Revolut Trading Review

Your capital is at risk.

Revolut launched in 2015 as an app-based alternative to traditional banks, with one of its main selling points being low or no fees when spending abroad. Since then, the platform has expanded and you can now invest in stocks, cryptocurrency, and bonds through the app. Revolut doesn't offer a SIPP or personal pension, but you can invest through the Revolut ISA.

After thorough testing for this review, my opinion is that while Revolut offers an easy way for its existing customers to dip their toe into investing, I believe you are better off looking at one of the many other U.K. investing platforms if you do not already have a Revolut account. Other platforms offer a much wider range of investments, more in-depth educational materials, and cheaper fees for frequent traders.

-

Minimum Deposit:

£0 -

ISA:

Yes -

SIPP:

No

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2026.

| 2026 | #14 |

| 2025 | #21 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Zero-commission trading.

- Easy to invest if you are an existing Revolut customer.

- Invest from as little as £1.

Cons

- No website.

- Limited investment options beyond U.S. stocks.

- Cannot buy U.K. shares, and no FSCS protection.

- No SIPP.

My top takeaways for Revolut in 2026:

- If you have Revolut’s standard plan, where you pay no monthly fees for your account, you’ll only get one free share trade a month. At the most expensive end, with an Ultra account costing £55 a month, you get 10 free trades every month.

- Revolut Trading offers more than 4,000 stocks on its platform across the U.S., U.K., and Europe.

- Revolut’s investment platform is app-only in the U.K., meaning you can’t trade or view your account on a web browser – although this may change soon.

- Revolut is one of the few investing platforms we test, offering the option to invest in crypto.

- There is no phone support for customers, although in-app live chat support is offered 24/7.

Revolut fees

Revolut U.K. offers zero-commission investing, meaning you won’t pay any trading fees when buying or selling shares. However, because Revolut is primarily a banking service, its accounts follow a tiered pricing structure. The number of free stock trades you receive each month depends entirely on which Revolut plan you hold.

Revolut offers five account tiers, each with different monthly fees and free-trade allowances:

Revolut's account plans and fees

| Plan | Cost per month to hold account | Number of free trades per month | Charge for extra trades outside allowance |

| Standard | Free | 1 | 0.25% or £1 – whichever is higher |

| Plus | £3.99 | 3 | 0.25% or £1 |

| Premium | £7.99 | 5 | 0.25% or £1 |

| Metal | £14.99 | 10 | 0.25% or £1 |

| Ultra | £55 | 10 | 0.12% or £1 |

On the Standard plan, you receive just one free trade per month. At the top end, the Ultra plan provides 10 free monthly trades for a £55 subscription. Any trades outside your monthly allowance are charged as a percentage of the transaction, with no minimum or maximum cap.

The fees mean you may be better off looking at other platforms such as Trading 212, Freetrade, or XTB if you are looking for free share trading. These platforms offer unlimited commission-free trades, unlike Revolut where you may only get one for free each month.

It’s worth pointing out that Revolut is primarily a banking service, and many use the app for its low fees when spending abroad. Investing is an additional add-on that some may be tempted to use while already a Revolut customer, especially now that Revolut offers an ISA.

Cryptocurrency fees: Revolut is one of the few major U.K. investing platforms we review that offers cryptocurrency investments. The charges for buying or selling crypto are 1.49% or minimums of £0.99, £1.49 or £1.99, depending on the transaction amount. When I tested selling £45 worth of bitcoin, the fee was £1.99.

These costs are comparable to competitors. eToro, which also offers crypto trading, charges 1% per trade. IG charges a total fee of 1.49% for cryptocurrency trades.

