AJ Bell Review

Your capital is at risk.

One of the U.K.’s biggest DIY investment platforms, AJ Bell is a great investment platform whether you are a new investor or one with experience and a large portfolio. You can invest in an extensive range of investments through a variety of accounts including ISAs and SIPPs.

AJ Bell has a great range of educational and research material and also offers ready-made portfolios for those who don’t want to manage their own. AJ Bell also has an app called Dodl, a slimmer version of the main AJ Bell platform aimed at beginner investors. Dodl comes with lower charges, so it may be a better option than the main AJ Bell platform for younger or newer investors.

-

Minimum Deposit:

£250 -

ISA:

Yes -

SIPP:

Yes

| Investment Choices | |

| Charges & Fees | |

| Website | |

| Education | |

| Mobile App | |

| Ease of Use |

Check out UK.StockBrokers.com's picks for the best investment platforms in 2025.

| #1 Ease of Use | Winner |

| 2025 | #5 |

| 2024 | #4 |

| 2020 | #6 |

Led by Elizabeth Anderson, Lead Writer and Researcher, the UK.StockBrokers.com research team collects data and tests products on an ongoing basis. We review the tools and features most important to U.K. investors – including beginners, casual investors, passive investors, and active traders.

We collect and track data on trading charges, fees, and interest rates to make it easier to understand the cost of investing in the U.K. We analyze a wide range of savings and investment offerings, like ISAs, SIPPs, investment portfolios, pensions, and active trading accounts. We hand-collect and audit data across more than 50 variables in our coverage of the best U.K. investment platforms.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on UK.StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Great range of accounts and investment choices.

- Great customer service - easy to contact on the phone.

- Dodl app offers a simpler account and fee structure.

Cons

- On the more expensive side if you have larger fund portfolios.

- Chart tools are basic for more sophisticated traders.

- No fractional share dealing.

My top takeaways for AJ Bell in 2025:

- AJ Bell’s platform is excellent for beginner and seasoned investors and offers ISAs, SIPPs, and ready-made portfolios.

- AJ Bell’s new app Dodl makes investing easy with zero trading fees and a simplified design and investment range.

- However, if you're looking to trade stocks irregularly, there are cheaper platforms available such as eToro, XTB, Freetrade, or Trading 212.

- AJ Bell offers a particularly good value if you have a large amount to invest in mutual funds, although be mindful of the £1.50 trading fee for non-AJ Bell funds.

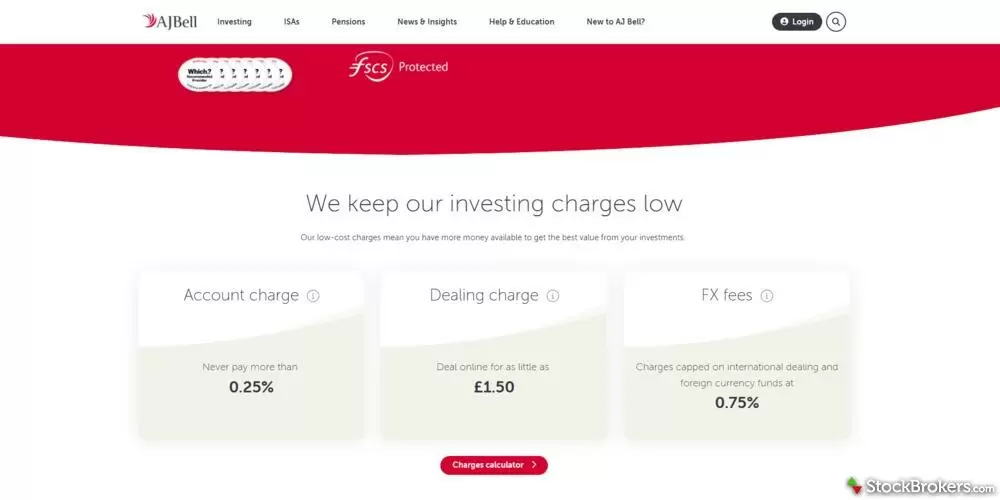

AJ Bell fees

Overall, AJ Bell's charges are on the low side for platform fees. However, AJ Bell's trading fees can take a chunk out of your investment if you're only investing small amounts.

