Saxo Review

Your capital is at risk.

Saxo is one of the most advanced investment platforms available to UK investors, offering global market access and professional-grade tools that cater primarily to experienced traders. Backed by Saxo Bank, a highly regulated international financial institution, the platform supports trading across 50 global stock exchanges and thousands of shares, ETFs, and mutual funds, giving investors choice.

While Saxo’s powerful tools and deep research make it ideal for active investors and professionals, the platform can feel complex for beginners. Its simplified SaxoInvestor platform helps bridge that gap, offering an easier interface and lower barriers to entry, though it still carries a learning curve.

Recent updates to Saxo’s pricing have made it more competitive, particularly for investors with larger portfolios. However, those with smaller balances may still find costs higher than at some low-cost rivals. Overall, Saxo remains one of the top choices for traders who value global access, data-driven insights, and a premium trading experience.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| #1 Mobile App | Winner |

| #1 Research | Winner |

| 2026 | #10 |

| 2025 | #9 |

| 2024 | #8 |

| 2023 | #4 |

| 2022 | #4 |

| 2021 | #5 |

| 2020 | #1 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Excellent web and mobile trading app.

- Offers ISAs and SIPPs.

- Offers mutual funds, in addition to stocks and ETFs.

- Excellent range of guides, webinars, and educational material.

Cons

- High fees for share and bond transactions.

- Platform or custody fees can work out to be expensive.

- Limited chart features on the mobile app.

- A steep learning curve for newer investors.

My top takeaways for Saxo in 2026:

- With Saxo, you have a choice of 23,500 shares on 50 stock exchanges worldwide, including Tokyo and Hong Kong stock, which is the widest range of stocks of any U.K. broker we tested.

- Placing trades is quick and simple through Saxo’s mobile app, and I found it easy to do basic functions such as creating and managing my watchlist.

- Saxo pulls in news feeds from Dow Jones, giving customers a good oversight of global finance news.

- Saxo now offers a flexible ISA, which is a great addition for investors.

- Saxo has reduced trading charges and removed minimum commission charges for stocks and ETFs on all exchanges. However, FX charges have increased for customers with less than £1 million invested.

Saxo fees

Saxo’s fees are competitive for high-value investors but remain on the higher side for smaller portfolios. The platform uses a tiered pricing model based on account type, with charges that are mostly percentage-based rather than flat. This structure benefits active or high-net-worth traders but can add up quickly for casual investors.

Saxo has three account tiers:

- Classic: For those with less than £200,000.

- Platinum: Amounts above £200,000 (access to lower fees and wider services).

- VIP: Amounts above £1 million (best fees and event invitations).

Custody & platform fees: A custody fee of 0.12% is charged on both Classic and Platinum accounts. This means Saxo is a generally more expensive platform. For investors with £45,000 invested in stocks or ETFs, you’d pay annual management charges of zero with Hargreaves Lansdown through a general trading account, or £45 if investing through an ISA. Other platforms, such as Trading 212 or Freetrade, don’t charge any platform fees on ISAs.

VIP clients pay a reduced custody fee of 0.08%, which becomes more cost-effective as your balance grows. For example, a £1 million portfolio would incur £800 annually, cheaper than AJ Bell (£875) or Hargreaves Lansdown (£1,000) for similar fund holdings.

Trading fees: Saxo removed all minimum trading charges for shares and ETFs across all exchanges in November 2025, so the commission fee will be based on the size of your transaction. Saxo charges a percentage fee of your transaction, which is 0.08% for the Classic account, 0.05% for Platinum, and 0.03% for VIP.

This pricing structure means transaction fees can get steep, and is a different approach to most of the other platforms we review that typically charge a flat fee. For example, if you invested £15,000 in an ETF, you'd pay a £12 transaction charge. Investing £100,000, you'd pay £80.

Trading costs for bonds range from 0.2% for Classic account holders to as little as 0.05% for VIP clients and come with a minimum of €20 per trade, which is again higher than many other platforms.

