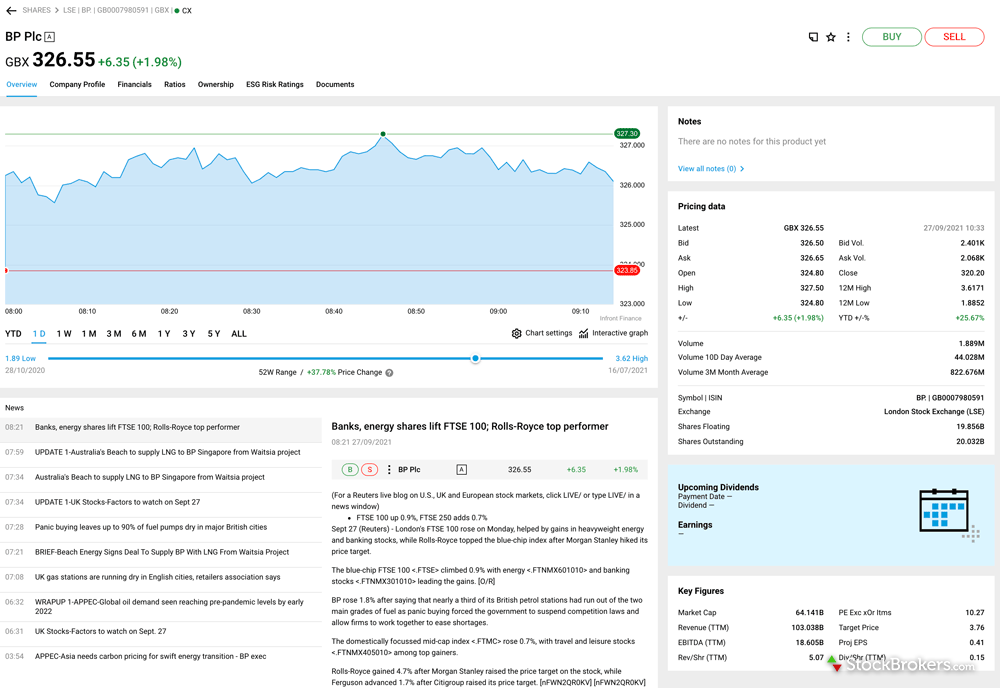

Charting: DEGIRO has improved its charting over the past couple of years, with pop-out interactive charts allowing traders to utilize 13 different indicators, nine drawing tools, and multiple chart types and views. Traders can even save chart templates. While it is a bit annoying to have to open a new web tab to access these features, it is still an improvement.

Overall though, the charting package offered by DEGIRO is average at best and this is an area in which the offering could easily be improved — particularly as the low fees are likely to attract investors who trade frequently and are more likely to demand an above-average charting platform (and mobile app).

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | No |

| Charting - Indicators / Studies | 13 |

| Charting - Drawing Tools | 9 |

| Charting - Notes | Yes |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | Yes |

Research

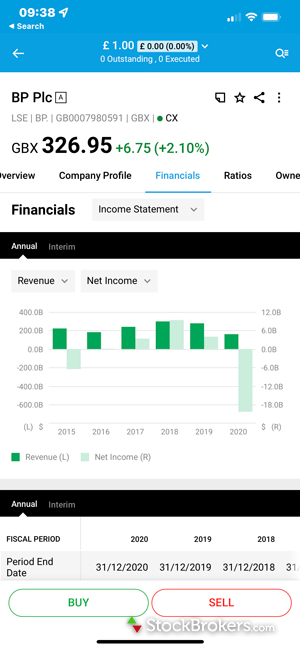

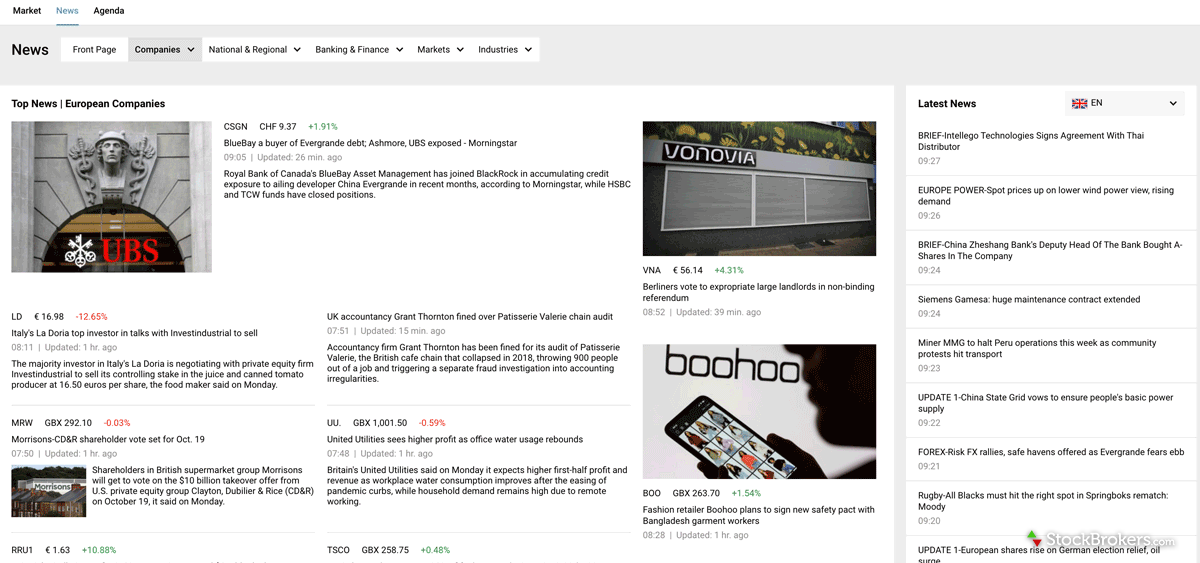

Over recent years DEGIRO has significantly expanded its research offering. For most stocks, DEGIRO offers financial reports (balance sheet, income statement, cash flow) and information about upcoming dividends and earnings, as well as company overviews, key ratios, and even analyst ratings. DEGIRO also offers news coverage, with both articles and videos. Although DEGIRO's overall research experience has improved, the research available for individual shares does not compare to brokers such as Hargreaves Lansdown and Interactive Brokers.