Mutual funds fee: AJ Bell charges a percentage of your investments to hold your money if you hold mutual funds, a fee model that’s common among investment platforms. AJ Bell charges 0.25% on funds up to £250,000, with the percentage fee dropping to 0.10% on amounts between £250,000 and £500,000. There are no custody charges on amounts above £500,000. The fees are cheaper than rival Hargreaves Lansdown, which charges 0.45% and only drops to zero on amounts above £2M.

This means the most you’ll pay per year in custody charges for funds is £875 if you have investments above £500,000. However, there is an additional charge of £3.50 a month if you hold shares through AJ Bell's ISA or general dealing account (or 0.25%, whichever is lower), so the total could be £917. FX fees are 0.75% if you're investing up to £10,000, and drops to 0.5% or 0.25% on amounts above this.

If you have a portfolio worth £500,000, you may be better off with a platform that charges a flat fee. Halifax, for example, charges £36 a year for its ISA and share dealing account, and Interactive Investor charges £143.88 a year. But, for those with small portfolios, AJ Bell can offer good value. For example, with a portfolio of £5,000, you’d pay annual charges of £12.50.

AJ Bell charges £1.50 per mutual fund trade, which is more expensive than many other platforms that tend not to charge for fund trades, although this fee is reduced to zero if you invest in an AJ Bell ready-made fund.

Share dealing fees: Fees to buy and sell stocks, investment trusts, bonds, and ETFs are £5 per trade, reduced to £3.50 if you trade more than 10 times a month and to £1.50 if you invest in the same asset each month through regular dealing.

AJ Bell works out cheap in terms of management fees if you only hold ETFs or stocks. Annual custody charges for shares, ETFs, and investment trusts are capped at £42 (or £3.50 a month) in AJ Bell's ISA or general dealing account. SIPP fees are 0.25%, capped at £10 a month or £120 a year.

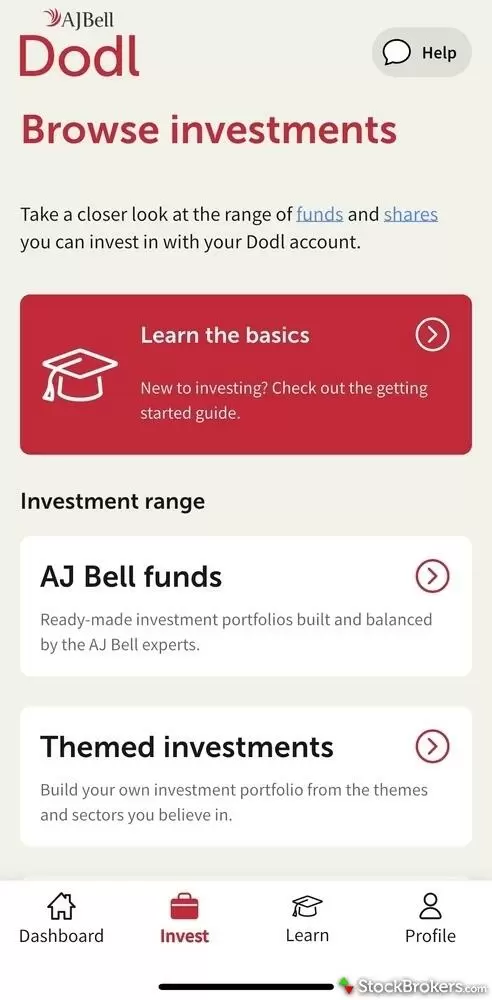

Dodl: AJ Bell also has an app-only investment platform called Dodl, which comes with lower charges than the main platform. The annual management fee is 0.15%, the same as low-cost provider Vanguard, with a £1 minimum monthly fee. There are no trading fees for buying and selling shares, so it works out much cheaper than going through AJ Bell’s main platform. However, there is no cap on platform charges, unlike the main AJ Bell platform. So if you have a large amount of money to invest, the main AJ Bell platform may offer better value. Keep in mind you'll pay FX fees of 0.7% if buying shares in another currency, such as U.S. shares.