Mutual fund fees: If you hold mutual funds with Saxo, a steeper 0.4% service charge is applied to Classic accounts. On £45,000 worth of fund investments, this would bring your total annual management fees to £180 – making Saxo even more costly compared with other brokers. AJ Bell, for example, charges annual service fees of 0.25% on funds, which means an account balance of £45,000 in funds would be a lower £112.50 total cost.

There are more than 6,000 global mutual funds offered by Saxo. Fund trades are free, although you will pay ongoing management fees to the fund manager and Saxo. For Classic accounts you'd pay 0.4% annually, it would drop to 0.2% for Platinum accounts if over £200,000, and 0.1% for VIP accounts with £1M invested.

Saxo is a better value for investors with high-value portfolios as the custody fee drops to 0.08% on VIP accounts. On a £1 million portfolio, you’d pay £800 a year in management fees with Saxo, compared to £875 you’d pay with rival AJ Bell or the £1,000 you'd pay with Hargreaves Lansdown to hold mutual funds.

Additional fees: There are no inactivity fees, which is good news for investors who don’t check their accounts or trade regularly. However, FX conversion costs can be higher for Classic accounts, particularly for balances under £1 million.

| Feature |

Saxo UK Saxo UK

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | $1 / £3 / €3 |

| Share Trading: 10-19 Deals/ Month | $1 / £3 / €3 |

| Share Trading: 20+ Deals/ Month | $1 / £3 / €3 |

| Annual Platform Fee (Funds): £0 - £250,000 | 0.4%, 0.2%, 0.1% |

| Annual Platform Fee (Funds): £250K-£500K | 0.4%, 0.2%, 0.1% |

| Annual Platform Fee (Funds): £500,000 - £1m | 0.4%, 0.2%, 0.1% |

| Annual Platform Fee (Funds): £1m and over | 0.4%, 0.2%, 0.1% |

| Bonds - Corporate - Fee | €20 minimum |

| Bonds - Government (Gilts) - Fee | €20 minimum |

| ETFs - Fee | From $1 |

| Investment Trusts - Fee | 0.03/0.06/0.08% |

| Telephone Dealing Fee | £50 |

Range of investments

Saxo offers one of the broadest investment ranges of any U.K. broker, giving access to over 23,500 shares across 50 global stock exchanges. This includes major international markets such as Tokyo, Hong Kong, and New York, as well as smaller regional exchanges that most competitors don’t cover.

Investors can also trade ETFs, investment trusts, bonds, mutual funds, forex, commodities, and futures, meaning you can achieve wide diversification in your portfolio. Saxo's range is particularly appealing to experienced or globally-minded investors seeking higher-risk trading opportunities.

Saxo now offers ISAs and SIPPs, providing U.K. investors with tax-efficient ways to hold shares, ETFs, and funds within their portfolios. This makes Saxo more versatile for long-term investing as well as active trading.

You can also invest in crypto exchange-traded notes (ETNs) on the Saxo platform, following updated FCA guidance that now permits U.K. retail investors to access these products. This addition gives Saxo one of the most comprehensive line-ups of regulated investment options among U.K. brokers.

Overall, Saxo excels in investment variety, offering advanced traders and global investors more markets, instruments, and flexibility than other brokers, though its complexity may be daunting for those seeking simplicity.

Saxo offers an extensive range of investments, including shares, funds, bonds, forex, commodities, and much more across 50 markets.

| Feature |

Saxo UK Saxo UK

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | Yes |

| Advisor Services | No |

Saxo ISA review

Saxo’s ISA is best suited to investors who want wide market access and advanced tools rather than simplicity. It offers flexibility and investment choice, but the interface and percentage-based fees may be daunting for beginners or casual savers. For experienced investors, however, it’s one of the strongest ISA offerings available in the U.K. for international diversification.

