FinecoBank Review

Your capital is at risk.

Editor's note: FinecoBank closes U.K. operations

FinecoBank announced on 15 Sept. 2023 that it is closing its business in the U.K. market due to regulatory changes pertaining to Brexit. The broker has said it is working on a transition plan and will communicate directly with clients on next steps, including information on how to transfer assets including ISA accounts to a new bank or broker. More information is listed here.

StockBrokers.com readers who are seeking a broker may compare our top choices in the U.K. for new investors here: Best U.K. Trading Platforms for Beginners.

FinecoBank is a solid broker to choose with a wide variety of share dealing options and low fees across the board. However, it does have some clear negatives, primarily a subpar range of educational materials and research reports.

FinecoBank’s low charges include just £2.95 for U.K. shares and ETFs, $3.95 for U.S. stocks and ETFs, and €3.95 for European stocks and ETFs, making Fineco a good match for both passive and active traders.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

No

FinecoBank pros & cons

Pros:

- Fineco is one of the cheapest brokers in terms of fees for purchasing both global and U.K. shares.

- Offers a wide variety of products that are available to trade, including stocks, ETFs, funds, bonds and CFDs.

- Now offers ISA accounts.

Cons:

- Fineco’s mobile app and trading platform are simply mid-range.

- Although the research and education areas are fairly substantial, there is room for significant development.

Overall summary

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Commissions & fees

Fineco is one of the lowest cost online brokers available for U.K. share dealing, alongside Trading 212, Freetrade, Capital.com and DEGIRO. Fineco does not charge any inactivity fees or impose minimum monthly commission.

Stocks, ETFs, and bonds: U.K. shares and ETF trades cost £2.95, while U.S. stocks and ETFs cost just $3.95 per trade; European stocks and ETFs cost only €3.95 per trade. Bonds cost £6.95 per trade.

Funds: Funds are free to buy and sell; however, there is an annual platform (custody) fee of 0.25% on the first £250,000 of assets held in funds (annual custody fees are not uncommon for dealing funds in the U.K.). All other assets (stocks, ETFs, bonds, etc.) do not contribute to this custody fee.

Forex and CFDs: Forex/CFD traders can trade on spreads as low as 0.8 pips on foreign exchange, and 0.4 pips on CFD indices. Commissions on U.K., U.S., and EU shares CFDs are £0.

Market data: By default, customers receive free delayed market data for available exchanges. To access real-time streaming market data, customers must activate the desktop platform PowerDesk. PowerDesk provides users free real-time market data for markets such as the U.K., U.S., DAX30, CAC40, etc.

When calculating annual share dealing costs, trading frequency and account balance are the two most important factors to consider. Assuming a £30,000 portfolio in a traditional, taxable share dealing account, here are five scenarios of how much Fineco would cost depending on trade frequency:

- 5 trades per year = £75

- 12 trades per year = £35.4

- 36 trades per year = £106.2

- 120 trades per year = £354

- 3 fund trades per year = £14.75

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | £2.95 |

| Share Trading: 10-19 Deals/ Month | £2.95 |

| Share Trading: 20+ Deals/ Month | £2.95 |

| Annual Custody Fee: £0 - £250,000 | 0.25% |

| Annual Custody Fee: £250K-£500K | 0.15% |

| Annual Custody Fee: £500,000 - £1m | 0.15% |

| Annual Custody Fee: £1m and over | 0.05% |

| Bonds - Corporate - Fee | £6.95 |

| Bonds - Government (Gilts) - Fee | £6.95 |

| ETFs - Fee | £2.95 |

| Investment Trusts - Fee | N/A |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

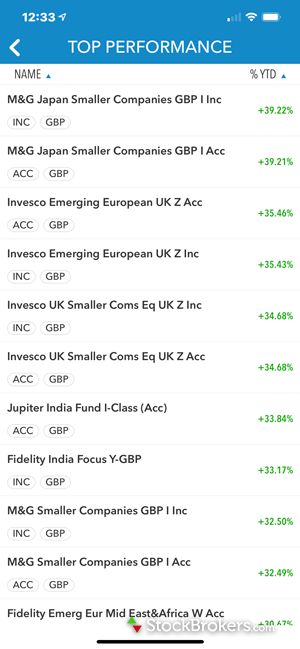

Mobile trading apps

The Fineco mobile app is perhaps not exemplary, but is sufficient. It provides traders with the ability to view market updates, news, and charts for stocks, indices, futures, forex, and CFDs. That said, I was surprised to see that while the app has dedicated tabs for CFDs, forex, and futures, there are no dedicated tabs for shares, ETFs, or funds. (See our full list of picks for Best Mobile Trading Apps.)