Dodl could be a great options if you are new to investing or have smaller accounts. You can invest through an ISA, Lifetime ISA, or pension with Dodl. Another bonus is that Dodl pays 4.06% interest on uninvested cash.

AJ Bell fees are transparent and easy to understand, although can work out on the higher end depending on how often you trade and how much you have to invest.

| Feature |

AJ Bell AJ Bell

|

|---|---|

| Minimum Deposit | £250 |

| Share Trading: 0-9 Deals/ Month | £5 |

| Share Trading: 10-19 Deals/ Month | £1.50 |

| Share Trading: 20+ Deals/ Month | £1.50 |

| Annual Platform Fee (Funds): £0 - £250,000 | £0 - £625 |

| Annual Platform Fee (Funds): £250K-£500K | £625 - £875 |

| Annual Platform Fee (Funds): £500,000 - £1m | £875 |

| Annual Platform Fee (Funds): £1m and over | £875 |

| Bonds - Corporate - Fee | £5 |

| Bonds - Government (Gilts) - Fee | £5 |

| ETFs - Fee | £5 |

| Investment Trusts - Fee | £5 |

| Telephone Dealing Fee | £25 |

What type of trader are you?

New to the world of investing? See my picks for the best UK trading platforms for beginners. More experienced traders should check out my guide to the best UK Trading Platforms for Active Traders. If you're looking to trade shares on the go, read my guide to the best UK stock trading apps.

Range of investments

The range of investments available through AJ Bell includes more than 16,000 shares, 4,000 ETFs, and 4,000 mutual funds across 24 markets, and about 350 investment trusts, as well as gilts and bonds. So there's a wide range of investments available to customers.

AJ Bell offers several types of ISAs, including a Stocks and Shares ISA, Lifetime ISA, and Junior ISA, giving investors a flexible choice depending on their goals and stage in life.

AJ Bell’s ‘favourite funds’ list helps to make diversification easier for novice or unconfident investors by picking funds it thinks are most likely to provide you with an income or with long-term growth. You can filter by fund type, fund sector or investment goal.

There's also the option to invest in one of AJ Bell's ready-made funds, which suits investors who simply want to buy into a portfolio that's already been put together for them. AJ Bell has seven funds to suit both investors looking for long-term growth and those wanting their investments to pay a monthly income. Total annual charges start at 0.56% a year, which is very competitive on price compared with other platforms offering ready-made investments. On a £10,000 investments into an AJ Bell ready-made Growth fund, you'd pay total annual fees of around £56.

AJ Bell offers some corporate bonds or gilts online. You can access a wider range by calling 0345 54 32 600.

AJ Bell doesn't currently offer any option to invest in cryptocurrency. AJ Bell says it expects to offer crypto ETNs now that they are widely available to U.K. retail investors, but it is still reviewing its position.

One downside of AJ Bell is that it does not offer fractional share dealing, meaning you have to buy whole shares. For a new investor looking to trade small amounts, a platform that allows you to buy fractional shares may be more suitable, such as Trading 212, Robinhood, Freetrade, or XTB.

The AJ Bell website offers good options to filter shares, funds, and ETFs by sector, region, performance, and other criteria.

| Feature |

AJ Bell AJ Bell

|

|---|---|

| Share Trading | Yes |

| CFD Trading | No |

| ETFs | Yes |

| Mutual Funds | Yes |

| Bonds - Corporate | Yes |

| Bonds - Government (Gilts) | Yes |

| Investment Trusts | Yes |

| Spread Betting | No |

| Crypto Trading | No |

| Advisor Services | No |

AJ Bell ISA review

AJ Bell’s ISA suits investors who prefer ready-made fund portfolios. Its in-house funds offer a simple way to get started without picking individual investments.

There’s a wide choice of around 4,400 funds in total, and you can filter by geography, sector, or charges. AJ Bell’s ‘favourite funds’ list highlights options it sees as having strong potential, and the list is updated regularly. Or you can opt for one of AJ Bell's ready-made funds.

Pricing: AJ Bell’s platform charge is 0.25% for funds, which is cheaper than Hargreaves Lansdown’s 0.45%. You’ll pay £1.50 each time you buy or sell a fund unless it’s an AJ Bell fund, which has no dealing fee. AJ Bell’s growth fund costs 0.31% plus the 0.25% platform charge for a total of 0.56% annually for a ready-made portfolio, which is a good value.