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Research - Shares | Yes |

| Research - CFDs | No |

| Research - Funds | Yes |

| Fund Research - Research Reports | No |

| Research - ETFs | No |

| Portfolio Allocation Breakdown | No |

Offering of investments

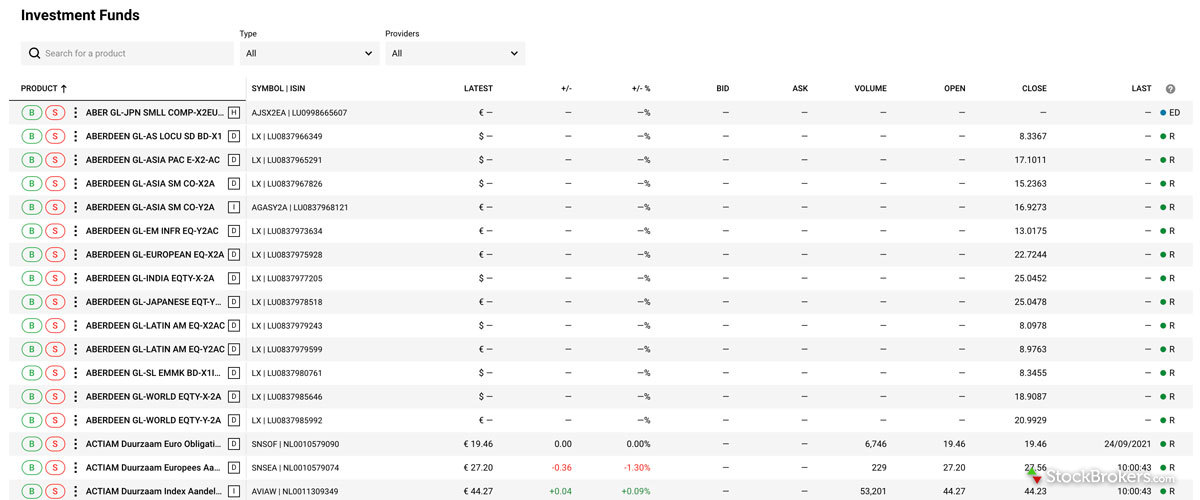

DEGIRO offers its clients access to a broad range of investments, including stocks, funds, bonds and gilts, ETFs, options, and futures. DEGIRO currently provides access to 30 international exchanges, providing either Direct to Market access or Smart Order Routing (SOR) through Morgan Stanley. All 30 exchanges lie within Europe, North America, Asia, and Oceania.

Currently, DEGIRO only offers a general trading account. Unfortunately, U.K. clients cannot open an Investment Savings Account (ISA) or join a personal pension saving scheme (SIPP). The cheapest U.K. brokers that offer ISA/SIPP accounts are Freetrade, for both ISAs and SIPPs; and Trading 212 and Capital.com for ISAs only.

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Education

While DEGIRO's educational offering is limited, the content it does provide is of high quality. Built internally by the company, DEGIRO offers 10 educational videos through its Investor's Academy, which covers shares trading and the broader investment journey. A couple additional videos depict things like how to buy a stock or bond, and there are articles on technical and fundamental analysis, options strategies, compound interest, and dollar cost averaging.

Despite being a low-fee, no-frills broker, the area of education is one where we feel DEGIRO could expand on what is currently a good quality offering. We watch with interest.

| Feature |

DEGIRO DEGIRO

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Final thoughts

If you are an investor looking for a low-cost way to trade stocks, DEGIRO is a solid choice, particularly for U.S. shares, which are commission-free. The trading platform is basic, but it is efficient and straightforward to use.

However, the low/zero commissions offered by Capital.com, Trading 212 and Freetrade are a challenge to DEGIRO’s low-fee, no-frills approach; and if you are a longer-term investor and require strong fundamental research, are looking for cheap funds trading, or want an ISA or SIPP account type, DEGIRO does not deliver.

About DEGIRO

Established in the Netherlands in 2013 by five previous Binck Bank employees, DEGIRO offers a low-cost alternative to the current range of brokerage platforms. Low trading fees and charges, alongside an advanced trading platform, have seen DEGIRO grow significantly (it is currently active in 18 countries) and it now cites more than 1 million customers.

Popular Stock Broker Reviews

- Freetrade Review

- Hargreaves Lansdown Review

- Halifax Share Dealing Review

- Trading 212 Review

- XTB UK Review

- Interactive Investor Review

- Interactive Brokers UK Review

- Fidelity UK Review

- AJ Bell Review

- Barclays Smart Investor Review

- Vanguard UK Review

- Capital.com Review

- eToro UK Review

- Lloyds Bank Investing Review

- Saxo Review

- IG Trading Review 2025

- CMC Invest Review

Popular Guides

More Guides

- Best Stocks and Shares ISAs for 2025

- Best Lifetime ISAs of 2025

- Best Paper Trading (Demo) Accounts in the UK for 2025

- Best SIPP Providers of 2025

- Best Cash ISA Accounts & Rates for 2025

- Best Junior SIPP Providers of 2025

- Best Crypto Brokers & Apps for April 2025