Other fees: There are no inactivity, withdrawal, or ongoing management fees on Revolut Trading beyond the plan fees.

| Feature |

Revolut Revolut

|

|---|---|

| Minimum Deposit | £0 |

| Share Trading: 0-9 Deals/ Month | 0.25% / 0,12% or minimum €1 |

| Share Trading: 10-19 Deals/ Month | 0.25% / 0,12% or minimum €1 |

| Share Trading: 20+ Deals/ Month | 0.25% / 0,12% or minimum €1 |

| Annual Platform Fee (Funds): £0 - £250,000 | N/A |

| Annual Platform Fee (Funds): £250K-£500K | N/A |

| Annual Platform Fee (Funds): £500,000 - £1m | N/A |

| Annual Platform Fee (Funds): £1m and over | N/A |

| Bonds - Corporate - Fee | 0.25% / 0,12% or minimum €1 |

| Bonds - Government (Gilts) - Fee | 0.25% / 0,12% or minimum €1 |

| ETFs - Fee | 0.25% / 0,12% or minimum €1 |

| Investment Trusts - Fee | N/A |

| Telephone Dealing Fee | N/A |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

Revolut offers a strong range of investments for beginners and casual investors, especially now that it includes U.K. and European shares, ETFs, commodities, and crypto. However, it still falls short in terms of depth, advanced products, and market coverage. Overall, Revolut is best for simple, app-based investing rather than comprehensive portfolio building.

You can invest in the world’s biggest companies through Revolut, including the likes of Coca-Cola, Disney, and Apple. Overall, Revolut offers more than 4,000 shares on its platform and has recently expanded the shares available from international markets including Europe and the U.K. Previously, only U.S. stocks were offered.

Revolut's ETF range has also expanded, with U.K.-listed ETFs added in 2025 from fund managers including Vanguard and Blackrock. Revolut also launched a stocks and shares ISA in 2025, allowing you to invest tax-free.

When searching for stocks, one useful feature is the ‘advanced search’ tool. You can filter companies by sector, size, dividend yield, or P/E ratio. Tapping on the ‘i’ information toggle gives you a brief description of what these terms mean. You can then save these companies to your collection or buy shares right away if markets are open.

In addition to shares and ETFs, Revolut offers the option to invest in commodities such as gold or silver. You can also buy digital currencies such as Bitcoin or Ethereum through Revolut. These are high-risk investments, and Revolut makes this clear by asking a few questions before you can buy crypto to assess your understanding of the risks.

There are around 250 cryptocurrencies available through Revolut. You can buy a fraction of a ‘coin’, meaning you can buy from as little as £1.

Overall, Revolut’s investment range is broad enough for casual investors and those who value convenience in an all-in-one financial app. However, more advanced traders or investors seeking deeper market access, options, bonds, or research tools will likely find Revolut’s offering too limited.

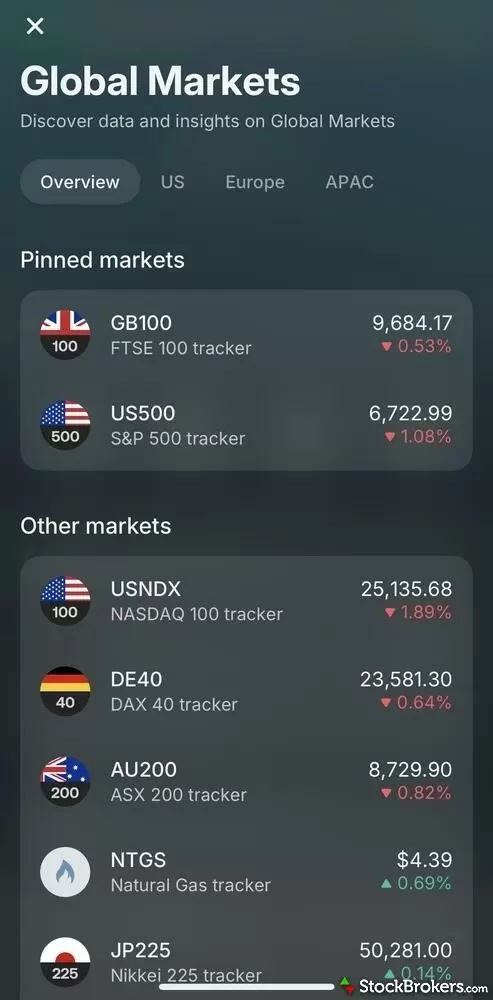

You can invest in a range of global markets through Revolut, across assets including stocks, ETFs, bonds, cryptocurrency, and commodities.