There is a dealing fee of £1.50 every time you buy or sell a fund, which can work out very expensive if you are only investing a small amount in an investment fund. Platforms such as Fidelity or Hargreaves Lansdown do not charge any fund dealing fees.

If you hold shares or ETFs in AJ Bell’s ISA, platform charges are 0.25%, capped at £3.50 a month (£42 a year). Share and ETF trades cost £5 each, or £1.50 if you set up regular investing from £25 a month. This can add up if you’re investing small amounts, so other platforms like Freetrade or Trading 212 may be more cost-effective for active trading.

Platform: The AJ Bell website is very detailed, offering investment ideas, expert views, and market news. However, I find the app more basic. It’s not easy to get investment inspiration. You also can’t search or filter shares, although you can filter funds, ETFs, or investment trusts.

Overall, AJ Bell’s ISA is not particularly inspiring. It’s a solid option if you want a ready-made fund portfolio at a reasonable cost. However, for lower fees and a simpler app, the Dodl ISA is worth considering, with a 0.15% charge or £1 monthly minimum.

Mobile trading apps

Overall, AJ Bell's mobile app experience is good but basic. It's reliable and easy to use for managing portfolios and placing trades, but it lacks some of the research depth and market insight tools that other brokers offer. The app is best suited to investors who prioritise simplicity over advanced trading features.

In my testing, I found AJ Bell’s main mobile app simple to use albeit very basic in design and features. Nevertheless, it’s easy to create or view your watchlist, buy and sell holdings, set up price alerts, and see your investments all in one place on the home page.

While there is a news and markets tab where you can see how global indices are performing, overall there is only limited news or analysis available in the app.

Elizabeth's take:

"You can also search for investment ideas in the app, but on a limited basis. I think the mobile app could offer more investment inspiration for stocks, which other platforms such as CMC Invest or Robinhood do well, and is already offered on Dodl."

The main app is separate from AJ Bell’s Dodl app; you’ll need to register for both and create a separate account if you want to access both. The Dodl app is very much aimed at beginner investors, offering just three investment ranges — AJ Bell funds, themed investments and shares — with a one-sentence description of each. Themed investments include sectors such as ‘big tech' and 'going for gold,' where you can invest in a fund that invests in major tech companies or the gold market. Despite being more basic, I found Dodl more interesting to use than AJ Bell’s main app.

The Dodl app is more streamlined and user-friendly than the main AJ Bell app, and can come with lower charges.

Trading platforms

AJ Bell's trading platforms are solid but not exceptional. The website is comprehensive and easy to navigate, offering useful account and research tools. However, the platform's charting capabilities are fairly limited, which may frustrate more advanced traders looking for detailed analytics.

The AJ Bell website is very detailed, offering lots of information on account opening and management, news and insights, and investment tools.

When you log in to the website, you are taken to your account summary, along with a pie chart showing the make-up of your portfolio. There are also various links to investment news and videos. You can also see the top 50 buys and sells of shares, funds, ETFs, or investment trusts that day, week, or month.

Share prices are delayed by 15 minutes by default, but you can select the ‘real-time’ switch to see live prices.

AJ Bell has fairly basic charting tools and is prone to being glitchy, I find. In my testing, I could not pull up chart informatioin for single stocks on either the website or mobile app.

| Feature |

AJ Bell AJ Bell

|

|---|---|

| Web Platform | Yes |

| iPhone App | Yes |

| Android App | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 31 |

| Charting - Drawing Tools | 8 |

| Charting - Notes | No |

| Charting - Display Corporate Events | Yes |

| Charting - Stock Overlays | No |

| Charting - Index Overlays | No |

Education

AJ Bell's educational resources are excellent. The company stands out for the depth and quality of its investor education, including webinars, podcasts, and written guides that cater to all experience levels. This makes AJ Bell a strong choice for beginners who want to learn as they invest.

I was impressed by the large amount of research, news, and views on the AJ Bell website and app. The company educates investors through regular webinars, live events, email briefings, videos, and online articles on its Learn hub. It records a weekly podcast called ‘AJ Bell Money & Markets,’ and its in-house experts are frequently quoted in the financial press.