Platforms & tools

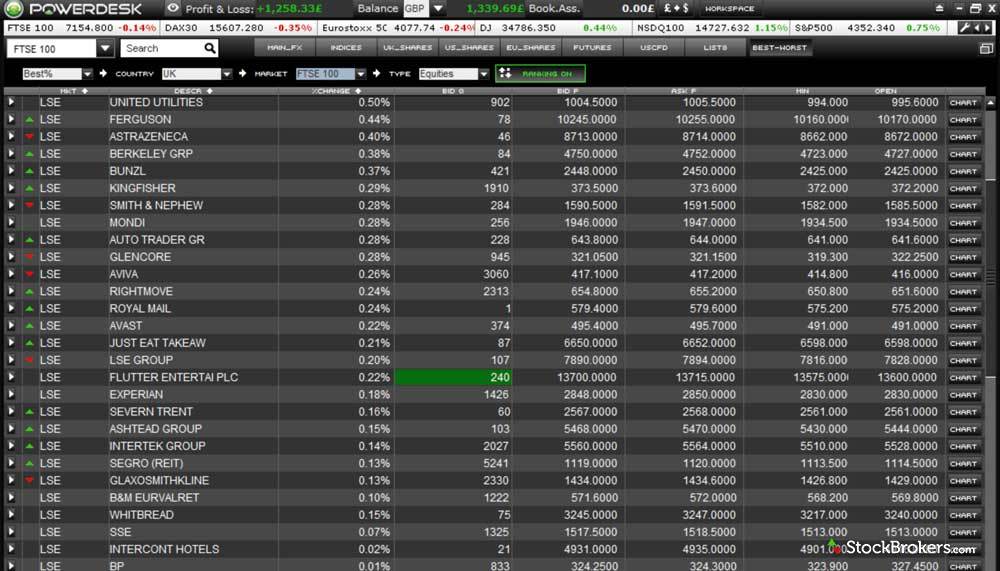

Fineco offers a free web platform and the downloadable PowerDesk desktop platform, which is also free to U.K. clients. Our testing found the web platform to be average at best, offering a standard selection of charting features with few additional tools. PowerDesk is a far better option for active traders, offering more charting features and technical indicators.

Web platform charting: Fineco offers 24 different technical analysis indicators, the ability to add share and index overlays, and the option to add corporate events and change chart types. Unfortunately, adding notes to a chart is not possible, while stock alerts are limited to price. The overall charting package, though average at best, will suffice for most casual traders. More active traders may want to consider brokers with more advanced platforms such as Saxo, Interactive Brokers and IG Group.

PowerDesk: PowerDesk, Fineco’s downloadable trading platform, is meant for active traders, offering over 90 technical indicators, customization charting features, up to 30 years of historical data, the ability to directly trade off charts, and more.

FinecoBank's web trading platform.

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 22 |

| Charting - Drawing Tools | 3 |

| Charting - Notes | No |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | Yes |