Saxo’s Stocks and Shares ISA allows you to invest in over 23,000 shares and 7,400 ETFs across 50 global markets, alongside 6,000 mutual funds and 5,200 bonds or gilts. This is one of the widest selections available, though Saxo does not offer ready-made portfolios, so investors must build and manage their holdings manually.

To help users get started, Saxo provides educational guides and demo accounts so you can explore the platform before committing funds. A key advantage is that it’s a flexible ISA, meaning you can withdraw and replace funds within the same tax year without reducing your overall annual allowance, which is an uncommon and valuable feature.

Fees: Saxo’s ISA charges an annual platform fee of 0.12% to hold your investments, plus a 0.08% trading commission per transaction. For example, on a £1,500 trade, the commission is just £1.20, making small trades cost-efficient. However, the percentage-based model can become costly as trade sizes and balances increase. Investors with larger portfolios may find a flat-fee broker such as Interactive Investor more economical.

Mobile trading apps

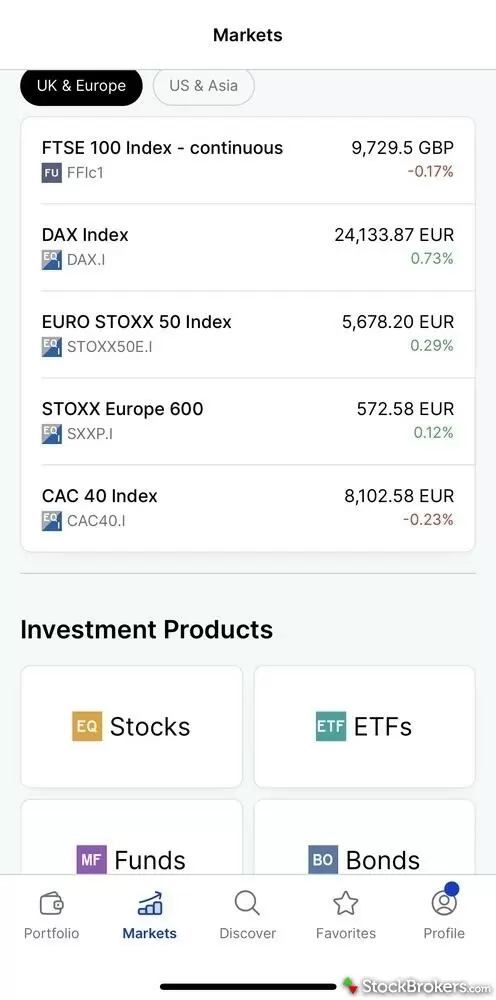

Saxo’s mobile apps strike a balance between depth and design. They are perfect for investors who value in-depth data, global access, and seamless functionality, but their complexity and limited real-time access mean beginners may prefer simpler alternatives.

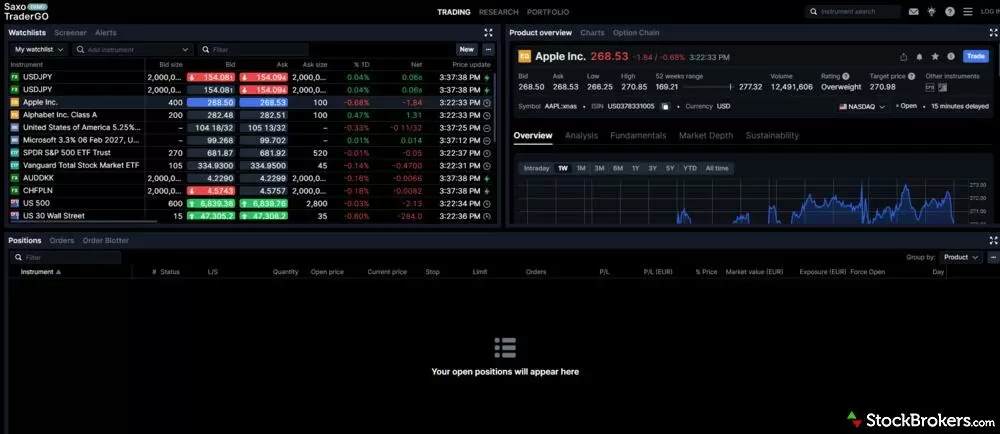

SaxoTrader is Saxo’s comprehensive trading platform, accessed through a mobile app and a web browser. There is also SaxoInvestor, a more streamlined version aimed at a wider range of investors.