| Feature |

Revolut Revolut

|

|---|---|

| Share Trading | Yes |

| CFD Trading | Yes |

| ETFs | Yes |

| Mutual Funds | No |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | No |

| Spread Betting | No |

| Crypto Trading | Yes |

| Advisor Services | No |

Revolut ISA review

Revolut’s stocks and shares ISA launched in July 2025. It is a convenient, beginner-friendly option for existing Revolut users, but it is not the most cost-effective or flexible ISA on the market. While the ISA offers a solid range of shares and ETFs within an easy-to-use app, the value you get depends heavily on which Revolut plan you pay for, and many investors will find better pricing and broader choice on dedicated investment platforms.

Through the ISA, you have the choice of more than 4,000 shares to invest in, as well as around 400 to 500 ETFs. It is a flexible ISA, meaning you can take money out and put it back into the ISA in the same tax year without it affecting your overall £20,000 annual allowance.

In terms of fees, this depends on the type of account you have with Revolut. The free standard plan allows one free trade a month, while other accounts cost between £3.99 and £55 and allow up to 10 free trades a month. Outside these allowances, trading fees are 0.25% of the transaction for most accounts or 0.12% for the most comprehensive accounts. For example, investing £5,000 in an ETF would cost either £12.50 with a Plus, Premium, or Metal account, or £6 with an Ultra account.

Platform charges will again depend on the account type you have. It’s possible to hold a free ISA with Revolut on its standard plan, but monthly charges can be as high as £55 if you hold the Revolut Ultra account, which also offers features such as global medical insurance and fee-free currency exchange with no limits.

Overall, Revolut’s stocks and shares ISA could offer a good entry point to customers already using Revolut for banking or overseas spending. But there are other platforms offering cheaper fees, more flexible trading options and a wider range of investment choices like Trading 212, Freetrade, AJ Bell, or Interactive Investor.

Mobile trading apps

Revolut offers a polished, user-friendly investing experience within its main banking app, making it a good choice for beginners or casual investors who want convenience above all else. However, the app remains limited for serious investors due to very basic charting, minimal analytical tools, and paywalled advanced features. Overall, Revolut is strong on usability but weak on depth.

When you log into your account, you see a summary of your ‘total wealth’ – the total amount across your accounts. The invest tab is at the bottom of the screen, where you have the option to invest in stocks, ETFs, commodities, or crypto.

On the Invest page you can see a summary of your own investments, the stocks that have gained or lost the most since markets opened, and market news. You can also see recently added stocks under ‘collections’ and view the most popular stocks bought by other investors. The same goes for crypto. You can see the day’s top gainers or losers, the currencies most traded, and the latest news.

Elizabeth's take:

"A useful feature of the Revolut mobile app is that you can see upcoming corporate events that may influence the price of a company’s stock, as well as information about upcoming dividend payments and overall analyst ratings."

The Revolut app handles all the basics well. You can check your portfolio, browse simple research, place trades, save stocks to a watchlist, and explore ideas through curated lists. However, the charting tools are extremely limited. You can view recent price movements but cannot overlay multiple assets or adjust chart settings, which makes deeper analysis difficult. Revolut offers a more advanced charting suite through its Trading Pro add-on, but this costs £15 per month and is not integrated into the standard investing interface.

Overall, Revolut’s mobile app excels in ease of use and accessibility, but investors who rely on detailed charting, research tools, or broader market data will likely find it too limited without upgrading to paid extras.

The Revolut app has limited chart options but traders can access advanced tools through the Trading Pro option at £15 a month.

Trading platforms

Revolut’s trading platform is one of the weakest areas of its offering. Because investing is app-only for U.K. customers, Revolut lacks the flexibility, screen space, and research capabilities that many investors expect. While the app is polished and easy to use, the absence of a full web platform makes Revolut unsuitable for serious research or active trading.

Revolut does not currently offer a dedicated web platform in the U.K., meaning you cannot trade, analyse charts, or even view your portfolio through a desktop browser. The Revolut website provides general information about accounts, fees, and investment products, which is helpful for newcomers exploring the platform, but all actual trading activity must take place within the mobile app.