| Charting - Index Overlays | Yes |

Research

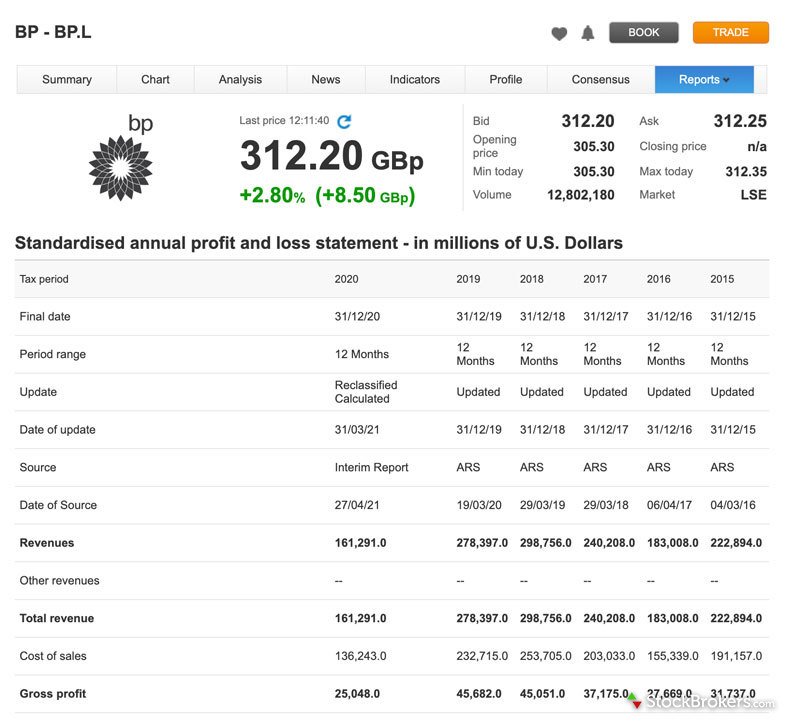

Overall, when it comes to researching stocks, ETFs, funds and the like, Fineco left me wanting more. If research reports and fund research are essential to you, read our reviews on Saxo, Interactive Brokers and Hargreaves Lansdown, which received the highest scores in this category.

Stocks research: A basic selection of research is available for individual stocks, including market news, a consensus of analyst ratings, and technical analysis insights from third-party provider iTrading. Fineco does not provide research reports on individual stocks, and little analysis is provided in terms of fundamental data or dividends.

Funds research: Limited research is available for funds, which makes sense given Fineco offers fewer than than 200 funds.

Screener tools: Fineco does offer screeners for stocks, ETFs, CFDs, and funds, which can filter assets based on technical, fundamental, and performance-based data. The stock screener includes pre-built “Search Ideas.” For example, the “Warren Buffet” search idea filters companies that offer constant growth forecasts over time. I found these search ideas to be unique and thought-provoking.

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Research - Shares | Yes |

| Research - CFDs | No |

| Research - Funds | Yes |

| Fund Research - Research Reports | No |

| Research - ETFs | Yes |

| Portfolio Allocation Breakdown | Yes |

Offering of investments

Fineco offers a comprehensive selection of tradeable investments, including shares, ETFs, bonds, funds, forex, and CFDs. Banking features are also available, while advisor services are not available in the U.K.

Stocks and funds: While stock selections are vast, spanning 26 global markets, the fund offering is somewhat disappointing, with just over 400 funds available from 10 fund families.

ISA/SIPP accounts: U.K. residents can now open tax-advantaged ISA accounts with Fineco. But Fineco does not currently offer SIPP tax-advantaged accounts; investors seeking such accounts should consider IG or Saxo.

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | No |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