The contact centre is very easy to access. Whenever I’ve had a query in the past it’s been easy to talk to someone.

One of AJ Bell’s main benefits is its range of investment choice, including 16,000 shares, 4,000 ETFs, and 4,000 mutual funds.

| Feature |

AJ Bell AJ Bell

|

|---|---|

| Education (Share Trading) | Yes |

| Education (Funds) | Yes |

| Education (Retirement) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

Final thoughts

AJ Bell is a solid all-rounder choice for investors, whether looking to invest in funds, stocks, or both. You can open a wide range of accounts, which is particularly useful for those looking to open a Lifetime ISA or Junior SIPP, as not many U.K. investment platforms offer these.

However, AJ Bell does charge £5 per time for one-off share transactions. If you have a small portfolio or are looking to trade stocks irregularly, there are cheaper platforms available – such as eToro, XTB , Freetrade, or Trading 212. These don’t charge trading fees beyond FX fees and the usual 0.5% stamp duty charge on U.K. shares.

On the other hand, you could sign up to AJ Bell’s new app Dodl where charges are much lower and competitive with the other commission-free brokers listed above. You’d get the benefit of the AJ Bell brand but at a much lower cost than its main platform. There are fewer investments through Dodl, but there are still enough for most investors.

For those interested in investing in mutual funds, AJ Bell offers a very wide choice to help you create a diversified investment portfolio. Ongoing account charges are 0.25% a year for amounts under £250,000, on top of other charges from the fund provider itself. AJ Bell also offers its own ready-made funds to bring fees down. There are no dealing charges for AJ Bell funds, but for funds from other providers, there is a £1.50 charge each time you invest. This can work out expensive. If you are just starting out, a platform that doesn't charge fund trading fees, such as Hargreaves Lansdown, may be more suitable.

AJ Bell Star Ratings

| Feature |

AJ Bell AJ Bell

|

|---|---|

| Overall Rating |

|

| Charges & Fees |

|

| Investment Choices |

|

| Mobile App |

|

| Website |

|

| Ease of Use |

|

| Education |

|

Our testing

Why you should trust us

Elizabeth Anderson has been a financial journalist for more than a decade. She’s written for major national newspapers, contributed to corporate reports and research, and reviewed dozens of share dealing platforms, SIPP providers, ISAs, and brokerage firms. Elizabeth started her career at Bloomberg and has worked for the BBC, The Telegraph, The Times and the i newspaper. She is passionate about helping people understand finance and investing. A keen investor herself, Elizabeth invests through general dealing accounts, ISAs and several SIPPs.

All content on UK.StockBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the U.K. brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At UK.StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and collect hundreds of data points while testing brokerage firms, share dealing platforms, SIPP providers, ISA providers, and other financial service providers relevant to U.K. investors.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running the latest version of and the iPhone 15 running the latest version of iOS.

- For Android, we use the Samsung Galaxy S23 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of trading platforms for web, desktop, and mobile, charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Read next

- eToro UK Review

- CMC Invest Review

- Trading 212 Review

- Halifax Share Dealing Review

- Lloyds Bank Investing Review

- Vanguard UK Review

- Hargreaves Lansdown Review

- Saxo Review

- XTB UK Review

- Interactive Investor Review

- Barclays Smart Investor Review

- IG Trading Review 2025

- Fidelity UK Review

- Interactive Brokers UK Review

- Freetrade Review

- Capital.com Review

Popular Guides

More Guides

- Best SIPP Providers of 2025

- 5 Best Demo Trading Accounts in the UK for 2025

- Best Stocks and Shares ISAs for 2025

- Best Junior SIPPs for 2025

- Best Cash ISA Accounts & Rates for 2025

- Best Lifetime ISAs of 2025

- Best Crypto Brokers & Apps for December 2025

About AJ Bell

AJ Bell is one of the UK’s biggest investment platforms, with around 490,000 customers. This is a similar amount to Interactive Investor and about a third of the U.K.’s largest DIY broker, Hargreaves Lansdown. AJ Bell was founded in 1995 as an actuarial consultancy and is now listed on the FTSE 250.