The lack of a web platform is a big downside of Revolut. I certainly sometimes find it easier to research and compare investments on a large screen, so I consider a web option necessary for serious investing.

However, Revolut is in the process of rolling out a web platform called Trading Terminal, and this is already available in some E.U. markets. It is accessed through Trading Pro, which costs £15 a month.

Charting tools for everyday users are also very basic. While you can view recent price performance, more advanced analysis, such as multi-asset overlays, technical indicators, or enhanced chart customisation, is locked behind the Trading Pro paywall. This divide between standard features and paid upgrades reinforces Revolut’s focus on casual rather than advanced investors.

Overall, Revolut’s trading platform is clean and intuitive, but the lack of a desktop interface and limited charting tools make it less competitive than platforms designed specifically for investing.

| Feature |

Revolut Revolut

|

|---|---|

| Web Platform | No |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 110 |

| Charting - Drawing Tools | 6 |

| Charting - Notes | No |

| Charting - Display Corporate Events | No |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

Revolut offers the basics in terms of education. You can learn about the basics of investing and cryptocurrency trading through the main website, but this isn’t prominent on the app. Other apps, such as AJ Bell’s Dodl app, Saxo, IG, Interactive Brokers, and Hargreaves Lansdown, have much better educational materials for new investors in a range of formats from video and podcasts to written articles and quizzes.

There is, however, a useful educational tool in the Revolut app called ‘Crypto Learn’. Here there are various articles on the basics of cryptocurrency and the risks involved. The Learn section also says blogs will be coming to the app soon.

While Revolut’s education tools are cleanly presented and simple to use, they fall short of what is available from investment-first platforms. Investors seeking deeper research tools, structured guidance, or a variety of learning formats may find Revolut’s educational resources insufficient.

The Crypto Learn section in the app offers tips on how to get started with crypto trading and information about different tokens.

| Feature |

Revolut Revolut

|

|---|---|

| Education (Share Trading) | No |

| Education (Funds) | No |

| Education (Retirement) | No |

| Client Webinars | No |

| Client Webinars (Archived) | No |

Are you new to investing?

We thoroughly tested 17 top U.K. brokerages to find the best choices for beginner investors. Read more in our guide.

Final Thoughts

Revolut’s investing features are most appealing to people who already use the Revolut app for everyday banking, spending abroad, or budgeting. The platform makes it remarkably simple to begin investing, and the absence of trading commissions, at least within the free monthly allowance, creates a low barrier to entry for new or small-scale investors. The addition of a stocks and shares ISA also strengthens Revolut’s offering by giving customers a tax-efficient way to invest up to £20,000 a year.

That said, I’m not sure there is enough to justify signing up to Revolut simply to use its investing service – particularly because if you have a basic account you only get one free trade per month. There are many other apps or platforms that offer more choices than Revolut while still offering zero fees on a greater range of tradeable instruments.

Revolut Star Ratings

| Feature |

Revolut Revolut

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- Fidelity UK Review

- XTB UK Review

- CMC Invest Review

- Barclays Smart Investor Review

- Halifax Share Dealing Review

- IG Trading Review 2026

- Saxo Review

- eToro UK Review

- AJ Bell Review

- Hargreaves Lansdown Review

- Trading 212 Review

- Vanguard UK Review

- Freetrade Review

- Capital.com Review

- Interactive Investor Review

- Lloyds Bank Investing Review

- Interactive Brokers UK Review

Popular Guides

More Guides

- 5 Best Demo Trading Accounts in the UK for 2026

- Best Crypto Brokers & Apps for March 2026

- Best Stocks and Shares ISAs for 2026

- Best Cash ISA Accounts & Rates for 2026

- Best Junior SIPPs for 2026

- Best Lifetime ISAs of 2026

- Best SIPP Providers of 2026

About Revolut

Revolut was founded in 2015 by entrepreneur Nik Storonsky and is headquartered in London. Originally a global money transfer platform known for its low fees when exchanging money into other currencies, Revolut has since expanded into investing and cryptocurrency trading. Revolut is estimated to have around 8 million customers in the U.K., and 45 million customers worldwide.