Through the app, you can trade stocks, mutual funds, ETFs, bonds, crypto ETNs, forex, options on forex, CFDs, and commodities.

Placing trades is quick and simple through the app, and I found it easy to do basic functions such as creating and managing my watchlist. When selecting a stock, you can see key financial information and view similar stocks people are interested in by scrolling to the bottom of the page on the ‘product overview’ tab. I liked the look and feel of the app and was impressed by the new design of the portfolio section, where you can see in detail your historical performance and scroll through a clear summary of your positions, including your profit and loss.

You can overlay different stocks on the same chart to compare historical performance although you can’t change the layout of a chart through drawing tools or add indicators. This is a disadvantage if you like sophisticated charting tools on the go — tools that are readily offered by rivals like IG.

Elizabeth's take:

"In my testing of SaxoInvestor, I found it easy to navigate. You can create watchlists, check your portfolio, read about different investing themes, view analysts’ consensus on individual stocks, and see a company’s ESG score. Ultimately, I was able to place a trade effortlessly, and the resulting charges were clearly shown before the transaction was initiated. Be aware that prices are delayed by 15 minutes. You can't subscribe to real-time prices through the app. It must be done through the website."

The SaxoInvestor mobile app is more streamlined than the SaxoTrader app, but still offers many more features than the mobile trading apps of other platforms.

Top apps

See our picks for best share dealing accounts for beginners, based on our extensive hands-on testing of share trading apps available in the U.K.

Trading platforms

Saxo’s platforms excel in functionality, research, and customization. They are ideal for active traders, global investors, and professionals who value data-rich environments, but may feel overly complex for casual investors seeking a simple, plug-and-play platform.

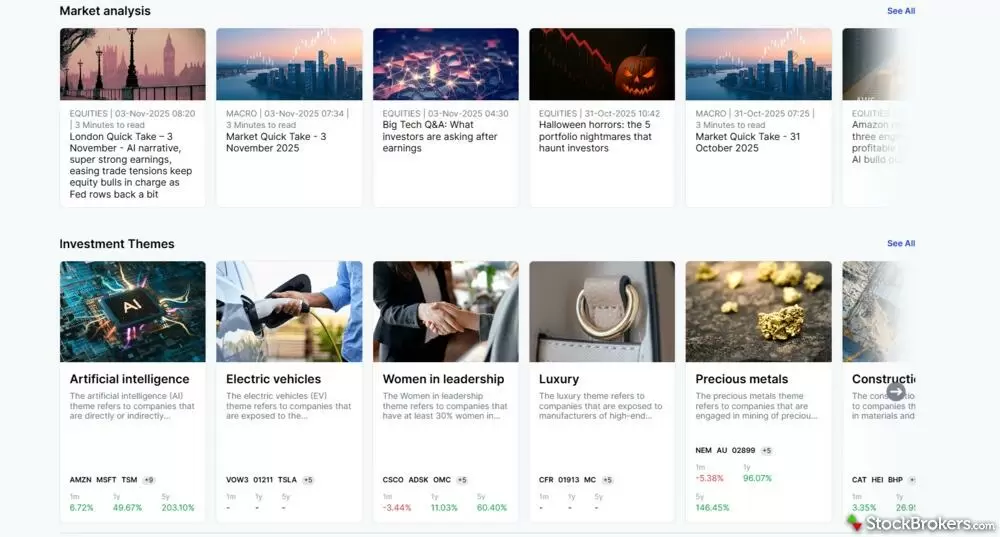

The SaxoTrader web homepage gives a very good oversight of stock market moves across regions and sectors. You can see the top gainers and losers of different regions, as well as analyst recommendations for stocks.