Education

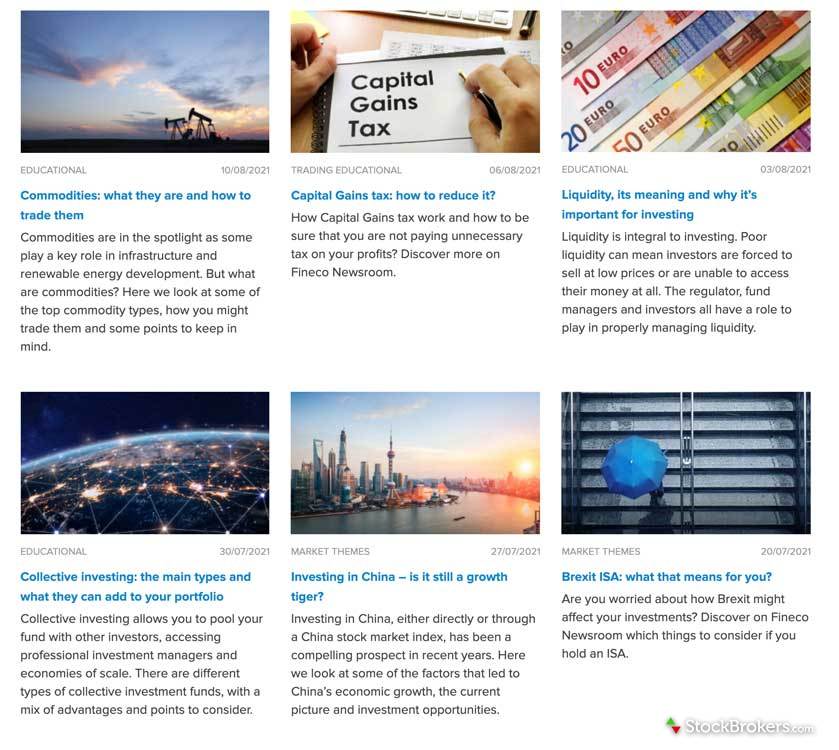

Fineco’s educational offering is improving but is still limited and comes in the form of webinars and videos. Fineco have managed to move away from a predominant focus on forex trading with broader webinars on macroeconomic events and also some beginners’ guides, although there could still be more on individual stock trading.

Videos include in-depth content on technical analysis, fundamental analysis, trading signals and strategies, and more.

Bottom line, Fineco has stepped up their educational offering for beginners and intermediate traders and investors, a welcome improvement.

| Feature |

FinecoBank FinecoBank

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

Banking services

One of the few brokers in our survey to offer banking services, Fineco provides a diverse selection of products and services, including a multicurrency trading account, free U.K./EUR ATM withdrawals and payments, free U.K. and SEPA bank transfers, and the use of a debit card with no monthly fee. Frequent travelers will appreciate Fineco’s currency conversion capabilities, allowing real-time conversions on over 20 different currencies at spread-only costs.

MoneyMap: One of the notable free banking tools Fineco offers, MoneyMap automatically categorizes income and expenses to help customers save. MoneyMap acts as a personalized budget, allowing you to easily track and manage costs.

Final thoughts

FinecoBank is a low-cost share dealing broker that will appeal to customers looking to trade shares, ETFs, forex, and CFDs on a global scale. While the web-based trading platform and research offerings are just average, Fineco provides enough tools and a growing education area at a discounted price to warrant consideration.

However, U.K. residents seeking a traditional U.K. brokerage offering may find themselves disappointed in Fineco, as it offers only a small selection of funds to trade, and SIPP accounts are currently not on offer.

About FinecoBank

Fineco launched as a bank in Italy in 1999. Over the last 20-plus years, FinecoBank has amassed over 1.3 million clients in Italy and €70 billion in total financial assets. Fineco is a publicly traded company on the Euro Stoxx 600 under the ticker FCBBF. Fineco is fully regulated by the FCA and PRA, and authorised by the Bank of Italy. Fineco is also a member of the Interbank Fund for Deposit Protection and the National Guarantee Fund.

Popular Stock Broker Reviews

- Vanguard UK Review

- IG Trading Review 2025

- Halifax Share Dealing Review

- CMC Invest Review

- Fidelity UK Review

- Saxo Review

- eToro UK Review

- Barclays Smart Investor Review

- Lloyds Bank Investing Review

- Trading 212 Review

- Capital.com Review

- Freetrade Review

- Interactive Investor Review

- XTB UK Review

- Interactive Brokers UK Review

- AJ Bell Review

- Hargreaves Lansdown Review

Popular Guides

More Guides

- Best Cash ISA Accounts & Rates for 2025

- Best Stocks and Shares ISAs for 2025

- Best Paper Trading (Demo) Accounts in the UK for 2025

- Best SIPP Providers of 2025

- Best Crypto Brokers & Apps for April 2025

- Best Junior SIPP Providers of 2025

- Best Lifetime ISAs of 2025

Compare FinecoBank Competitors

Select one or more of these brokers to compare against FinecoBank.

Show all