The web platform is very cleanly laid out. You can filter stocks in many different ways, such as by popularity across sector or region, which allows you to see the general trader sentiment towards certain stocks. New themes have been added in 2025, allowing you to sort by companies in construction, healthcare innovation, or clean energy, for example.

When selecting a stock, the quote includes a chart overview, news, fundamentals, and ESG information. I found the information given to be comprehensive and laid out well.

SaxoTrader is certainly one of the most comprehensive investing platforms of all the brokers we tested. There is also SaxoTraderPro, which offers advanced trading features for professional or large-scale traders. It supports six monitors, unlike SaxoTrader which supports two.

The SaxoInvestor website, aimed at a wider range of investors, is a slimmed-down version of SaxoTrader. I found it easier to use and it should be the choice for beginner investors if opting for a Saxo account. You can view your portfolio and how your investments are performing, see global market movements, check the current most popular stocks across different regions, and read global stock market news. You can compare different stocks through the ‘advanced chart’ setting and there are still many ways to customise a chart.

One downside I found of Saxo was that account verification was on the slow side. I couldn't start investing straight away.

| Feature |

Saxo UK Saxo UK

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 64 |

| Charting - Drawing Tools | 20 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | No |

Education

Saxo offers a great range of educational material across all its platforms, which is one of its main strengths. It offers e-learning courses and video guides, so whether you are a beginner building foundational knowledge or an experienced trader expanding into new asset classes, Saxo’s materials deliver both depth and accessibility, supported by credible in-house experts.

Courses include an introduction to equities or bonds, and how to get started with options trading for those looking to take more risk.

There is also a weekly podcast called Saxo Market Call, which looks at topics such as AI and discusses the potential impact of political events such as government budgets or elections on global stock markets. If you are interested in financial news and how broader economic news impacts the stock market, then Saxo is a great source of information.

Saxo offers a wide range of educational materials.

| Feature |

Saxo UK Saxo UK

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Final thoughts

Saxo is a very sophisticated trading platform that will appeal to investors with extensive trading experience. You can invest in stocks and assets worldwide, unlike general U.K. investment platforms that typically focus on only Europe and North America. However, Saxo is not likely to be suitable for beginner investors. SaxoInvestor makes investing more accessible. However, the charges can still work out to be on the higher end compared to other platforms aimed at new investors, such as Trading 212, eToro, or XTB. Investors with a large portfolio should also be mindful of the trading charges, which are a percentage of your trade rather than a flat fee, and the increased FX fees.

Saxo Star Ratings

| Feature |

Saxo UK Saxo UK

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Barclays Smart Investor Review

- Halifax Share Dealing Review

- Interactive Brokers UK Review

- Freetrade Review

- Vanguard UK Review

- eToro UK Review

- Interactive Investor Review

- Lloyds Bank Investing Review

- Capital.com Review

- Hargreaves Lansdown Review

- IG Trading Review 2026

- CMC Invest Review

- Fidelity UK Review

- AJ Bell Review

- Trading 212 Review

- XTB UK Review

Popular Guides

More Guides

- Best Junior SIPPs for 2026

- Best Cash ISA Accounts & Rates for 2026

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Lifetime ISAs of 2026

- Best SIPP Providers of 2026

- Best Crypto Brokers & Apps for March 2026

- Best Stocks and Shares ISAs for 2026

About Saxo

Saxo is the U.K. subsidiary of Saxo Bank Group. Established in 1992, Saxo Bank is a Danish investment bank and its technology is used by more than 200 banks around the world. With headquarters in Copenhagen and clients in over 180 countries, Saxo Bank is privately held and processes over $17 billion worth of transactions every day.